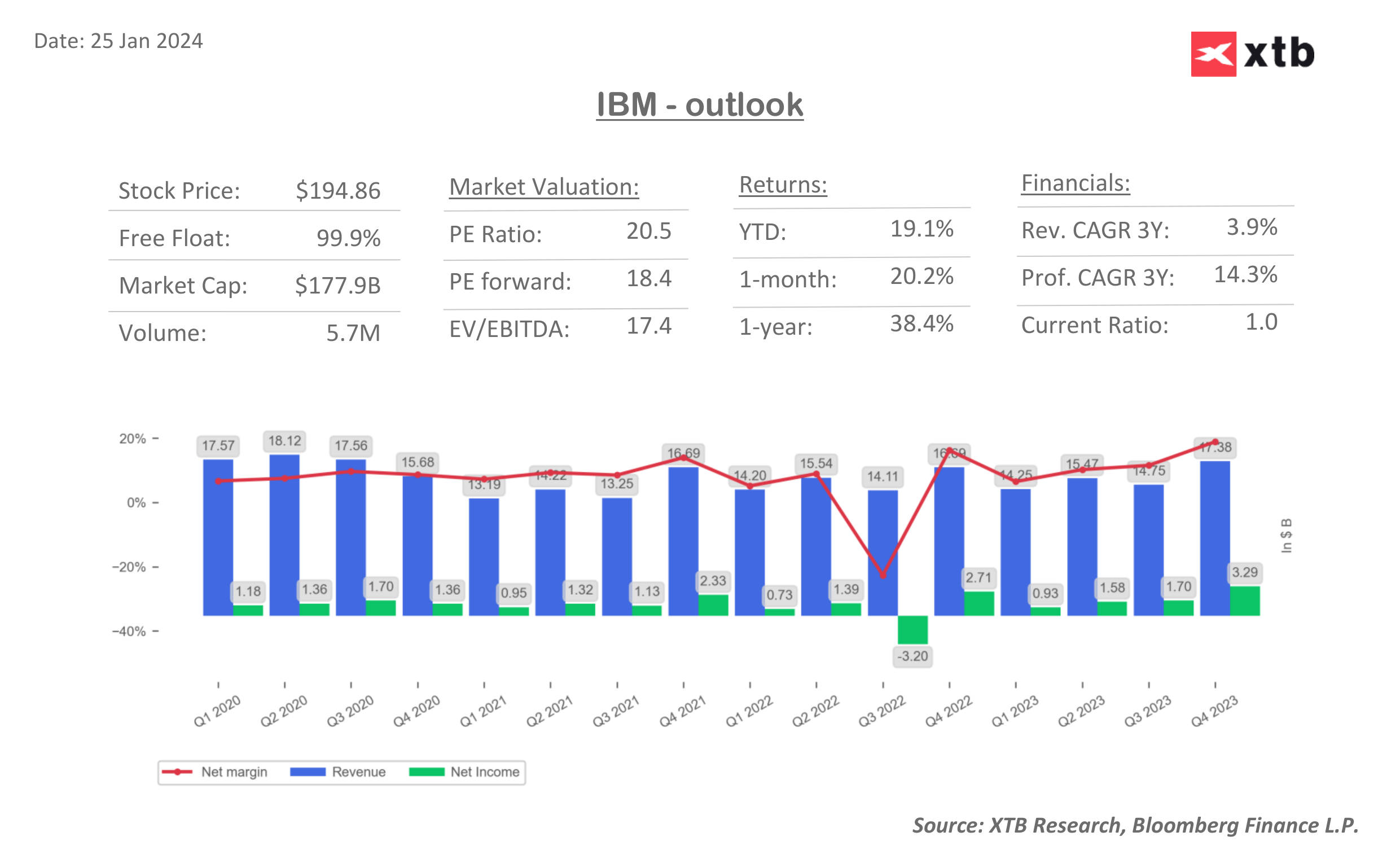

International Business Machines (IBM) reported strong fourth-quarter earnings, beating analyst expectations on both the top and bottom lines. The company also issued a bullish outlook for 2024, with strong guidance for free cash flow and revenue growth. IBM shares are up nearly 13% after yesterday’s report.

Key Highlights:

- Revenue: $17.38 billion, up 4.1% year-over-year (y/y), above the consensus estimate of $17.29 billion

- Software revenue: $7.51 billion, up 3.1% y/y, just below the consensus estimate of $7.69 billion

- Consulting revenue: $5.05 billion, up 5.8% y/y, just below the consensus estimate of $5.11 billion

- Infrastructure revenue: $4.60 billion, up 2.7% y/y, in line with the consensus estimate of $4.35 billion

- Adjusted gross margin: 60.1%, up from 58.6% y/y

- Operating EPS: $3.87, up from $3.60 y/y

- Free cash flow: $6.09 billion, up 17% y/y

Comments from company:

CEO of the company, Arvind Krishna attributed the strong fourth-quarter results to continued adoption of hybrid cloud and AI offerings. He also said that client demand for AI is accelerating, with IBM's book of business for Watson X and generative AI doubling from the third quarter to the fourth quarter. IBM's strong outlook for 2024 is based on its expectation for continued strong demand for hybrid cloud and AI offerings. The company also expects to benefit from its investments in data and automation. IBM also announced further job cuts, similar to other tech companies like Alphabet or Amazon.

Comments from Wall Street analysts:

Analysts were positive about IBM's fourth-quarter results and outlook. Analysts from Evercore Isi called the results positive for the story and said that IBM is an underappreciated AI beneficiary. Jefferies analyst Brent Thill said that IBM's revenue beat was driven by its infrastructure business and that the company is "on a turnaround story with FCF support." Bloomberg Intelligence said that IBM's outlook for free cash flow is "encouraging and suggests greater operational efficiencies and steady organic growth."

Overall, IBM's fourth-quarter results and outlook were strong. The company is well-positioned to benefit from the continued growth of hybrid cloud and AI, and its investments in data and automation should drive future growth.

IBM shares have jumped to the highest since 2024 and are only 10% off the all time highs. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.