After a new high around $71.35, OIL has been trading under pressure as of late. On a daily time frame, OIL painted a Dark-cloud cover (red box), a dual-candle pattern that is a top reversal after uptrend. Today, prices are trying to break an important support at 66,75$, the tenkan-line of Ichimoku. If sellers manage to break this support, the next support will be the kijun-line (blue line) at 64,40$.

OIL D1 interval. Source : xStation5

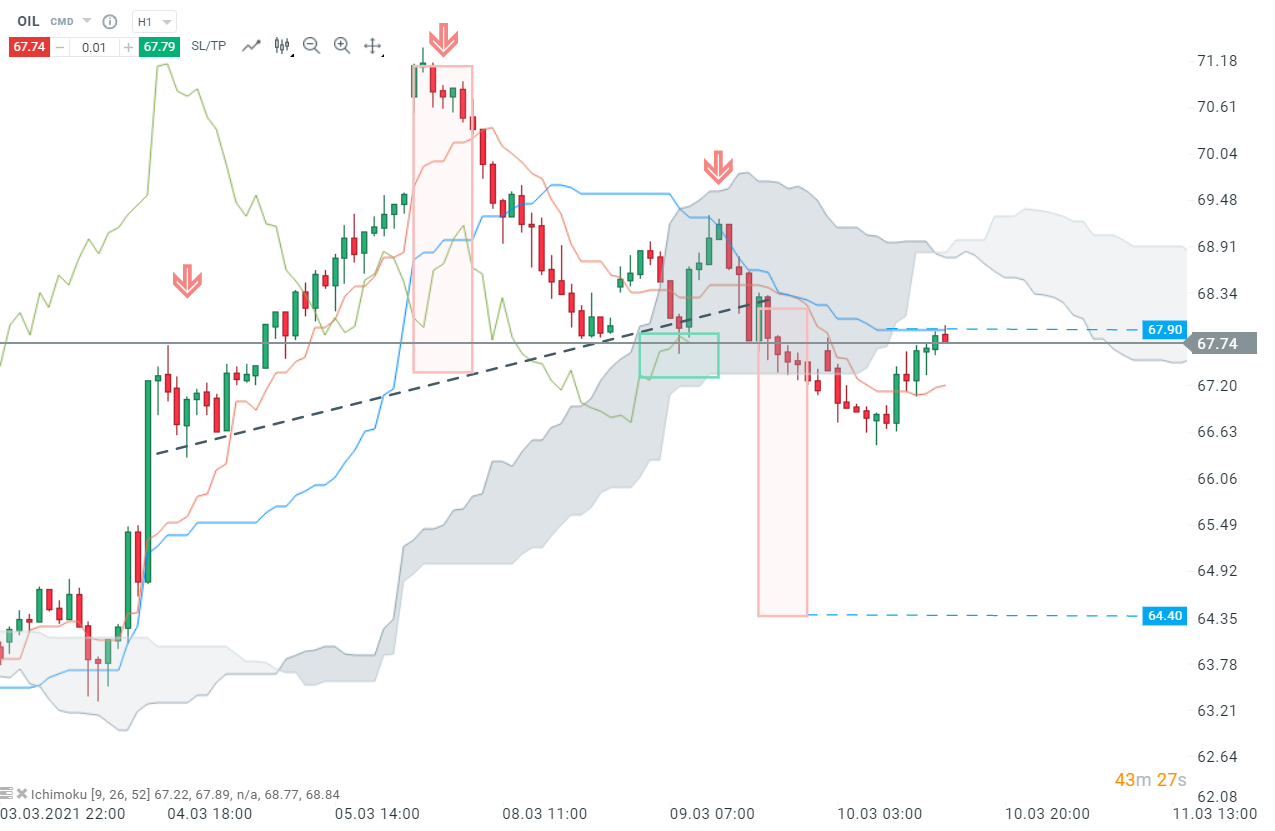

On hourly interval, OIL painted a reversal head and shoulder pattern which allowed prices to break the downside of the Ichimoku cloud after breaking the neckline. Breaking the downside of the cloud is a bearish signal and the confirmation will come from the chikou-span (green line), representing closing prices 26 periods in the past. If the chikou-span manages to fall under the cloud (green box), the bearish signal will be confirmed and the decline could deepen to the target of the SHS patter near $64.40, which coincides with the daily Kijun mentioned above.

From now, buyers are trying to take control of the market, which leads prices to an important support at $67.90 - the H1 kijun-line (blue line). As long as the price sits below the $67.90 resistance one should expect the price to continue to fall.

OIL H1 interval. Source : xStation5

Keep in mind that prices are located above the cloud in the daily time frame, so the main trend remains bullish. Breaking the H1 cloud only means that a short-term correction may occur.

When it comes to fundamentals, release of the DOE report on weekly stocks will be decisive and could lead to a realisation of the main scenario. In other cases, prices could break the H1 kijun mentioned above and rise to the next support- the Ichimoku cloud. Indeed, the cloud is often an area of support or resistance depending on the relative location of the price.

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

BREAKING: Another strong increase of oil inventories. Oil WTI close to 74

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.