Intel (INTC.US) has introduced its next-generation AI solutions, the Xeon 6 CPU and Gaudi 3 AI accelerator, aiming to challenge Nvidia’s (NVDA) dominance in the AI market. The Xeon 6, built with P-cores, offers double the performance of its predecessor and is designed for AI and high-performance computing, while the Gaudi 3 targets large-scale generative AI applications. Despite the advancements, Intel faces stiff competition from Nvidia and AMD, with Nvidia’s stock up 140% year-to-date, while Intel’s has dropped 50%.

Intel is undergoing a major transformation under CEO Pat Gelsinger, focusing on advanced chip development and expanding its manufacturing capabilities. The company has faced recent challenges, including disappointing earnings and workforce reductions, making it a potential takeover target for Qualcomm. Despite these difficulties, Intel continues to secure significant clients like Amazon and Microsoft for its custom chip business and plans to separate its foundry segment from its design operations to enhance customer confidence.

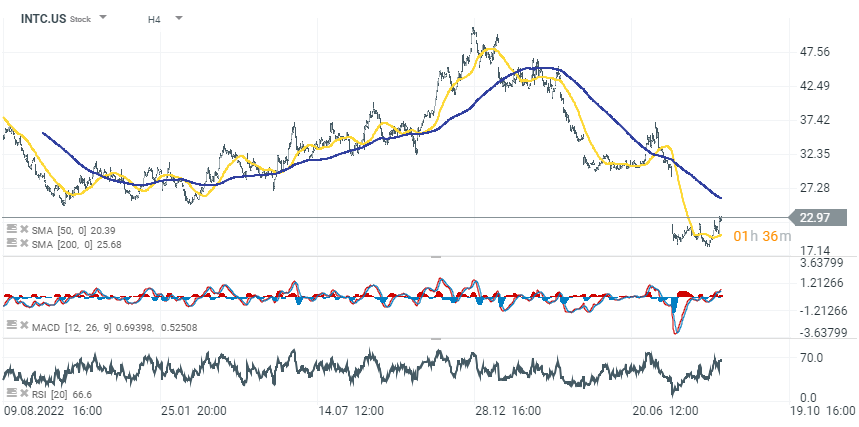

Intel (D1 interval)

Intel stock seems to be stabilizing after significant drops in late July. During August and September, the stock price has been hovering between $19 and $21, and in the last few trading sessions, there's been an attempt to break above this range. The stock is currently up 2.0% on a daily interval.

Source: xStation 5

Market wrap: European stocks attempt to stabilize despite the surge in oil prices 🔍

Chubb to insure ships crossing the Strait of Hormuz 🗽 What does it mean for the company?

Rheinmetall earnings: Formidable growth, but the market expected more

From Dependence to Control. Meta’s Development of Proprietary AI Chips

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.