The Turkish lira is failing to halt its ongoing powerful downward momentum (-0.82% against USD today), and the factor that added fuel to the sell-off today was a slightly higher-than-expected CPI inflation reading.

Inflation in Turkey fell to its lowest level since 2021, with consumer prices rising by 39.6% year-on-year in May, slightly lower than forecast (39.2%) and compared to 43.7% in the previous month. On a monthly basis, inflation was close to zero for the first time in four years.

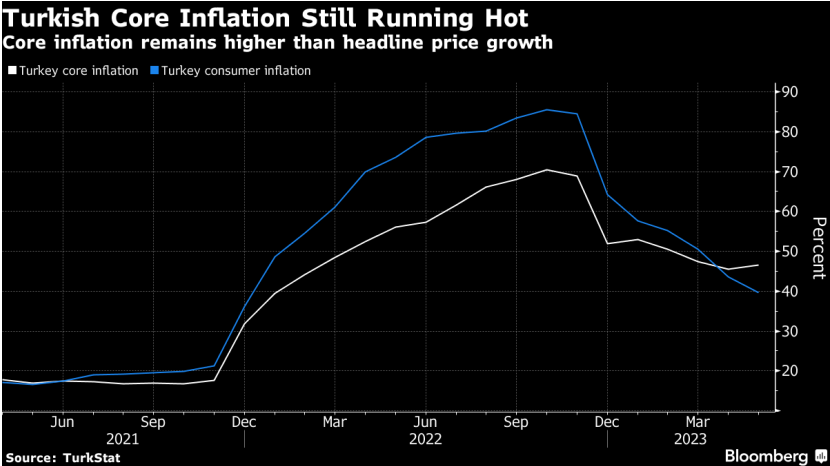

Despite the good tone of the headline reading itself, investor sentiment is still spoiled by the underlying reading, which no longer shows this downward dynamic.

Source: Bloomberg via TurkStat

Source: Bloomberg via TurkStat

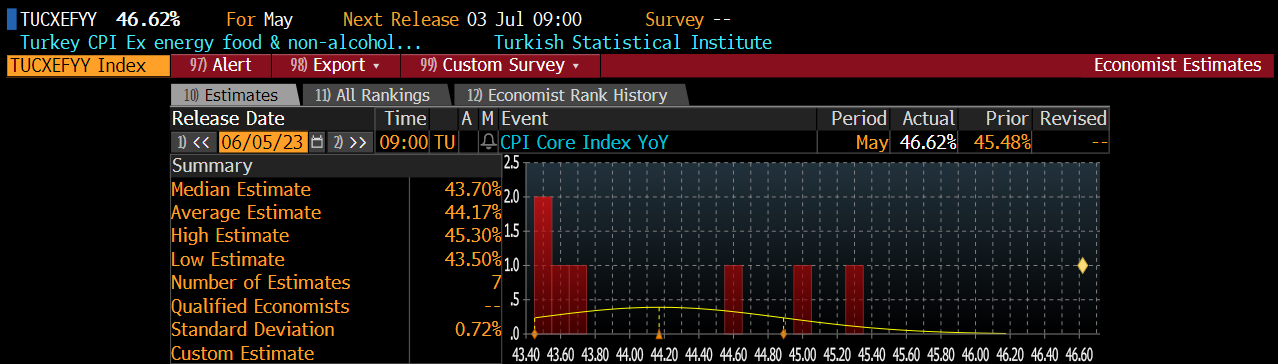

Core inflation surprised analysts with a much higher reading than expected, which, coupled with Erdogan's uncertain policy, puts tremendous pressure on the Turkish lira. Source: Bloomberg

Core inflation surprised analysts with a much higher reading than expected, which, coupled with Erdogan's uncertain policy, puts tremendous pressure on the Turkish lira. Source: Bloomberg

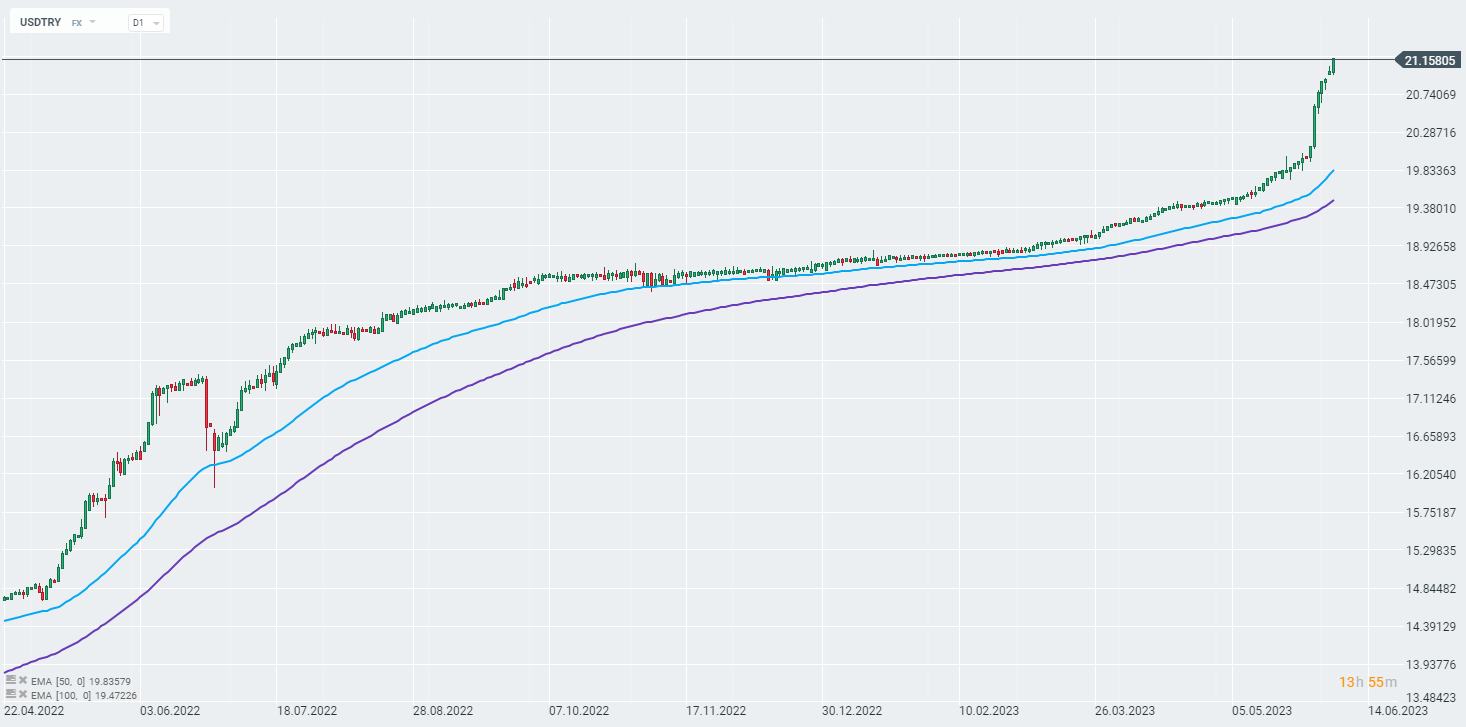

On the other hand, however, and in the matter of Erdogan's policies themselves, we may see some information suggesting a change in the authorities' attitude towards inflation. Mehmet Simsek, Turkey's new Treasury and Finance Minister (and former BofA Merill Lynch strategist), said on Sunday that "the main goal will be to fight inflation rationally". Investment banks also seem to have a different view of the lira. Goldman Sachs predicts a further weakening of the lira against the dollar. On the other hand, Societe Generale recommended a short position on the USDTRY pair in view of the stretched positioning and the high positive carry/aggressive market valuation of the lira's depreciation in futures.

Quotation chart of the USDTRY pair. D1 interval. Source: xStation 5

Quotation chart of the USDTRY pair. D1 interval. Source: xStation 5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Market Wrap: Capital Flees Europe 🇪🇺 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.