Ahead of Thursday’s session open, one of the giants of the U.S. defense industry released its results. Market expectations were beaten, and the company’s valuation climbed to a new all-time high, rising 4% after the publication.

An unprecedented level of geopolitical tensions and defense spending is supporting defense contractors. This also applies to Lockheed Martin, which recently found itself at the center of negative attention from the U.S. administration due to its dividend and share buyback policy.

Financial Statement Insights

The company slightly exceeded expectations both in terms of EPS and revenue in Q4 2025.

- GAAP EPS: USD 5.80 (market consensus: USD 5.75)

- Revenue: USD 20.3 billion (market consensus: USD 19.85 billion)

- Operating margin: 10.1%

On an annual basis:

- Sales increased by 5% in 2025 (to USD 75 billion), and profits rose by 11% (to USD 6.7 billion), resulting in cumulative GAAP EPS of 21.49.

- The company’s backlog grew by 17% to USD 194 billion, with a book-to-bill ratio of 1.2. The annual operating margin was exactly 9%.

- In full-year 2025, the company allocated USD 3.1 billion to dividends and USD 3.0 billion to share repurchases. Free cash flow (Non-GAAP) totalled USD 6.9 billion.

Business segments

The CEO says demand for the company’s products is unprecedented, with the strongest growth in the missiles and fire control segments. Sales in this segment rose to USD 14.4 billion (+14%), while profit surged by 382% to USD 1.9 billion. The key “workhorses” in this segment remain the Patriot and JASSM systems.

In the aeronautics segment, the company continues to benefit from sales and support of F-35 aircraft. In Q4, operating profit jumped by 80%, but year over year it fell by 17%. This is largely linked to above-plan write-downs related to one of the company’s classified projects. Given industry trends, this is most likely connected to the X-59 project and other hypersonic vehicles.

Guidance

Alongside strong results, the company also delivered optimistic guidance.

For next year, the company forecasts sales of USD 77.5–80.0 billion and full-year EPS of USD 29.35–30.25 per share.

Management states it expects continued double-digit sales growth in the missiles and fire control segment.

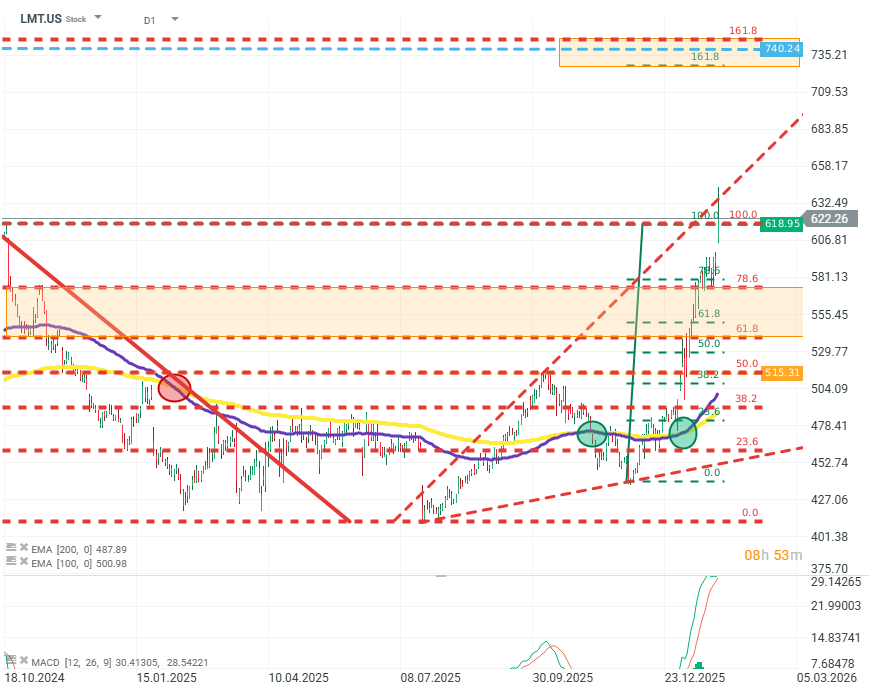

LMT.US (D1)

If the price holds above the most recent highs, then, given the current upward momentum and the structure of the EMA 100 and 200 moving averages, the stock may have a chance to continue rising even toward the USD 740 area. A pullback, potentially reinforced by a possible negative signal from the MACD indicator, could bring the price down toward support between the 78.6% Fibonacci level and the 50% retracement of the most recent upswing. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Does the current sell-off signal the end of quantum companies?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.