Lyft (LYFT.US) stock rose more than 4.5% during today's session after ride-hailing reported quarterly earnings of 9 cents per share, slightly beating analysts’ expectations of 8 cent per share. Revenue in Q4 increased 70% YoY to $970 million, topping analysts’ estimates of $940.1m, closing a year in which Lyft's sales were up 36% from 2020 levels. Company's net loss narrowed to $259 million in the quarter, and adjusted EBITDA for all of 2021 was $92.9m, marking the first time the company achieved its profitability target on a full-year basis.

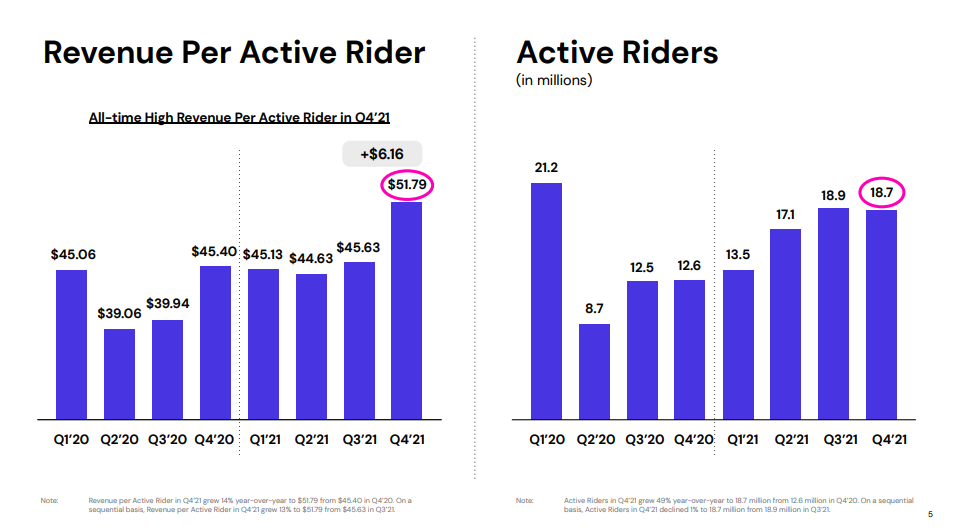

However active rider counts decreased slightly to 18.7 million and still remain below pre-pandemic levels, while revenue per active rider jumped 14% to $51.79. Nevertheless compared to same period last year, number of active riders increased nearly 50%, which is a sign that client's demand continues to recover. Lyft President John Zimmer attributed a small dip in quarter-over-quarter ridership growth to seasonality and a less busy New Year’s Eve.

Screenshot of company's active riders and revenue per active rider for 2020 and 2021, taken from Lyft’s investor deck via TechChurch

Screenshot of company's active riders and revenue per active rider for 2020 and 2021, taken from Lyft’s investor deck via TechChurch

For the current quarter company expects revenue in the region between $800 million and $850 million a notable 15% decline from prior quarter levels that new CEO Elaine Paul put down to the lingering impact of the Omicron surge on ride demand. Analysts expected guidance of $989.9 million, per StreetAccount. Lyft also expects rides to decline slightly quarter-over-quarter, however no specific figures were provided.

Lyft (LYFT.US) stock extended gains following the release of quarterly results. Price bounced off the support at $39.30 which coincides with 61.8% Fibonacci retracement of the upward wave launched in March 2020. If current sentiment prevails, next target for buyers is located at $47.37 and is marked with upper limit of the 1:1 structure. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.