- Philadelphia Federal Reserve index spiked to a nearly 50-year high

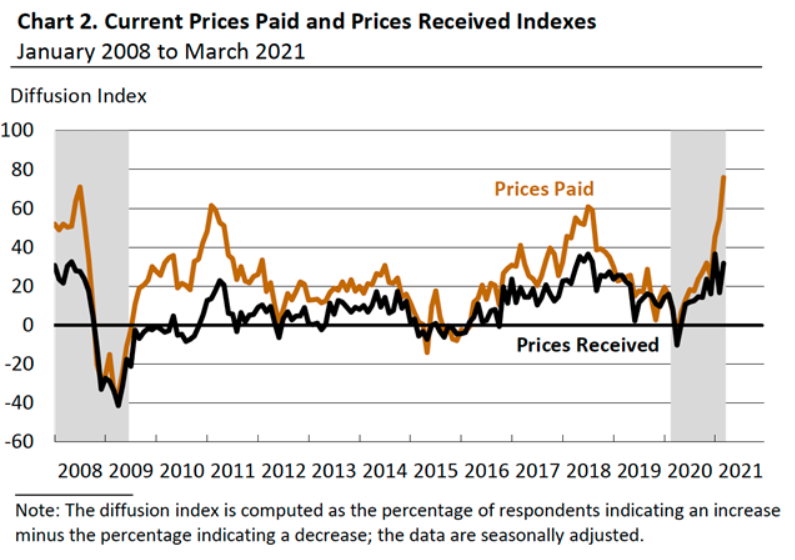

- The firms continued to report price pressures from purchased inputs

The US manufacturing sector is showing fresh signs of strength at the end of the first quarter as the Philly Fed index surged to 51.8 in March from 23.1 in February, beating analysts expectations of 23. Today's reading is the highest since 1973.

The Philly Fed Business Sentiment Indicator rose sharply in March. Source: Bloomberg via ZeroHedge

The Philly Fed Business Sentiment Indicator rose sharply in March. Source: Bloomberg via ZeroHedge

Looking in more detail, all categories have increased except for inventories as the companies showed more widespread optimism about growth over the next six months. New orders and shipments at factories in the region that covers eastern Pennsylvania, southern New Jersey and Delaware soared. General activity and employment indexes also increased. Nearly 59% of the firms reported increases in current activity this month (up from 35% last month), while only 7% reported decreases (down from 11%). The index signals that overall manufacturing activity in the region continued to expand in March for the tenth consecutive month, after a strong rebound in June driven by the reopening of activity. "The firms' responses indicated widespread growth in the region's manufacturing sector this month," the Philly Fed said. However today's report also showed more signs of inflation pressure as a measure of prices paid advanced to the highest in more than four decades.

The prices paid index rose sharply from 54.4 to 75.9, its highest reading since March 1980. Source: philadelphiafed.org

The prices paid index rose sharply from 54.4 to 75.9, its highest reading since March 1980. Source: philadelphiafed.org

As one can see, subsequent indicators show that inflation in the US is accelerating significantly and more investors are getting nervous, even despite the assurances from Fed Chair Powell, who claims that it is a transitional phenomenon. However, if this trend continues, it may negatively affect corporate profits or the end customer will experience significant inflation.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

BREAKING: Pound frozen after lower-than-expected GDP data from UK 🇬🇧 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.