We are slowly entering the second phase of Thursday's trading session.

The markets are still awaiting the BoE and ECB decisions on interest rates. The first will take place in less than 14 minutes, at 13:00. The ECB will decide at 14:15.

The European Central Bank is expected to keep interest rates unchanged for the fifth time, as the strong economy has so far withstood global tensions and the strong euro. The Bank of England is also expected to keep interest rates unchanged, despite growing concerns about the British labour market.

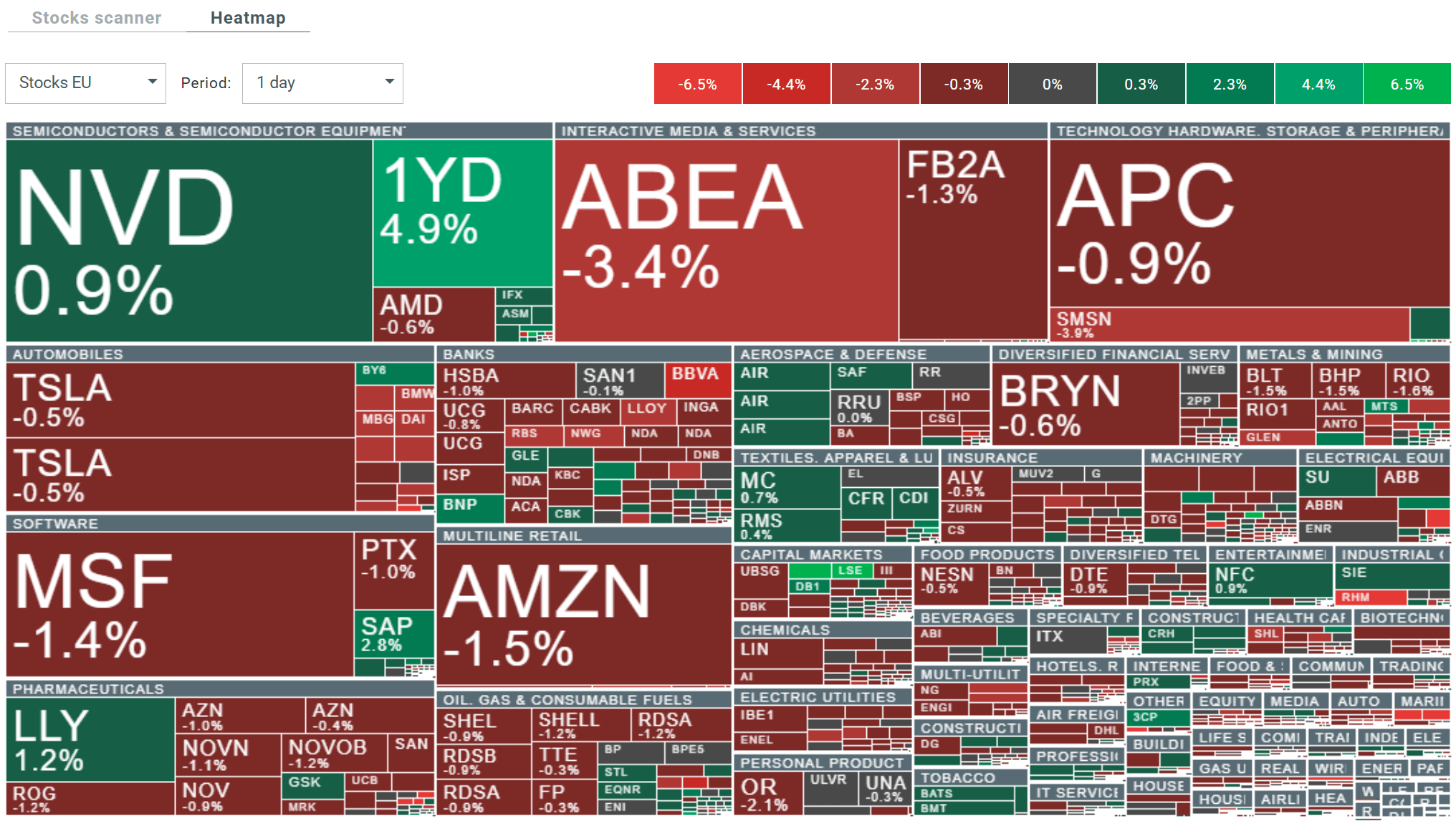

At present, Germany's DAX is down 0.46% on the cash market, France's CAC40 is up 0.2%, and the UK's FTSE100 is down 0.45%.

Precious metals return to dramatic declines: silver slumps 11% to $78, completely erasing the rebound of the last two sessions, gold retreats another 1.7% to $4,875, platinum contracts lose 6.5%.

The Stoxx Europe 600 index fell by 0.16%, with the technology and media sectors performing best and automotive stocks performing worst.

Source: xStation

Rheinmetall AG recorded a decline of 6.9% after analysts' forecasts led to a downward revision of the consensus earnings forecast for this year.

A.P. Moller-Maersk A/S fell 3.8% after the Danish container giant announced it would focus on cost discipline in the face of deteriorating freight rates caused by the reopening of the Red Sea.

KGHM Polska Miedź SA fell by 4.9%, leading declines in shares of companies in the basic materials sector.

Meanwhile, the decline in silver prices provided a boost for Pandora A/S, whose shares rose 6.3%, offsetting a break in share buybacks following a forecast of slower sales this year.

Shell Plc fell 2.3 per cent after its profit missed expectations.

The Swiss franc and the US dollar are performing best on the Forex market. We are seeing declines, particularly in the British pound.

We are seeing significant declines in cryptocurrencies. Bitcoin has fallen below £70,000 for the first time since November 2024.

Daily Summary - Wall Street is waiting for Nvidia (25.02.2026)

BREAKING: Massive Crude Build Shatters Expectations. WTI is down by 1%

US OPEN: Wall Street holds its breath ahead of Nvidia earnings

Chart of the day: US100 gains ahead of the Nvidia earnings 📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.