Macroeconomics & Currencies

-

The UK at a Crossroads: Q4 GDP growth at just 0.1% QoQ, combined with a decline in GDP per capita, confirms a real economic slowdown. This ramps up pressure on the Bank of England (BoE) to consider more aggressive interest rate cuts.

-

Pound Resilience vs. Vulnerability: Despite the weak data, GBP is up 0.1% against the US Dollar today (trailing only CHF and NZD in the G10). However, the high trade deficit leaves the Pound exposed to further weakness if the UK’s yield advantage over the USD and EUR narrows.

-

Forint Under Pressure: EUR/HUF is up 0.4%. The Hungarian currency is struggling due to falling inflation (increasing the likelihood of rate cuts) and the ongoing dispute between Hungary and the EU, which threatens the release of crucial Union funds.

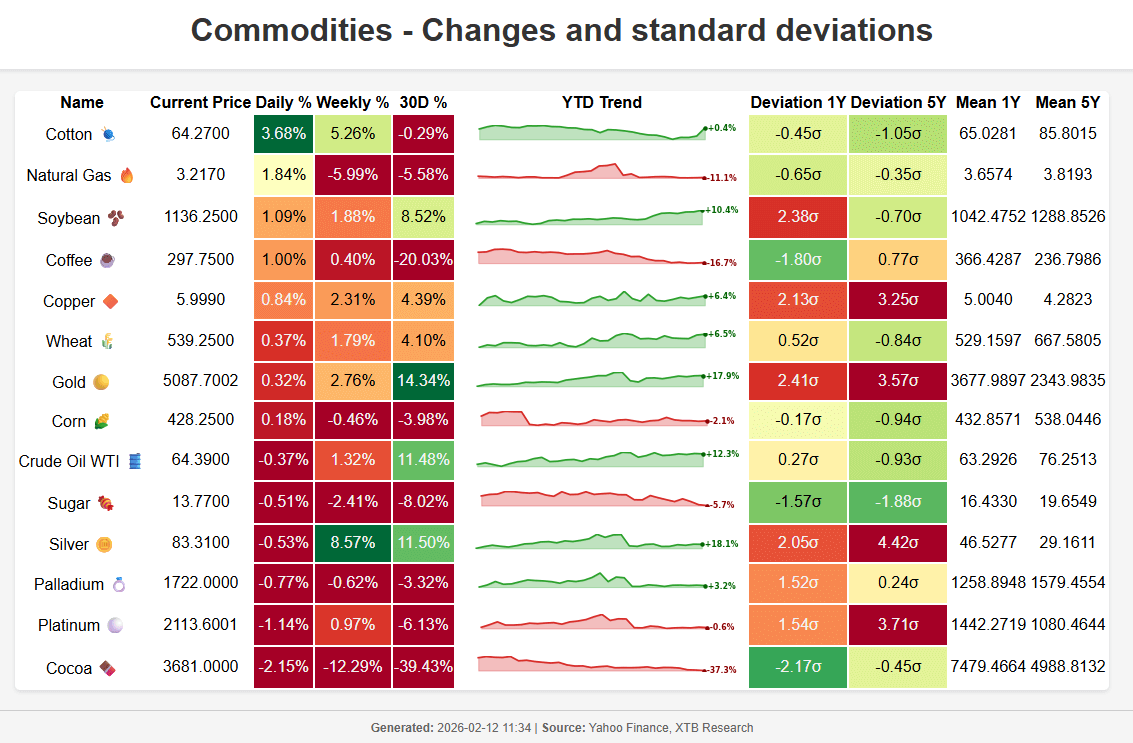

Commodities & Precious Metals

-

Oil Influenced by Geopolitics: WTI has retreated below $65 per barrel, though tensions remain high. The Israeli Prime Minister is reportedly pressuring Donald Trump to dismantle Iran’s ballistic missile program, while Trump appears to favor a quick nuclear deal over further escalation.

-

Pullback in Metals: Following a strong rally in the previous session, we are seeing a moderate correction. Gold is trading below $5,100, Silver remains above $83, and Platinum is holding just above $2,100.

-

Silver Supply Surge: There is a notable increase in silver sales to scrap yards in the US. This could boost recycling volumes and help narrow the global supply deficit.

Earnings Season & Corporate News

-

Unilever (-3%): While underlying sales grew by a better-than-expected 4.2% YoY, total revenue (€12.6 billion) missed estimates, leading to a 3% drop in the first hour of trading.

-

Mercedes-Benz (-2%): The automaker reported a staggering 57% drop in annual profits, largely due to tariff-related costs estimated at $1.2 billion. 2025 operating profit came in at €5.8 billion, missing the €6.6 billion forecast.

-

Tech Sector Slump: * Cisco plummeted 7% in post-market trading following disappointing quarterly results.

-

Robinhood shed nearly 9% yesterday as crypto-related revenues failed to meet expectations.

-

Watchlist: Focus shifts to Applied Materials and Arista Networks, both reporting after today’s closing bell.

-

Cryptocurrencies & Policy

-

Bitcoin Stabilizes: Following yesterday’s sharp sell-off, BTC is holding steady above $67,000. Ethereum (ETH) is rebounding after its recent dip below the $2,000 psychological level.

-

The Powell Dispute: Scott Bessent indicated that, following legal consultations, the investigation into Jerome Powell’s standing will likely be handled by the Senate Banking Committee rather than the Department of Justice.

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.