Merck & Co., the global pharmaceutical giant known for oncology drugs and vaccines, today released its fourth-quarter 2025 results and 2026 guidance, which can be described in one word: mixed. The company posted solid quarterly revenue growth driven by key products such as Keytruda and new lung disease treatments, but at the same time faced significant challenges with its Gardasil vaccine, which weighed on full-year forecasts.

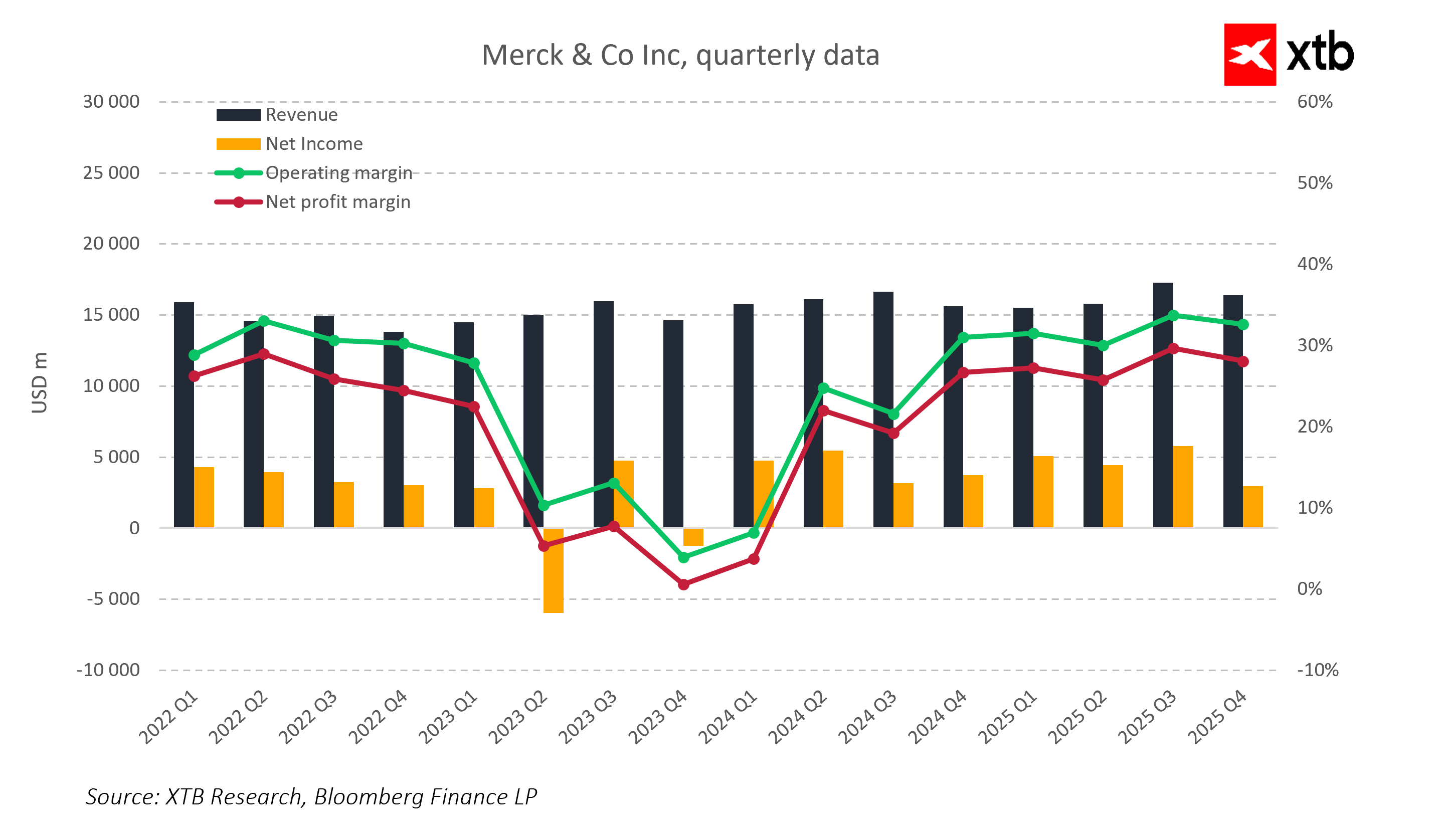

Revenue for Q4 reached USD 16.4 billion, up 5% year-over-year, exceeding analyst expectations of USD 16.17 billion. Adjusted earnings per share (EPS) came in at USD 2.04, slightly above the forecast of USD 2.01. GAAP EPS was USD 1.19, down from USD 1.48 a year earlier.

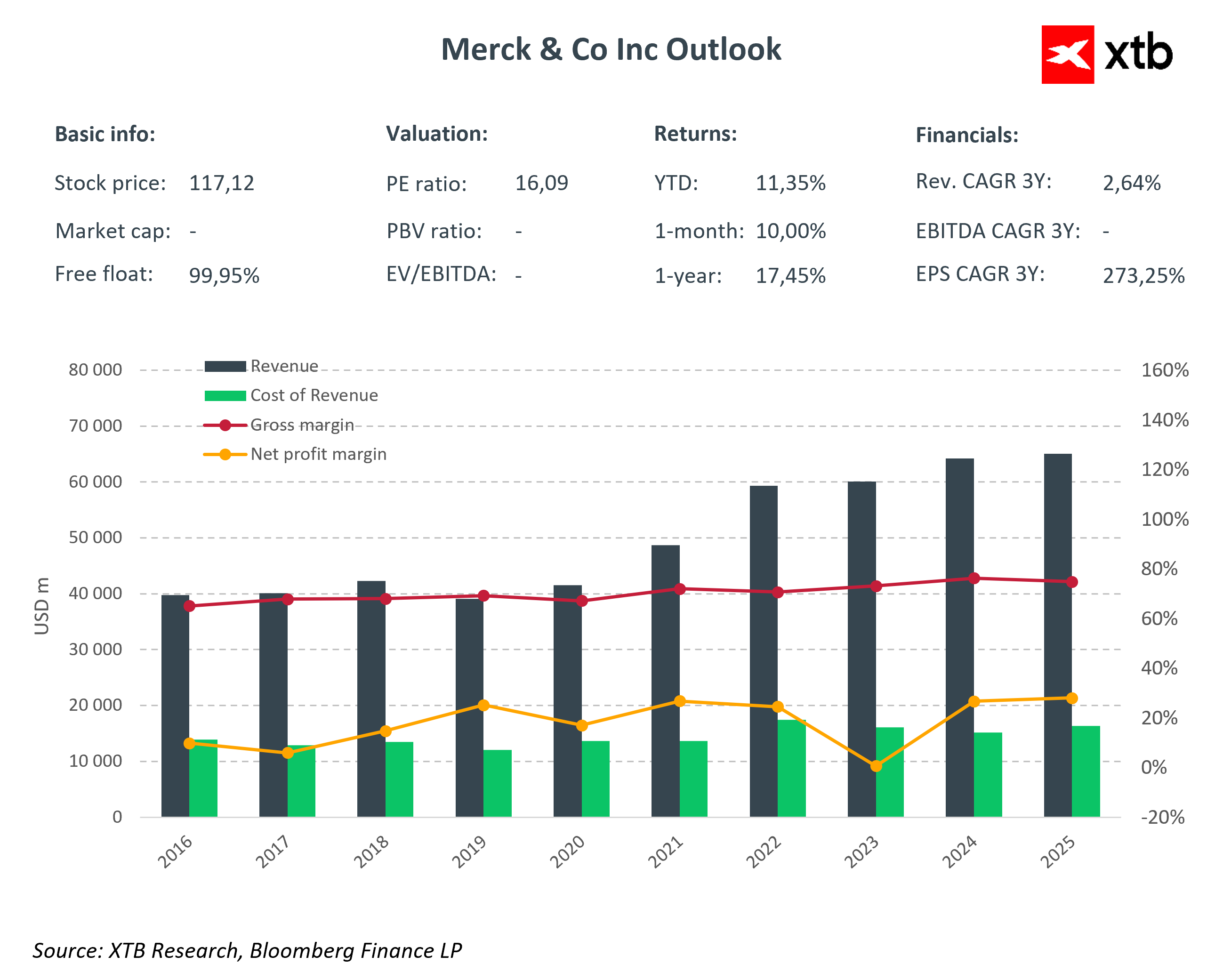

Despite strong quarterly results, Merck’s guidance for 2026 was somewhat disappointing: the company expects revenue between USD 65.5 billion and USD 67 billion, with adjusted EPS of USD 5.00–5.15, compared with analysts’ expectations of USD 67.5 billion and EPS of USD 5.27. Gross margin is projected at approximately 82%, slightly above market expectations of 81.8%.

Key Financial Results for Q4 2025

-

Total revenue: USD 16.40 billion (+5% y/y, forecast: USD 16.17 billion)

-

Adjusted EPS: USD 2.04 (forecast: USD 2.01)

-

GAAP EPS: USD 1.19 (down from USD 1.48 y/y)

-

Keytruda: USD 8.37 billion (+6.8% y/y, forecast: USD 8.24 billion)

2026 Guidance

-

Revenue: USD 65.5–67 billion (forecast: USD 67.5 billion)

-

Adjusted EPS: USD 5.00–5.15 (forecast: 5.27)

-

Gross margin: 82% (forecast: 81.8%)

Key Products and Segments

Q4 results show a mixed picture for Merck’s business:

Growth Drivers:

-

Keytruda: Sales rose 6.8% y/y to USD 8.37 billion, above the forecast of USD 8.24 billion.

-

New lung disease drugs (Ohtuvayre/Winrevair): Strong results following the Verona Pharma acquisition.

-

Other products (Reblozyl, Lenvima, Bridion, Isentress): Sales in line with or slightly above expectations.

-

Animal Health: USD 1.51 billion (+7.7% y/y), a stable non-pharmaceutical segment.

Products Under Pressure:

-

Gardasil: Sales declined 33% y/y to USD 1.03 billion, with no deliveries to China planned in 2026.

-

Lagevrio and Lynparza: Sales below expectations.

Strategy and Development Outlook

In terms of strategy and development, Merck continues efforts to diversify its portfolio and prepare for market changes, including the expiration of Keytruda’s U.S. patent in 2028. The company is focusing on expanding its portfolio with new oncology, pulmonary, and antiviral drugs, as well as innovating existing products. In this context, Merck is investing heavily in R&D and expanding U.S. production, planning capital and R&D expenditures exceeding USD 70 billion. Additionally, the company reached an agreement with the U.S. government regarding import tariffs, under which products will be supplied through a “direct-to-patient” program in exchange for a three-year tariff delay.

Merck’s 2026 guidance points to moderate revenue and profit growth while maintaining stability in key business segments. Strong results from Keytruda and new pulmonary drugs, combined with product development investments and portfolio optimization, position the company to face upcoming generic competition and maintain its strategic pharmaceutical footprint.

Conclusions

-

Merck maintains a stable position in the pharmaceutical sector, with strong foundations in oncology, pulmonology, and specialty drug segments.

-

Q4 results show growth in key areas, offset by a decline in Gardasil sales.

-

Full-year guidance indicates moderate growth, while the company prepares for future generic competition for Keytruda.

-

Strategic acquisitions and investments in new products demonstrate efforts to diversify revenue sources and strengthen the company’s long-term position.

PayPal shares slide 5% as Semafor denies Stripe acquisition rumors📉

US100 loses 1% amid Nvidia weakness 📉Heico crashes 13%

D‑Wave Quantum: Concrete Results Today, Big Dreams Tomorrow

Will Nvidia’s report reignite optimism on Wall Street?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.