Meta Platforms (META.US) will publish its report for the last quarter of 2023 after today's US stock market close. Investor expectations are high for both the past quarter and the forecast for 2024. The scale of these expectations is evident in the company's stock performance in January this year, which outperformed competitors like Alphabet, Microsoft, and Amazon.

Analyst Expectations:

Q4 2023:

- Estimated Revenues: $39.01 billion, including:

- Estimated advertising revenues: $37.81 billion

- Daily active Facebook users: 2.07 billion

- Monthly active Facebook users: 3.06 billion

- Ad impressions: +24.6%

- Average price per ad: -4.12%

- Earnings Per Share (EPS): $4.91

- Operating Margin: 39.5%

Q1 2024

- Estimated Revenue: $33.64 billion

2024 Year

- Total Expenses: $96.45 billion

- Capital Expenditure: $33.37 billion

Investor expectations are high, given the significant growth in the company's market capitalization throughout 2023. Recently, investor attention has been focused on the company after it surpassed a market capitalization of 1 trillion dollars. The Meta Platforms report is expected to not only show strong performance in the previous quarter but also a promising outlook for 2024. In this context, the company's development in artificial intelligence is of particular interest. Although Meta does not offer products directly related to AI, it has a wide scope to utilize this technology to enhance functionalities on social platforms and internal company operations. The year 2024 will also be interesting in terms of advertising expenditures, as it is an election year in the USA.

Meta Platforms' financial dashboard also shows how dynamic the company's development has been in recent years. Particularly noteworthy is the positive rebound in all indicators in 2023, improvement in liquidity, and employment.

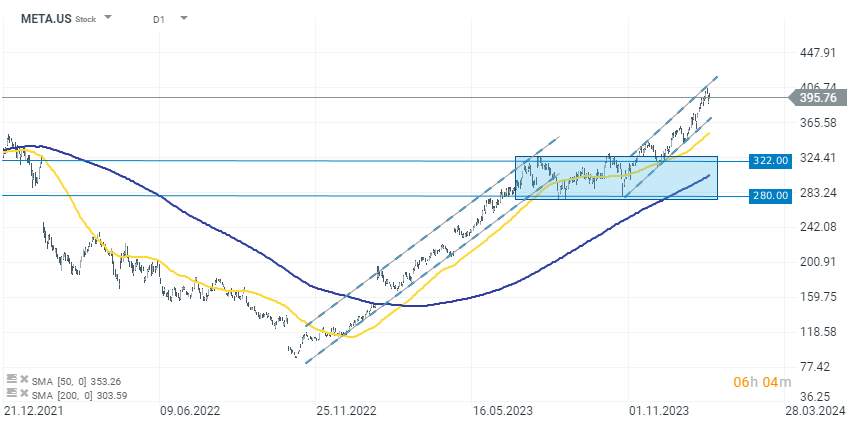

Meta Platforms Chart, H4 Interval

The company's improved performance in 2023 is reflected in its capitalization, which increased by over 200%. The shares remained in an almost continuous growth channel, except for a consolidation period in the early second half of 2023. If the results are good, we can expect the trend to continue, remembering that the current share price remains in a growth channel. However, failing to meet market expectations could exert downward pressure. In such a case, it is important to monitor the levels of the last consolidation, namely $280-$320.

Source: xStation 5

Daily summary: Markets recover optimism at the end of the week

US OPEN: Investors exercise caution in the face of uncertainty.

Oklo shares surged in a true “atomic open” on today’s session

Rio Tinto and Glencore shake up the mining market🚨 Giants negotiate merger 🤝

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.