- Microsoft acquires 27 percent of OpenAI shares valued at 135 billion dollars, securing access to key AI technologies until 2032.

- OpenAI gains greater market independence through the removal of Azure exclusivity for non-API products and the establishment of a non-profit foundation.

- Tomorrow’s Microsoft Q1 2026 report will serve as a critical indicator of AI market dynamics and the effects of the Microsoft-OpenAI collaboration.

- Microsoft acquires 27 percent of OpenAI shares valued at 135 billion dollars, securing access to key AI technologies until 2032.

- OpenAI gains greater market independence through the removal of Azure exclusivity for non-API products and the establishment of a non-profit foundation.

- Tomorrow’s Microsoft Q1 2026 report will serve as a critical indicator of AI market dynamics and the effects of the Microsoft-OpenAI collaboration.

The restructuring of OpenAI and the transfer of 27 percent of its shares to Microsoft, valued at approximately 135 billion dollars, significantly increases the transparency of the company's capital structure and highlights the strategic importance of its collaboration with the Redmond giant. To date, Microsoft has invested 13.75 billion dollars in OpenAI, and now formally gains access to key artificial intelligence technologies, including post-AGI models, until 2032. Excluding consumer hardware from intellectual property rights gives OpenAI a degree of independence, showing that the partnership is long-term in nature but does not fully limit competition in selected areas. Following the announcement, Microsoft shares rose by about two percent.

The removal of Azure exclusivity for non-API products gives OpenAI greater market freedom and the opportunity to work with other providers, such as Oracle, while maintaining API exclusivity on Azure. The creation of the non-profit OpenAI Foundation, holding shares worth 130 billion dollars, allows the company to continue its scientific and social mission, balancing the increasingly commercial nature of its operations.

Within the broader AI ecosystem, companies like Nvidia, AMD, and Oracle also play key roles. Microsoft's investment in OpenAI is not a one-off strategic move but part of a long-term plan to maintain technological dominance. Control over infrastructure, access to breakthrough models, and OpenAI's operational flexibility provide Microsoft with a competitive edge while simultaneously mitigating risks associated with technology monopolization.

Why this matters today

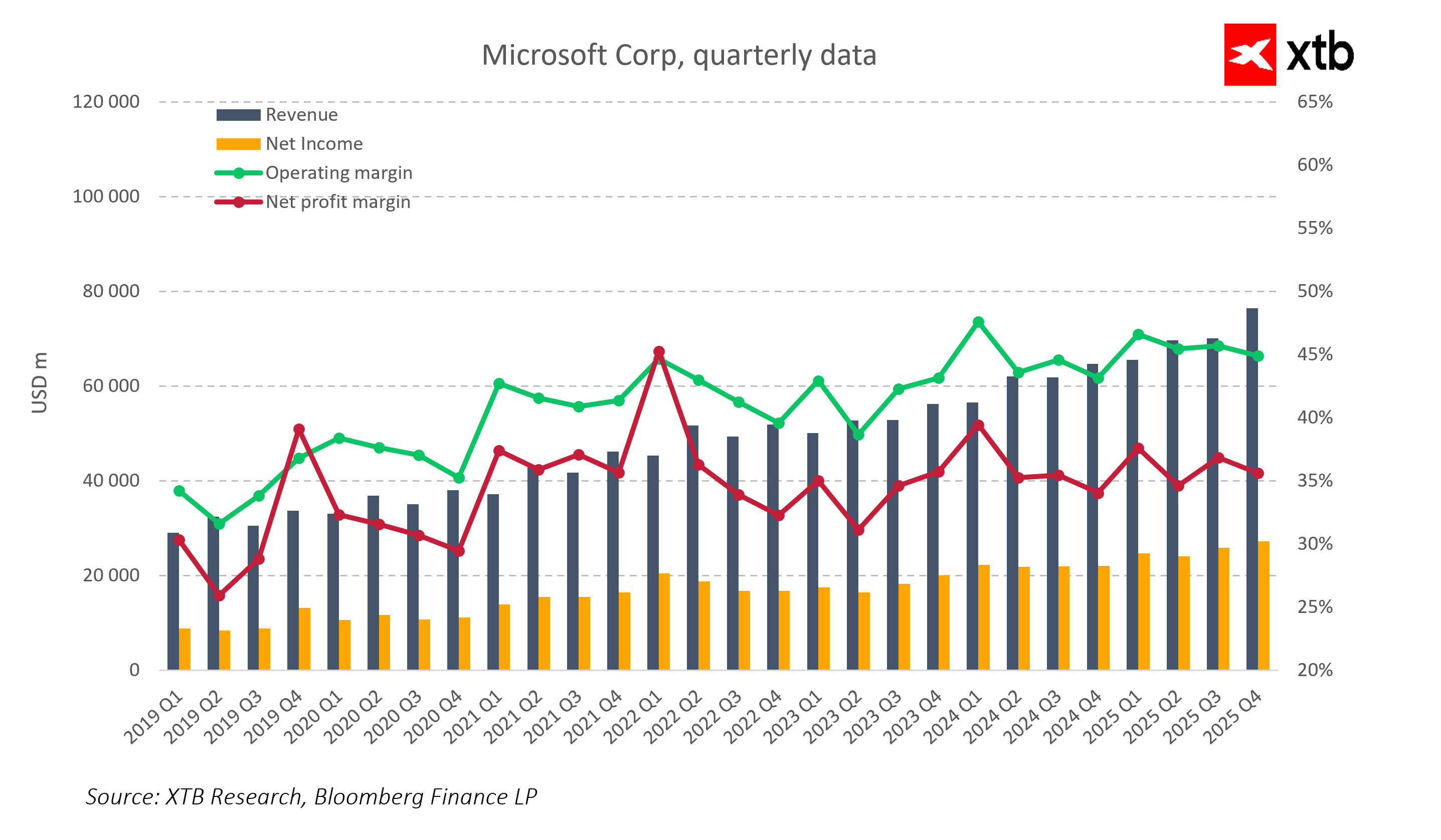

Microsoft is set to release its results for the first quarter of fiscal 2026 tomorrow, which will serve as an important market reference point. Analysts’ consensus forecasts revenue in the range of 74.9 to 75.5 billion dollars and earnings per share around 3.65 dollars, representing year-on-year growth of approximately 10 to 11 percent. The fastest growth is expected in the Intelligent Cloud segment, with Azure projected to increase by 25 to 37 percent. The Productivity and Business Processes segment is expected to grow by 14 percent, while More Personal Computing may see a slight decline, underlining the growing importance of investments in AI and cloud services.

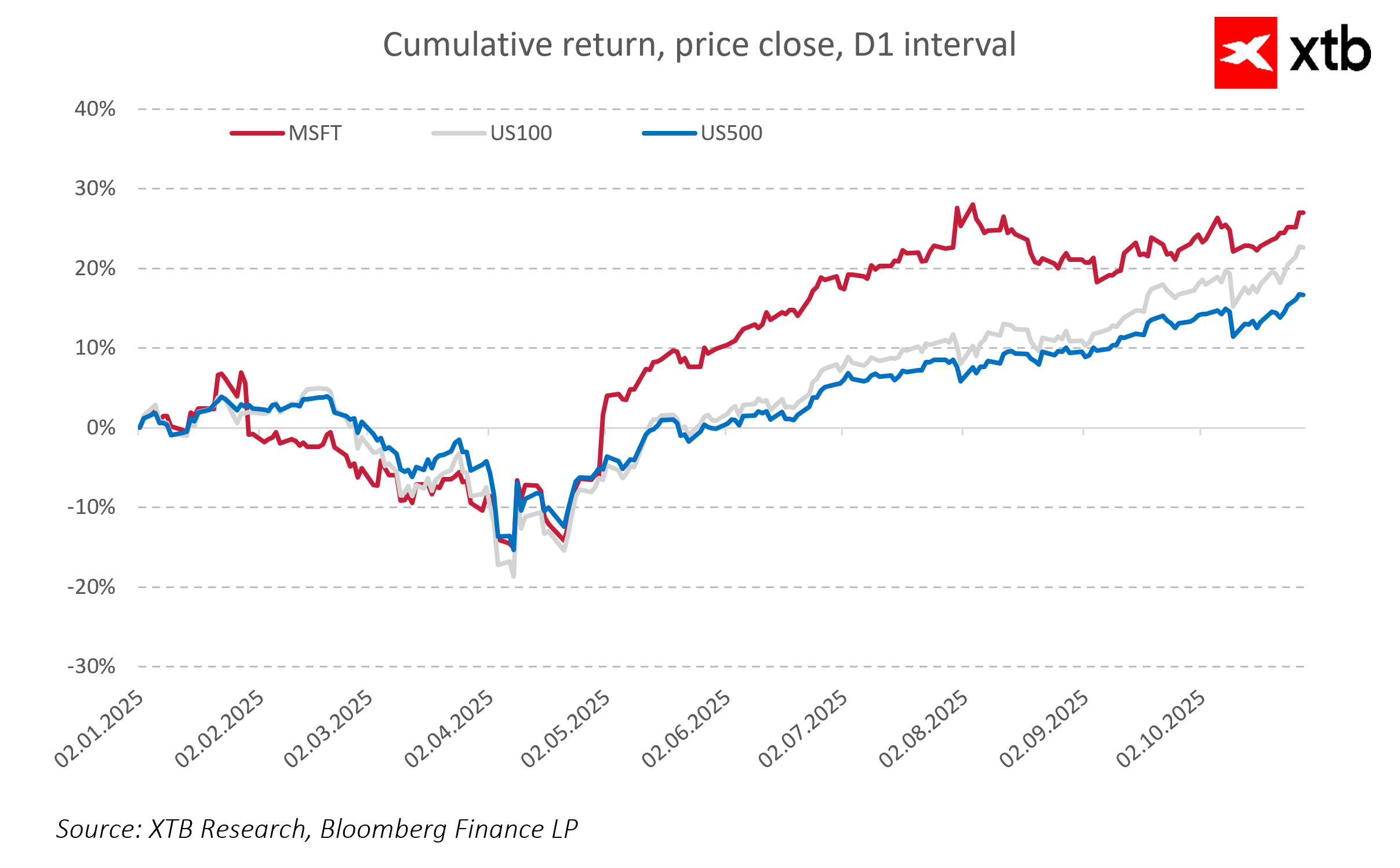

Analysts note that higher capital expenditures could temporarily reduce margins, but in the medium term they support strong growth potential. The average target price for Microsoft shares ranges between 610 and 635 dollars, suggesting the possibility of further upside following the earnings release and a positive market reaction if the company’s leadership in AI and cloud is confirmed.

Implications for investors

The OpenAI restructuring consolidates the strategic partnership with Microsoft while increasing the AI company's operational flexibility. Tomorrow’s report will act as a gauge for AI development pace, real cloud revenue, and Microsoft’s strategy to maintain its competitive edge. The results could significantly shape the dynamics of the technology market in the coming months and influence the valuation of companies heavily invested in AI development.

The combination of long-term strategic partnership, a flexible cooperation model, and the upcoming financial report makes investors closely watch both Microsoft’s results and OpenAI’s next steps, given the growing role of artificial intelligence in the economy and global investment landscape.

Daily Summary: Middle East Sparks Oil Market

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

Oil Under Pressure as G7 Decision Remains Pending

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.