- The most important event of the weekend was the first round of the French parliamentary elections. According to the Exit Poll results, Le Pen's National Rally won 34% of the vote. The Popular Front, meanwhile, received 28.1% of the vote, the presidential Ensemble 20.3%, and LR/DVD, 10.2% of the vote.

- The first reaction to the first round of voting in the French parliamentary elections, brought a slight rebound on the euro. The EUR/USD pair started trading higher by about 30 pips. Although Marine Le Pen's party won the largest share of the vote, it still lacked an overall majority.

- The New Popular Front has called for alliances ahead of a second round of voting next Sunday to block the far-right Le Pen party from winning an outright majority and forming a government, which has spooked French asset markets in recent weeks.

- In the face of this news, high volatility can be observed today on the shares of French banks, which have lost heavily in recent days on the wave of political events. Institutions such as BNP Paribas, Societe Generale and Credit Agricole are currently trading around 20% off their local highs.

- Futures contracts are pointing to a higher opening of the US and European cash sessions, with the upward momentum in Europe appearing likely to be stronger in this case.

- A number of important macroeconomic readings are scheduled for today. These will include CPI data from Germany, PMI data revisions for the world's major economies and ISM PMI data for US manufacturing. Investors will also hear several speeches by central bankers, including Governor Lagarde.

- China's Caixin PMI industrial data for June were. 51.8 (expected 51.2, previous 51.7)

- Japan's final manufacturing PMI for June 50.0 (previously 50.4).

- The Japanese government revisited the construction orders data and further lowered the GDP result. Japan's Q1 GDP was -2.9%; previously it was -1.8%.

- "Roaring Kitty," a well-known influencer of the "meme stocks" market, was sued for securities fraud.

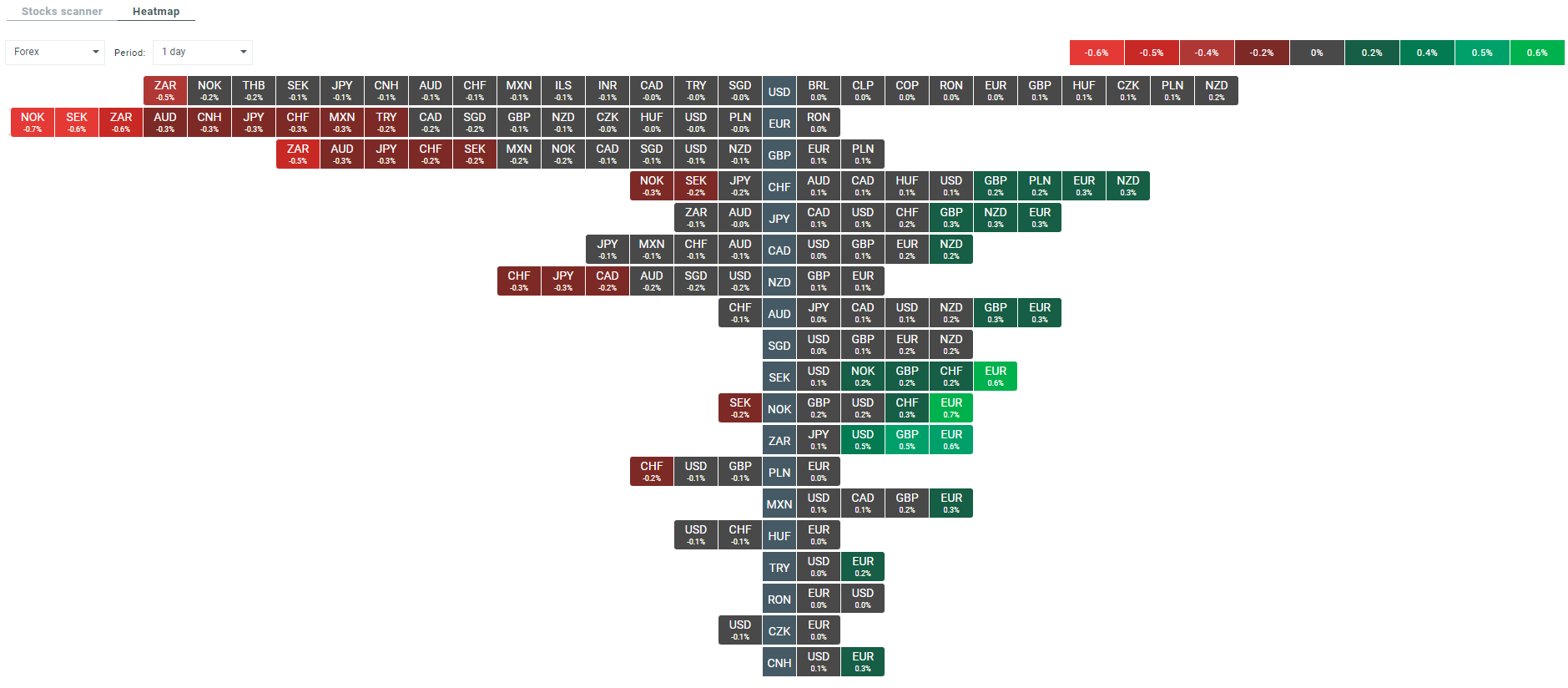

- In the FX market during the first phase of Monday's trading, the euro and the British pound are the best performers. In contrast, larger declines are seen in the Australian dollar and the Japanese yen.

- Bitcoin is regaining some ground and is back above the $63,500 barrier.

Source: Heatmap showing the volatility on each currency pair at the moment. Source: xStation

Source: Heatmap showing the volatility on each currency pair at the moment. Source: xStation

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.