-

US indices finished yesterday's trading significantly lower - S&P 500 dropped 1.40%, Nasdaq declined 2.20% and Russell 2000 closed over 1.40% lower.

-

The stock market experienced a sell-off, driven by robust jobs data and an increase in Treasury issuance.

-

This market reaction came a day after the U.S. credit was downgraded, leading traders to pull back following a rally that amassed $6.5 trillion.

-

Equities suffered broad declines, with the S&P 500 experiencing its worst performance since April.

-

The Nasdaq 100 index fell by 2%, following a 40% increase earlier in the year, spurred by interest in artificial intelligence.

-

Both NVIDIA and Tesla shares dropped by at least 2.7%.

-

The VIX, often referred to as Wall Street's "fear gauge," saw its most significant rise in nearly five months.

-

Ten-year bond yields reached levels not seen since November.

-

The U.S. dollar appreciated against all other developed-market currencies. Despite gains, the mood surrounding the dollar remains cautious, with less than 0.1% changes observed in dollar pairs.

-

Concerns grew among traders regarding a steepening yield curve, as rates on long-term bonds rose more quickly than those on short-term maturities.

-

A high-level conversation took place between the Pentagon's top Asia official and a representative from China's Ministry of Foreign Affairs, focusing on U.S.-China defense relations and regional security.

-

Australian Composite PMI registered at 48.2, and Australian Services PMI was 47.9.

-

Japanese Services PMI came in at 53.8, with the Composite PMI at 52.2.

-

Australian Trade Balance was reported at 11321M, with imports decreasing by 4% and exports by 2%.

-

The Chinese Caixin Services PMI was measured at 54.1.

-

India's Services PMI was recorded at 62.3.

-

Japan's Chief Cabinet Secretary Matsuno emphasized the close monitoring of foreign exchange movements and their potential effects on the Japanese economy.

-

Bill Ackman, of Pershing Square Capital Management, is taking a short position on bonds, anticipating a persistent inflation rate around 3%.

-

A preview of the Bank of England's Monetary Policy meeting hints at a potential 25 basis points rate increase.

-

Both Deutsche Bank and Japanese bank Nomura are projecting a 25 basis points rate hike from the Bank of England.

-

Analysts at ANZ bank are holding their end-of-year oil price prediction at $100 per barrel, citing expected slow growth in U.S. oil production.

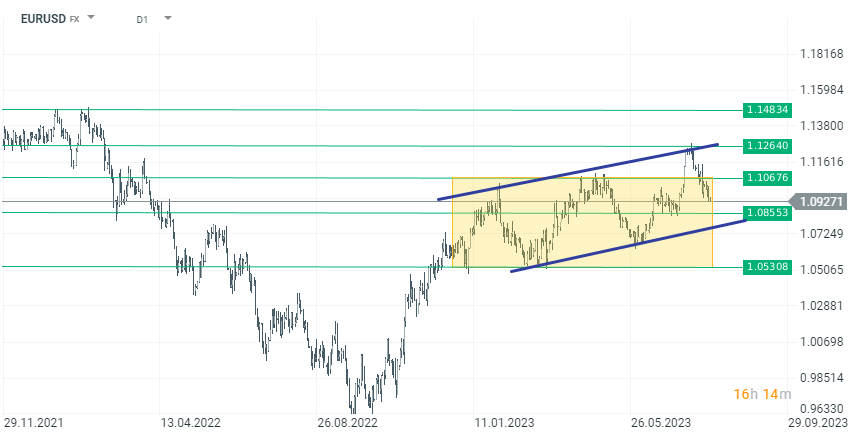

The U.S. dollar continues to strengthen, and today it is the best-performing currency among the rest of the developed countries. EURUSD has returned to the consolidation range and below the key level of 1.10. Currently, EURUSD is trading 0.10% lower at 1.0927.

The U.S. dollar continues to strengthen, and today it is the best-performing currency among the rest of the developed countries. EURUSD has returned to the consolidation range and below the key level of 1.10. Currently, EURUSD is trading 0.10% lower at 1.0927.

Economic Calendar: U.S. Unemployment Claims in spotlight (12.03.2025)

BREAKING: EURUSD muted after stable US CPI report 🇺🇸 📌

Market Wrap: Market awaits Middle East resolution and US CPI🕞

Economic calendar: US CPI inflation the key release 🔎

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.