-

Indices in the Asia-Pacific region are having a weaker session. Indices in China are losing about 0.10-0.50% despite good PMI data from the services sector.

-

The Japanese Nikkei 225 index is trading 0.53% lower, Kospi is recording a loss of around 0.80%, while the Australian S&P ASX 200 is trading with little change.

-

In the first part of today's session, among the strongest G10 currencies are the Australian dollar (AUD) and the New Zealand dollar (NZD). On the other hand, among the weakest currencies is the Japanese yen (JPY). The USDJPY pair is up 0.44% to 143,700.

-

The Caixin PMI indicator for services in China turned out much better than expected. The actual data was 52.9 in December compared to the November reading of 51.5 and expectations of 51.6.

-

Service activity in China increased at the fastest pace in five months, raising the level of optimism in the sector. These data contrast with the official survey conducted on Sunday by the NBS, which showed that the sub-index of service activity was 50.4.

-

Final PMI data from Australia in December rebounded slightly but remained below analysts' expectations. The actual PMI data for services showed an increase to 47.1, against a forecast of 47.6 and 46.0 previously.

-

The Japanese PMI for manufacturing was 47.9 in December against expectations of 47.7 and 48.3 the month before. According to reports, demand from key export customers from China, Europe, and North America, as well as from important sectors such as electronics, was lower.

-

As reported by the Taiwanese Ministry of Defense, three Chinese spy balloons were spotted on Tuesday during a flight over the island of Taiwan near an airbase. This was the first such incident since a similar event last month when similar balloons were noted in the Taiwan Strait.

-

Cryptocurrencies are rebounding after yesterday's weaker session. Bitcoin is trading again above 43,000 USD. Ethereum gains 1.30% to 2240 USD. Market sentiment improved after further reports of a possible decision as early as this Friday.

-

Also, yesterday after the close of the session, the SEC held a meeting with exchanges where trading in potential Bitcoin ETFs is to take place.

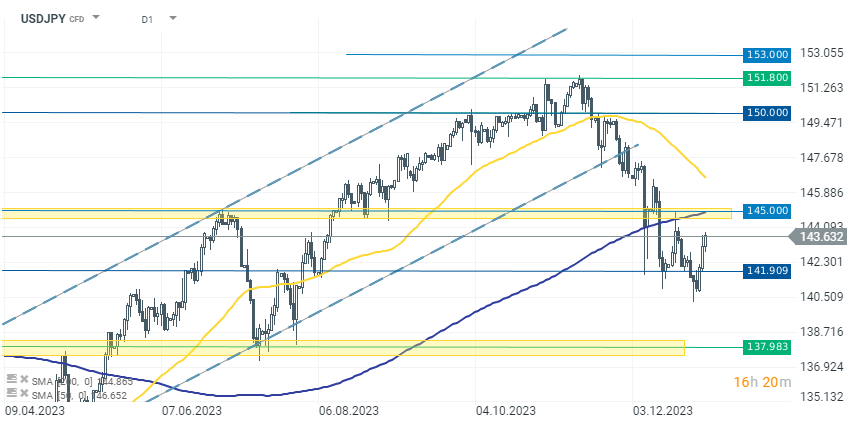

Today, USDJPY is gaining 0.40%, continuing its dynamic rebound for the third consecutive session. Currently, the rate is approaching the key level of 145.000, which has repeatedly and effectively prevented bulls from rising. Source: xStation 5.

Today, USDJPY is gaining 0.40%, continuing its dynamic rebound for the third consecutive session. Currently, the rate is approaching the key level of 145.000, which has repeatedly and effectively prevented bulls from rising. Source: xStation 5.

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.