-

Indices in the Asia-Pacific region are recording a session without a clear direction. Indices in China are losing about 0.50-0.60%. The Japanese Nikkei 225 index is trading 0.40% higher, while the Korean Kospi and Australian S&P ASX 200 are recording a loss of around 0.40%.

-

In the first part of today's forex market session, we also do not record major changes. The session was calm, and most currency pairs limit changes to a range from -0.10 to 0.10%.

-

The dollar is among the stronger currencies, and among the weakest currencies is the Japanese yen (JPY). The USDJPY pair is recording an increase of 0.14% to the level of 144,760.

-

North Korea fired over 200 artillery shells into the sea near the tense maritime border with South Korea on Friday. The rockets fell near the South Korean island of Yeonpyeong, and residents were ordered to evacuate in the face of the first such case since November 2010.

-

According to Politico, the American government is planning the US response to a wider, prolonged war in the Middle East. The military is developing plans to strike Iran-backed Houthi fighters who are attacking commercial shipping in the Red Sea, according to three American officials with access to confidential information.

-

The Japanese PMI index for services for December is at 51.5, lower than the preliminary estimates of 52.0, but higher than 50.8 points in the previous month.

-

Retail sales in Singapore performed slightly better than expected. Year-on-year data showed an increase of 2.5% y/y against a forecast of 2.2% y/y and -0.1% y/y previously.

-

The PMI index from India for services showed exceptionally positive sentiments in the sector. The index in December was 59 points compared to 56.9 points a month earlier.

-

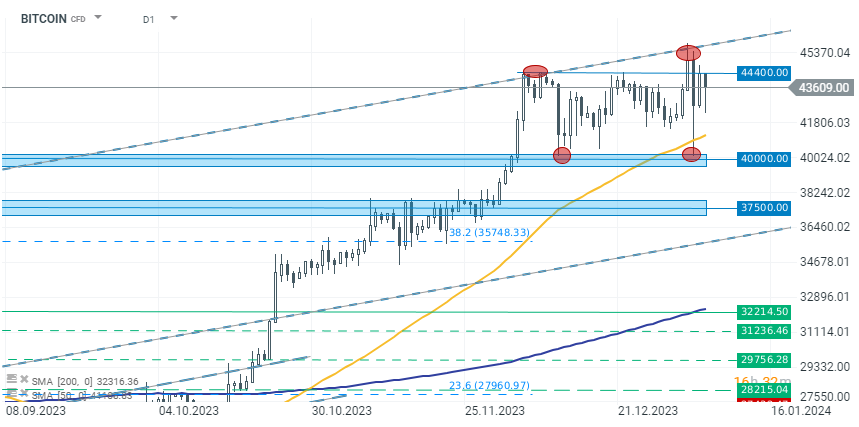

Cryptocurrencies are recording slight declines after yesterday's increases due to potential acceptance of ETFs today. Bitcoin is trading -1.10% lower around 43700 USD, and Ethereum -0.80% lower at the level of 2250 USD.

-

Yesterday's late-day increases were caused by analysts' reports about today's potential acceptance of ETF applications. The information is to be announced in the second part of the day.

Bitcoin remains in a consolidation channel as investors await the final information about the approval of ETFs by the SEC today. In both cases, we may witness greater volatility in the asset. Source: xStation 5.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.