Stocks in the Asia-Pacific region are showing mixed results after a relatively negative session on Wall Street, where the S& P 500 and DJIA indices fell from record highs, and US President Donald Trump turned his attention to the housing and defense industries, announcing a ban on large institutional investors buying more single-family homes and signing an executive order prohibiting the purchase of shares in defense companies.

Trump announced that he would not allow defense companies to pay dividends or carry out buybacks until they accelerated military equipment production, increased investment in manufacturing capacity, and reduced "excessive" executive compensation.

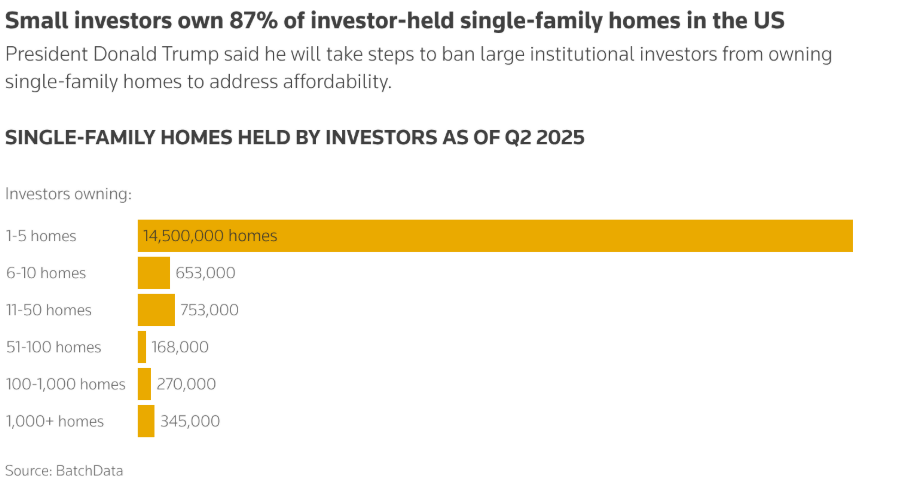

Source: BatchData via Reuters

At the same time, he stated that no manager in these companies should earn more than $5 million per year, and that money for investments should come from dividends, buybacks, and wage cuts, rather than debt or government funds.

Trump announced a ban on large funds buying single-family homes, which temporarily knocked around $17 billion off Blackstone's market capitalization, but the "mega" funds themselves account for only about 2-3% of all transactions in the single-family home market, which means that removing this segment of demand will not significantly change prices, as the main problem in the market is very low supply resulting, among other things, from existing investor ownership and high interest rates.

In response to these comments by the US president, shares in companies such as Lockheed Martin and Northrop Grumman fell by 3%, while shares in real estate companies such as Blackstone fell by as much as 6%.

In November, real wages in Japan fell by 2.8% y/y – the sharpest decline since January – due to a sharp drop in bonuses and persistently high inflation, which is putting further pressure on household purchasing power and complicating the BOJ's plans to tighten policy. Bond markets reflected these tensions with weaker demand for 30-year JGBs, while the Nikkei extended its losses below 52,000 points on a wave of profit-taking in the AI sector and the return of trade tensions with China, including an anti-dumping investigation into Japanese dichlorosilane.

Andrew Hauser of the RBA confirmed the hawkish rhetoric, assessing November's CPI as in line with expectations and emphasizing that inflation above 3% is still too high, which likely signals the end of rate cuts in this cycle and maintains the risk of a hike in February, supporting short-term yields and limiting the AUD's weakness during today's session.

On the FX market itself, defensive currencies such as the Japanese yen and the Swiss franc are performing best today. On the other hand, we are seeing large losses on pairs related to the AUD and NZD, which are reacting to the weakness of the commodities market.

SILVER is currently down 2.1%, while GOLD is down 0.4% on the wave of position reduction in local peak zones. Palladium and platinum are also losing significantly. At the same time, WTI oil prices are falling below $56.5 per barrel, continuing their long-term downward trend.

Bitcoin opens the session with a decline of nearly 1%. The situation is similar on Ethereum, where the scale of the sell-off is currently similar.

BREAKING: Another strong increase of oil inventories. Oil WTI close to 74

Strong Service ISM Reading as activity expanded most since 2022

BREAKING: Stronger than expected ADP fails to support the dollar 🇺🇸

Dollar rally stalls, but for long❓💸

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.