-

US indices finished yesterday's trading mostly higher. S&P 500 gained 0.10%, Dow Jones moved 0.3% higher and Russell 2000 rallied 1%. Nasdaq was a laggard and finished flat

-

Indices in Asia-Pacific traded mostly higher today - Nikkei and S&P/ASX 200 gained around 1.2% each, Kospi rallied 1.4% and Nifty 50 traded 0.6% higher

-

Indices from China traded 0.1-0.5% lower

-

DAX futures point to a higher opening of the European cash session today

-

New Bank of Japan Governor Ueda said that a small rate hike would not be a problem for the Japanese financial system. Ueda also said that he agreed with PM Kishida that there is no need to revise government-BoJ joint statement

-

AUD gains after Australia and China reached agreement on barley exports and Australia suspended WTO dispute against China

-

Fed Williams said he expects inflation to get back under 2% by 2025

-

Citigroup expects oil to drop below $70 per barrel amid slower-than-expected demand recovery in China and significant production potential in Iraq and Venezuela

-

Chinese CPI inflation decelerated from 1.0 to 0.7% YoY in March (exp. 1.0% YoY). PPI inflation came in at -2.5% YoY as expected (-1.4% YoY previously)

-

Bitcoin jumps 3% and trades above $30,000 mark for the first time since June 2022

-

Energy commodities trade mixed - oil gains 0.5% while US natural gas prices drop 0.3%

-

Precious metals benefit from USD weakness - gold gains 0.5%, silver trades 0.6% higher and platinum adds 0.4%

-

AUD and EUR are the best performing major currencies while USD and NZD lag the most

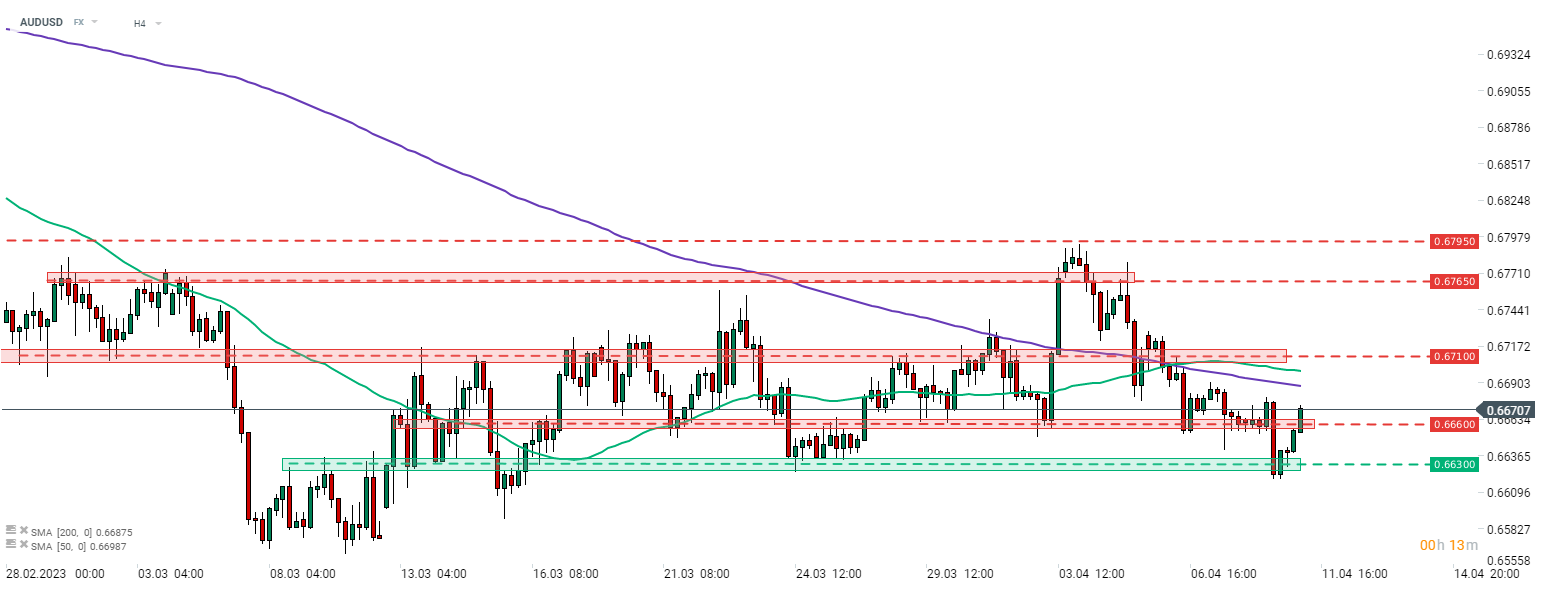

AUDUSD bounced off the 0.6630 support zone and climbed back above the 0.6660 area. Improvement in Australia-China trade relations is driving today's upward move on the pair. Source: xStation5

AUDUSD bounced off the 0.6630 support zone and climbed back above the 0.6660 area. Improvement in Australia-China trade relations is driving today's upward move on the pair. Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.