-

US indices finished yesterday's trading mixed. S&P 500 gained 0.25%, Dow Jones moved 0.26% lower and Nasdaq added 0.98%. Russell 2000 finished flat

-

Indices from Asia-Pacific traded mostly higher today. Nikkei gains 0.4%, indices from China traded up to 3% higher while Kospi and S&P/ASX 200 finished flat

-

DAX futures point to a slightly higher opening of the European cash session

-

Biden administration will review Trump-era tariffs on China and may drop them in order to lower inflation

-

Fed's Barkin said that central bank will have to decide whether to put the brakes on once Fed rate reaches neutral level. Fed's Mester thinks that rate hikes beyond neutral level will be needed. Fed's Waller thinks that rates can be raised without increasing unemployment

-

US Senate approved Lisa Cook nomination for Fed Board of Governors

-

Chinese CPI inflation accelerated from 1.5 to 2.1% YoY in April (exp. 1.8% YoY). PPI inflation decelerated from 8.3 to 8.0% YoY (exp. 7.7% YoY)

-

South Korean exports increased 8.9% YoY in the first 10 days of May. Semiconductor exports were 10.8% YoY higher

-

API report pointed to a 1.62 million barrel build in US oil inventories (exp. -1.2 mb)

-

Majority of cryptocurrencies is trading slightly higher today. TERRA is an exception as it drops 35% following almost-70% plunge yesterday

-

Oil regained ground and both WTI and Brent are trading around 2.5% higher. WTI climbed back above $100 mark

-

Precious metals benefit from USD weakness. Platinum and silver gain over 1% while gold and palladium trades 0.1% higher

-

AUD and NZD are the best performing major currencies while USD and JPY lag the most

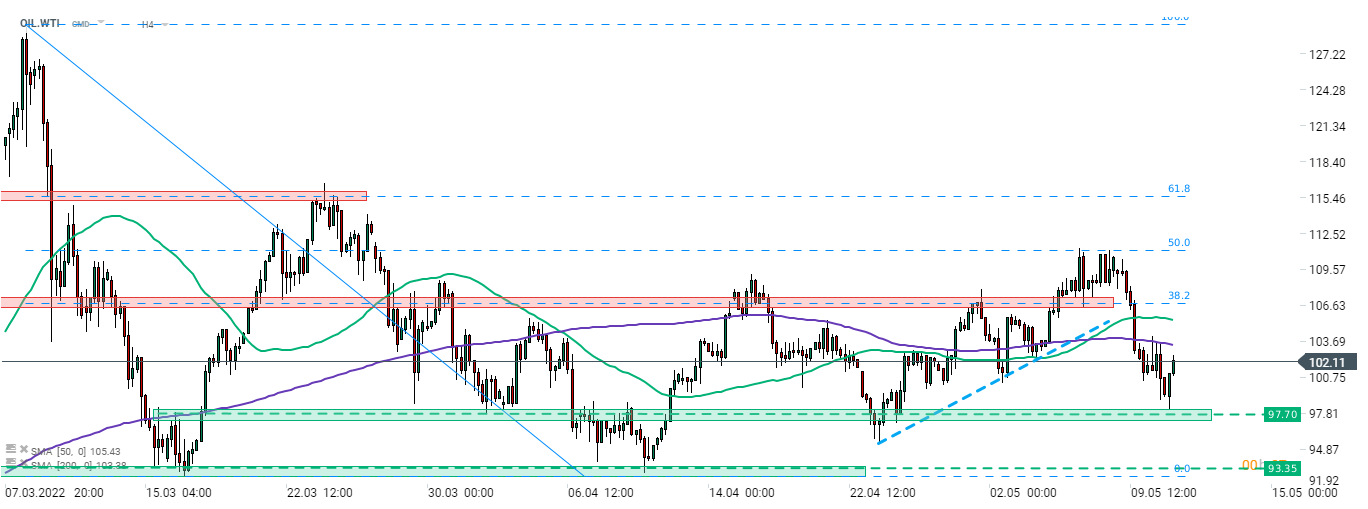

OIL.WTI dipped below $100 per barrel yesterday amid risk asset sell-off. However, bulls managed to regain control and price climbed back above those psychological hurdle. A near-term resistance to watch is marked with 200-period moving average at H4 interval (purple line, $103.40 area). Source: xStation5

OIL.WTI dipped below $100 per barrel yesterday amid risk asset sell-off. However, bulls managed to regain control and price climbed back above those psychological hurdle. A near-term resistance to watch is marked with 200-period moving average at H4 interval (purple line, $103.40 area). Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.