-

Asia-Pacific (APAC) markets traded in a weaker mood today, following the momentum of yesterday's US session. Japan's Nikkei 225 is up by 0.56%, the Hang Seng index is down more than 1.10%, S&P/ASX 200 is trading lower by 0.35% and Korea's KOSPI is lower by 0.40%.

-

Stocks and bonds ticked lower across the region on Thursday due to signals of Chinese weakening and potential Fed interest rate hikes.

-

Japan, Australia, China, and South Korea saw decreasing shares, pushing regional equity market prices to March levels, indicating a significant 2-day drop.

-

Hong Kong's Hang Seng index fell, possibly entering a bear market, Tencent's revenue drop impacted Chinese IT stocks amid gloomy news.

-

China's real estate recession might be worse than official figures. Chinese investors protested outside the office of one of the country’s biggest shadow banks, in a rare show of public outrage after the firm skipped payments on dozens of investment products.

-

Oil prices dropped for a fourth day due to Chinese economy concerns and stricter US monetary policy fears.

-

Morgan Stanley downgrades China's 2023 GDP forecast to 4.7% (from 5%) and 2024 prediction to 4.2% (from 4.5%).

-

Australia's Unemployment Rate reaches 3.7%, slightly exceeding the forecast of 3.6%, with a Participation Rate of 66.7%.

-

China intervenes in FX markets to prevent yuan's decline towards its 2007 low.

-

Japan's Total Trade Balance stands at -78.7B, which is a significant deviation from the forecast of 47.85B. The annual export change indicates a decrease of -0.3%, and imports are lower by -13.5% compared to the previous year. Core Machinery Orders show a decrease of -5.8% year on year, which aligns exactly with the forecasts.

-

RBNZ's Governor Orr anticipates a recession as a minimum outcome, envisions a restrictive approach for 1-2 years, attributing uncertainties to guidance.

-

Cryptocurrencies are experiencing further declines as negative sentiment dominates the market. Bitcoin has fallen below $29,000 and is down by 0.30% today. Altcoins have decreased by 5% or more.

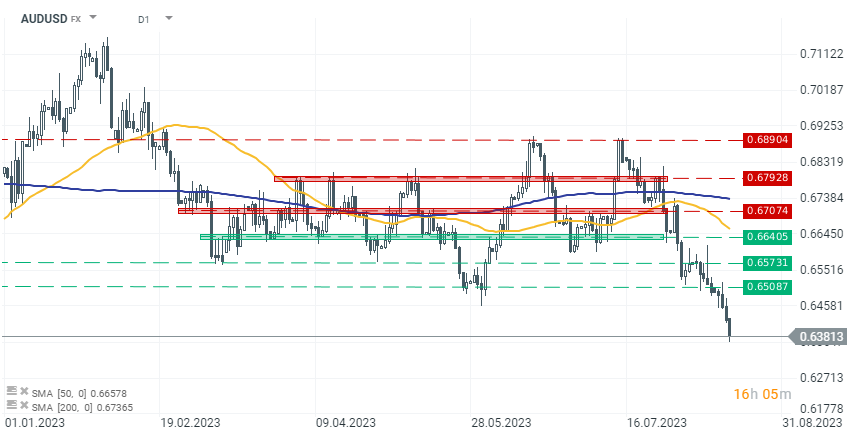

The Australian Dollar deepens its declines after worse-than-expected job market data. The AUDUSD is trading at its lowest level since November 2022.

The Australian Dollar deepens its declines after worse-than-expected job market data. The AUDUSD is trading at its lowest level since November 2022.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.