-

US indices had a solid session yesterday with S&P 500 finishing less than 10 points below its record high. S&P 500 gained 0.37%, Dow Jones moved 0.43% while Nasdaq dropped 0.05%

-

Stocks in Asia traded mixed. Nikkei dropped over 1.5%, Kospi dropped slightly, S&P/ASX 200 traded flat and indices from China gained slightly

-

DAX futures point to a lower opening of the European session

-

160 Republicans wrote a letter to US President Biden urging him to fix supply chain issues before considering any new spending measures

-

Fed Mester said that she does not expect rate hikes anytime soon. She also said that upside risks to inflation remain

-

Japanese Minister of Economy, Trade and Industry said that electricity supply-demand balance is expected to be the tightest in a decade during the upcoming winter season

-

United Kingdom has reached a preliminary free trade agreement with New Zealand

-

New Zealand credit card spending dropped 12.9% YoY in September (exp. -6.3% YoY)

-

South Korean exports increased 36.1% YoY during the first 20 days of October while imports were 48% YoY higher. Semiconductor exports increased 23.9% YoY

-

Tesla reported record revenue for Q3 2021 - $13.76 billion (exp. $13.63 billion). Unlike other carmakers that have already reported results, Tesla managed to increase sales in spite of chip shortages. Net income reached $1.62 billion, or $1.86 per share (exp. $1.59 per share). Company recorded a Bitcoin-related impairment of $51 million. Stock traded lower in the after-hours trading

-

Bitcoin reached fresh record levels yesterday with new all-time high being painted just slightly below $67,000 mark

-

Precious metals trade mixed - platinum and palladium gain while silver and gold drop

-

Brent reached a 3-year high near $86 per barrel but has pulled back since

-

AUD and GBP are the worst performing major currencies while CHF and JPY outperform

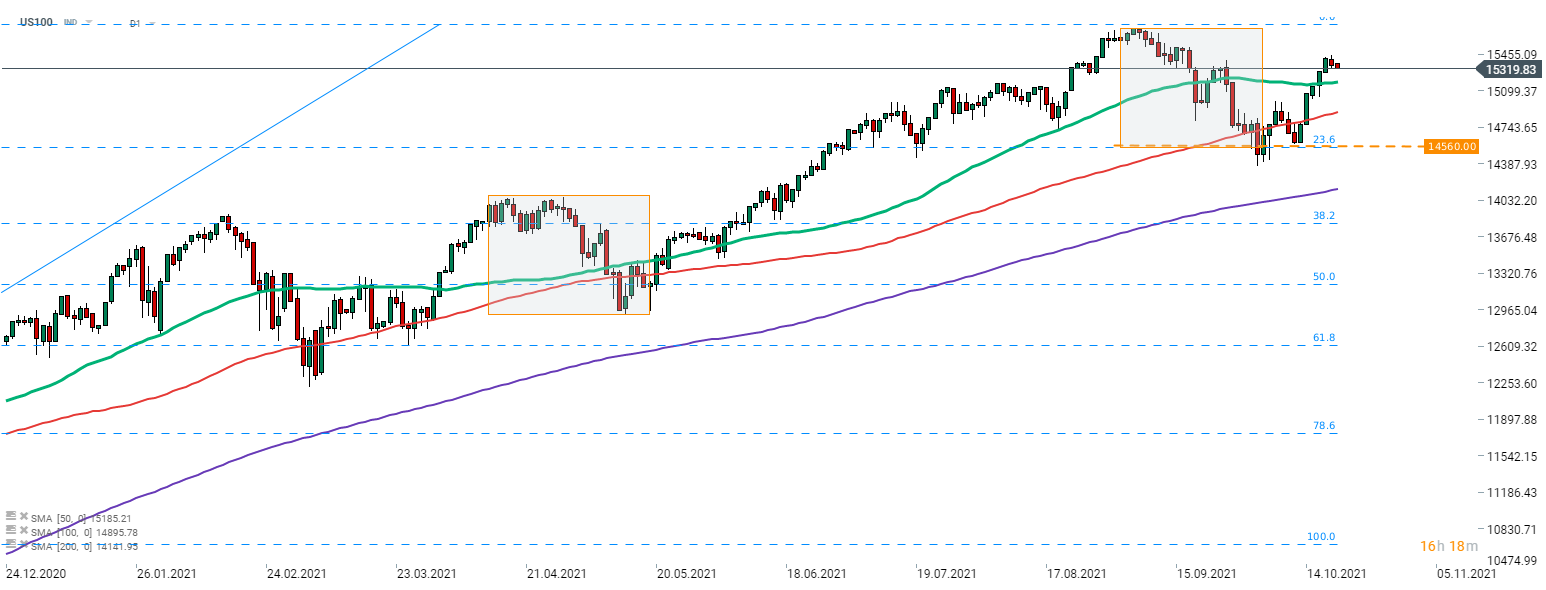

While the US tech sector tended to outperform the broad market, things look different now. S&P 500 (US500) trades around 0.5% below its all-time high while Nasdaq-100 (US100) would need to gain almost 3% to reach new record levels. Source: xStation5

While the US tech sector tended to outperform the broad market, things look different now. S&P 500 (US500) trades around 0.5% below its all-time high while Nasdaq-100 (US100) would need to gain almost 3% to reach new record levels. Source: xStation5

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.