- Markets resume standard trading after the Easter break.

- US stock index futures are trading higher. The initial upward movement came before Tesla's announcement that it is offering five-year zero-interest financing for its refreshed Model Y in China. Interestingly, the company's results themselves will be released today after the close of the Wall Street session.

- However, we are seeing a slightly different mood in Europe, as the declines observed yesterday on Wall Street are taking hold here. Markets on the Old Continent are therefore trying to "catch up" on yesterday's performance. Recall that the Nasdaq lost 2.55% yesterday.

- Shares of Chinese companies associated with cross-border trade and payments rose after the government began to seek to combat US tariffs, planning to promote the operation of free trade zones.

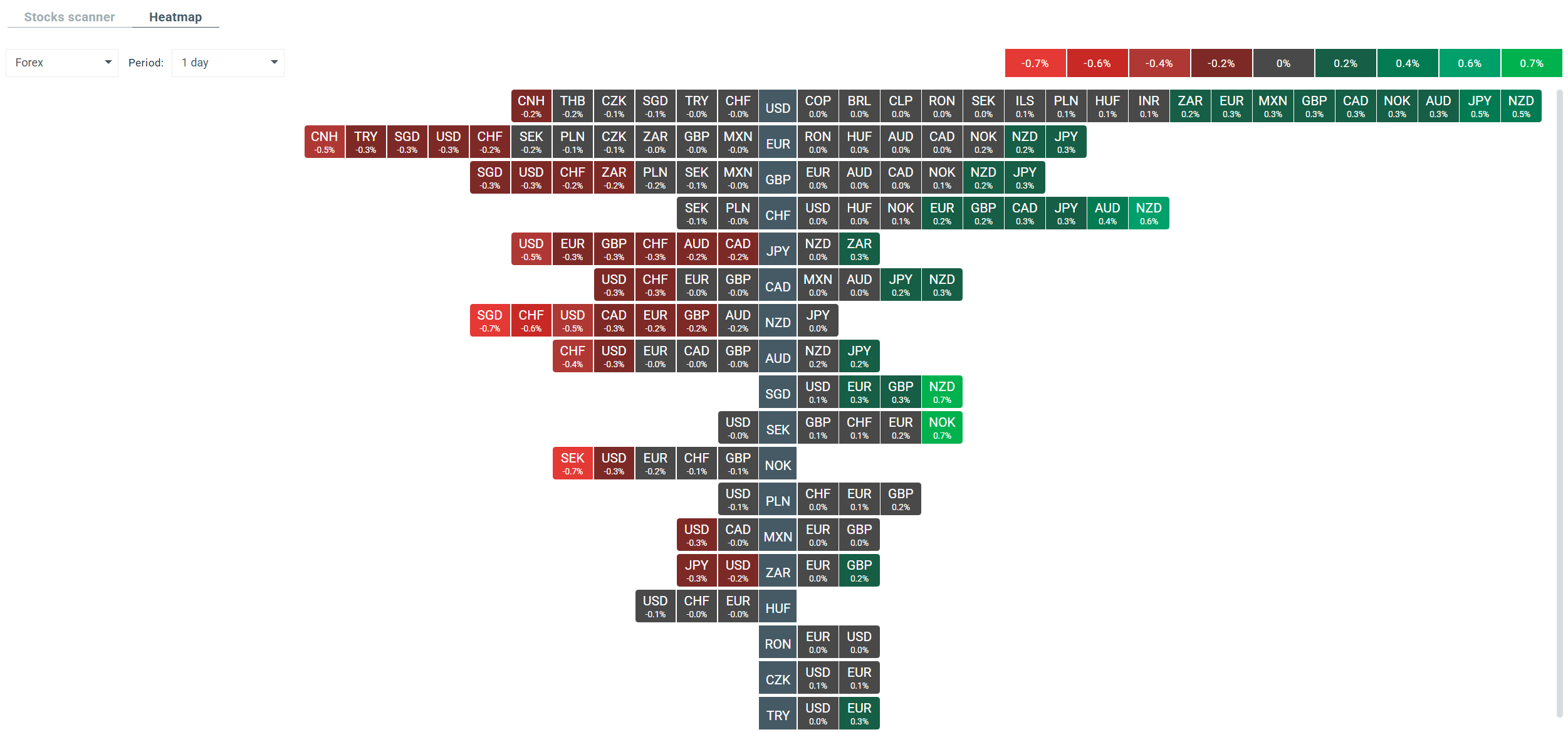

- On the broad FX market, the Japanese yen is currently the best performer, while the US dollar is proving to be the biggest loser. Antipodean currencies are doing relatively well, while the euro is also not doing so well.

- Gold continues its upward trend and is trading near $3,480 per ounce. Broad-market uncertainty supports this precious metal, which is gaining over 1.6% today alone.

- Bitcoin resumes its upward momentum and tests its 100-day exponential moving average. The cryptocurrency has increased by over 4% since yesterday.

- The most important events of the day will be Tesla's and SAP's quarterly results. Macro data from the Polish labor market, numerous speeches by FED and ECB bankers (including Lagarde) and the industrial price index from Canada.

Current volatility on the currency market. Source: xStation

Daily summary: Markets capitulate under the influence of the Persian Gulf

US Open: Wall Street in Blood

DE40 dips 3% and falls to 2026 lows 🚨📉

Chart of the day 🚨OIL surges 5% putting pressure on Wall Street

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.