-

US indices ended yesterday's session relatively weak. The benchmark Nasdaq of technology companies gained just 0.06% on the day, while the S&P500 itself lost 0.28%. The Dow Jones was the worst performer on the day, losing 0.51%.

-

The mood of Asia-Pacific markets is mixed, with the Nikkei up 0.25%, the Kospi losing 0.2%, the Nifty 50 rising 0.08% and the S&P/ASX 200 gaining 0.57%. The Hang Seng performed relatively well, gaining 0.78%.

-

European index futures point to a higher opening of the session on the Old Continent.

-

Investor attention will focus today on PMI data readings and Nvidia results (after the US session).

-

Australia's Woodside Energy is in talks with unions over possible strikes. According to Bloomberg, talks are expected to continue into the evening and the outcome of these meetings alone could be key to gas market sentiment.

-

US debt securities fared slightly better during early trading in Asia, halting the rapid wave of declines seen last week.

-

PMI data from Australia surprised on the downside. The reading for manufacturing came in at 49.4 points compared to the last 49.6 points, while services fell from 47.9 points to 46.7 points. The Composite index falls at 47.1.

-

Japan's PMI index readings surprised slightly above analysts' expectations. Manufacturing data at 49.7 against the last reading of 49.6. Services at 54.3 against the last reading of 53.8. The Composite index rises to 52.6 against the last reading of 52.2.

-

New Zealand Q2 retail sales were -1.0% q/q (-2.6% expected).

-

The US Department of Commerce eases export restrictions on 27 Chinese entities, and US Secretary of Commerce Raimondo herself met with Chinese Ambassador Xie Feng. The talks were described as "productive". A meeting of the Secretary in China is scheduled for next week.

-

Two tankers (one with LNG, the other with petroleum products) collided in the Suez Canal

-

API data show smaller-than-expected drop in oil stocks

-

Oil is currently gaining around 0.3% and US gas prices are trading at yesterday's closing levels.

-

Precious metals are trading higher, with gold adding 0.3% and silver over 0.9%.

-

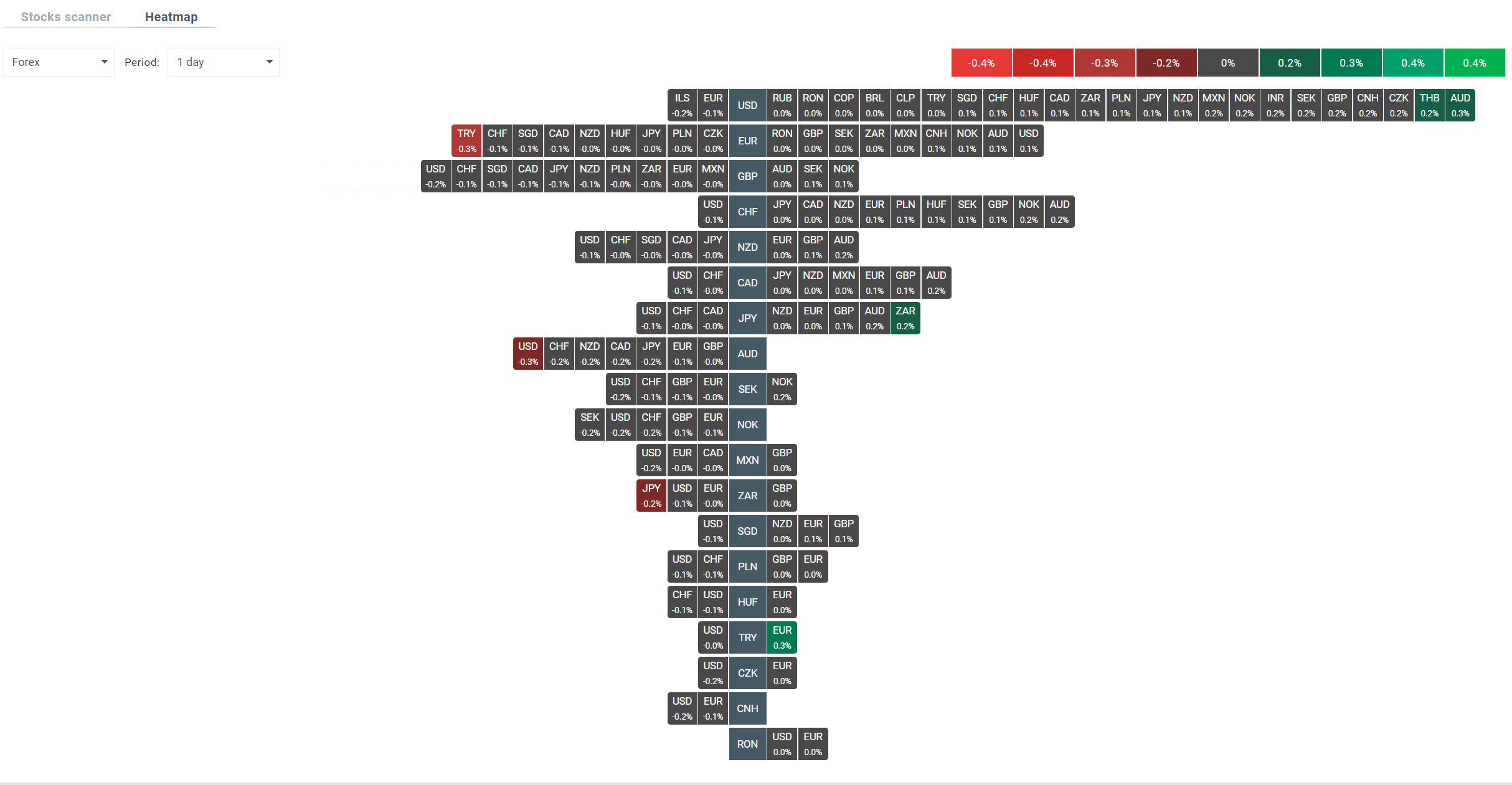

AUD and JPY are the strongest of the major currencies, with USD and CHF performing the weakest.

Current heatmap on FX market. Source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.