-

Wall Street indices launched yesterday's trading lower and were set for another day of heavy losses. However, indices staged a massive reversal and managed to finish the day higher

-

S&P 500 gained 0.28% (low: -4.01%), Dow Jones added 0.29% (low: -3.25%) and Nasdaq moved 0.63% higher (low: -4.9%)

-

Stocks in Asia failed to benefit from improvement in moods on Wall Street. Nikkei dropped 1.7%, S&P/ASX 200 and Kospi moved 2.5% lower each while indices from China traded 1.3-2.1% lower

-

DAX futures point to a higher opening of today's European cash session

-

US Department of Defense said that 8.5 thousand US soldiers are ready to move to Eastern Europe and aid NATO

-

Virtual meeting between the leaders of the UK, US, Germany, France, Poland and EU was held yesterday. Leaders agreed that Russian incursion into Ukraine must be met with swift response

-

US Secretary of State Blinken said that he prefers to return to Iran nuclear deal but talks with Iran cannot drag for too long

-

Japan will pay subsidies to gasoline wholesalers in order to halt price increases

-

BoJ Governor Kuroda said that increase in commodity prices is a bigger factor in CPI acceleration than weak JPY

-

Bitcoin reached a low slightly below $33,000 yesterday. However, cryptocurrency started to regain ground along with US equities and is now trading slightly below $36,000

-

Precious metals trade mixed - gold trades flat, silver drops while platinum and palladium gain

-

Oil trades higher on the day with Brent recovering back above $86.00 per barrel

-

CAD and JPY are the best performing major currencies while NZD and CHF lag the most

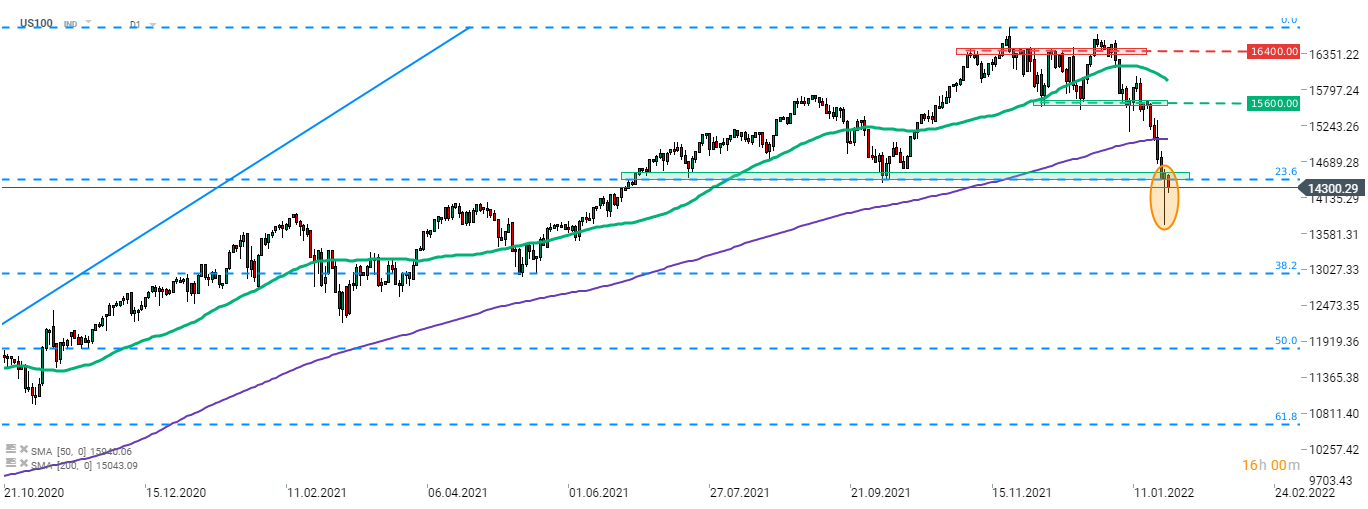

US indices staged a massive reversal yesterday with Nasdaq-100 (US100) recovering over 5% off the daily lows. A bullish candlestick pattern with long, lower wick was painted at 14,400-14,500 pts price zone. Nevertheless, some weakness can be spotted today. Source: xStation5

US indices staged a massive reversal yesterday with Nasdaq-100 (US100) recovering over 5% off the daily lows. A bullish candlestick pattern with long, lower wick was painted at 14,400-14,500 pts price zone. Nevertheless, some weakness can be spotted today. Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Strong Service ISM Reading as activity expanded most since 2022

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.