-

Indices in the Asia-Pacific region are experiencing a minor correction. The Japanese Nikkei 225 is down 1.35%, the Australian S&P ASX 200 loses 0.20%, and the Kospi gains 0.50%. Stock markets in China are returning to declines, recording a drop of 1.70-2.10%.

-

In the first part of today's forex market session, there are no major changes. The session was calm, with most currency pairs limiting changes to a range of -0.20 to 0.10%.

-

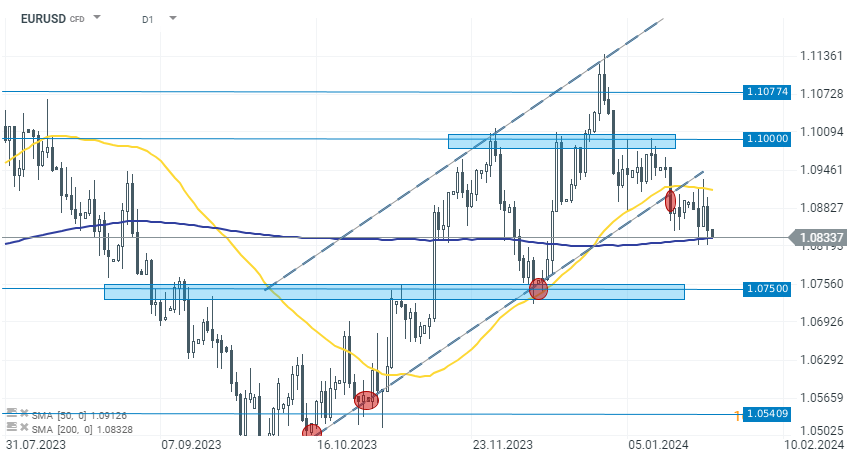

The EURUSD pair deepens yesterday's losses, losing 0.10% to a level of 1.0836.

-

Intel's financial report highlights a mixed performance. In the fourth quarter, the company saw a revenue increase of 10% year-over-year, reaching $15.4 billion. However, for the full year, Intel's revenue declined by 14% compared to the previous year, totaling $54.2 billion. Earnings per share (EPS) in the fourth quarter stood at $0.54. The full-year EPS was significantly lower at $1.05. Looking ahead to the first quarter of 2024, Intel forecasts revenue between $12.2 billion and $13.2 billion.

-

Today, early in the day, the minutes from the last meeting of the Bank of Japan (BoJ) were published. The Bank of Japan's policymakers agreed to continue debating the timing of exiting ultra-loose monetary policy and the appropriate pace of interest rate hikes after its conclusion.

-

Some members of the bank stated that the BOJ could maintain yield curve control as a loose framework, even after short-term interest rates return from negative territory.

-

Many members stated that positive wage inflation pressure must be confirmed to consider ending negative interest rates, YCC.

-

The head of Japan's largest labor union, Rengo, Tomoko Yoshino, confirms the desire for further wage and price increases.

-

Venezuelan President Nicolas Maduro reached an agreement with the political opposition regarding elections to be held later this year. This agreement led the United States to temporarily ease oil sanctions imposed on Venezuela.

-

North Korean leader Kim Jong Un may undertake some form of military aggression against South Korea in the coming months, following a shift to openly hostile policy, according to anonymous sources from a U.S. office.

-

The cryptocurrency market is noting slight increases, with Bitcoin gaining 0.45% and returning above the $40,000 level, while Ethereum rises 0.20% to $2,220. The market continues to be under immense selling pressure from Grayscale, which continues to sell off assets of its ETF.

-

The United States has made a public announcement that it will be selling over $130 million in bitcoins seized in money laundering related to Silk Road and drug trafficking crimes.

EURUSD is already losing over 0.10% in the first part of the day, and the rate is currently testing the SMA 200 average. Source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.