-

Stock indices in the Asia-Pacific region are recording a moderately bullish session. The Japanese Nikkei 225 is trading up 0.77%, the Australian S&P ASX 200 is gaining 0.05%, and the Kospi is up 1.42%. Stock markets in China are trading higher by about 0.50-0.60%.

-

In the first part of today's session after the weekend, there are no major changes in the forex market. The session is calm, with most currency pairs limiting their changes to a range of -0.20 to 0.20%.

-

The dollar is not recording significant changes. The most gaining currency today is the Australian dollar. The EURUSD pair is losing 0.05% today to 1.0840.

-

New Zealand's December trade balance narrows to a significantly smaller deficit. Expectations for interest rate cuts this year by the Reserve Bank of New Zealand are strengthening, which may lead to an earlier interest rate cut. Trade report details:

- Import: actual 6.26 billion (forecast -, previously 7.23 billion)

- Export: actual 5.94 billion (forecast -, previously 5.99 billion, revision 5.95 billion)

- Trade balance: actual -323 million (forecast -, previously -1,234.0 million)

-

On Saturday, North Korea conducted its third military demonstration this year. The exercises included the firing of multiple cruise missiles near an eastern military port, as reported by the Chiefs of Staff of South Korea. The military maneuvers were monitored by South Korean and American intelligence agencies, as reported by agencies from both countries.

-

US President Joe Biden announced that three American soldiers were killed and more than 34 were injured in a drone attack on a U.S. military base on the Jordan-Syria border. Biden stated that the attack was organized by "radical militant groups supported by Iran." The U.S. announced that retaliatory actions are planned.

-

According to Klaas Knot, a member of the Governing Council, the European Central Bank must be certain of a sustained decline in wages to be able to lower interest rates.

-

Meanwhile, Governing Council member Francois Villeroy de Galhau stated that the European Central Bank could lower interest rates at any time this year, and all options are open at the upcoming meetings.

-

Cryptocurrencies are gaining despite huge supply pressure. Bitcoin is trading 0.50% higher and has risen from a local low of 38,400 USD to 42,200 USD currently.

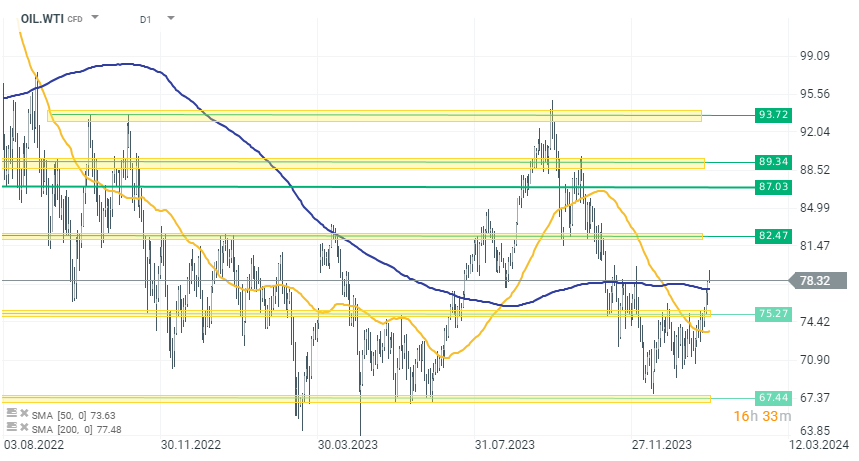

Today's oil quotes OIL.WIT are gaining 0.30% to 78.30 USD per barrel. The price is in an uptrend since confirming a double bottom formation around 67 USD. Source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.