-

Bad news is still good news, which means that markets still anticipate a soft landing scenario. After yesterday's worse Job Opening data report markets ended the session with solid gains.

-

The S&P 500 was up by 1,45% and Nasdaq 100 by 2,15% both approaching the crucial support levels.

-

Indices from Asia-Pacific traded mostly higher today. Nikkei gained 0.51%, S&P/ASX 200 added 1.2%, Kospi and Nifty 50 jumped by 0.5%.

-

Indices from China traded 0.2-0.3% higher after yesterday's strong gains, awaiting mortgage rate cuts in China.

-

Beijing reportedly plans to cut interest rates on some ¥38.6 trillion of existing mortgages.

-

US job openings decrease to 8.83 million, a more than two-year low, indicating reduced labor demand.

-

Consumer confidence in the U.S. declines due to worsening job outlooks and persistent inflation.

-

Japanese Consumer Confidence is at 36.2, slightly below the forecast of 37.4.

-

Australian CPI YoY is at 4.9%, lower than the forecast of 5.2% and the previous 5.5%.

-

Toyota is optimistic on economic growth, plans a 10% global output increase and a 26% domestic production increase for Sep-Nov quarter.

-

Bank of Japan board member Naoki Tamura anticipates sustained achievement of the 2% inflation target and advocates for keeping easy policy due to uncertainty. Ending negative rates, yield curve control are options in case BOJ were to exit easy policy but timing of easy policy exit must not be too late, but not too early too.

-

Morgan Stanley’s Analyst expects a strong rally in U.S. stocks, with the S&P 500 approaching 5,000 by year-end.

-

Today, USD is one of the strongest currencies among major economies, while the Japanese Yen is on the other end. USDJPY is trading 0.21% higher today.

-

Cryptocurrency market enjoys gains after US court ruled in favor of Grayscale and reccomended the SEC to reconsider Grayscle BTC spot ETH application again; Grayscale Bitcoin Trust was up by 17%, and Bitcoin was gaining 7%.

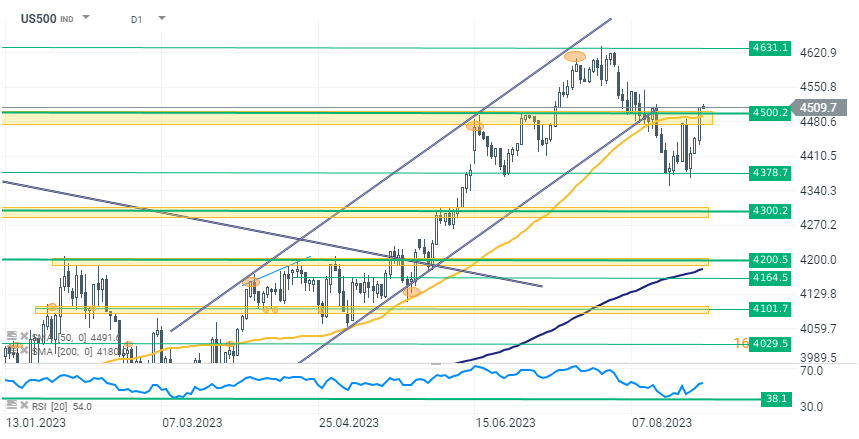

The US500 index has returned above the key support line at 4500 points after yesterday's dynamic increases. The Jolts data on new job openings turned out to be much worse, which led to euphoria in risky assets in anticipation of the end of the rate hike cycle.

The US500 index has returned above the key support line at 4500 points after yesterday's dynamic increases. The Jolts data on new job openings turned out to be much worse, which led to euphoria in risky assets in anticipation of the end of the rate hike cycle.

Daily summary: Markets capitulate under the influence of the Persian Gulf

US Open: Wall Street in Blood

DE40 dips 3% and falls to 2026 lows 🚨📉

Economic calendar: Eurozone CPI and central bankers speeches in focus

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.