- We are starting a new week of trading on international markets.

- The start of Monday trading is very volatile and interesting. The trend of "de-dollarization," already visible last week, has come to a halt today.

- The EURUSD pair is down 0.32% intraday and is trading in the 1.1852 zone. At the same time, USDJPY is holding steady below 154.500, a key control zone marked by the 100-day EMA.

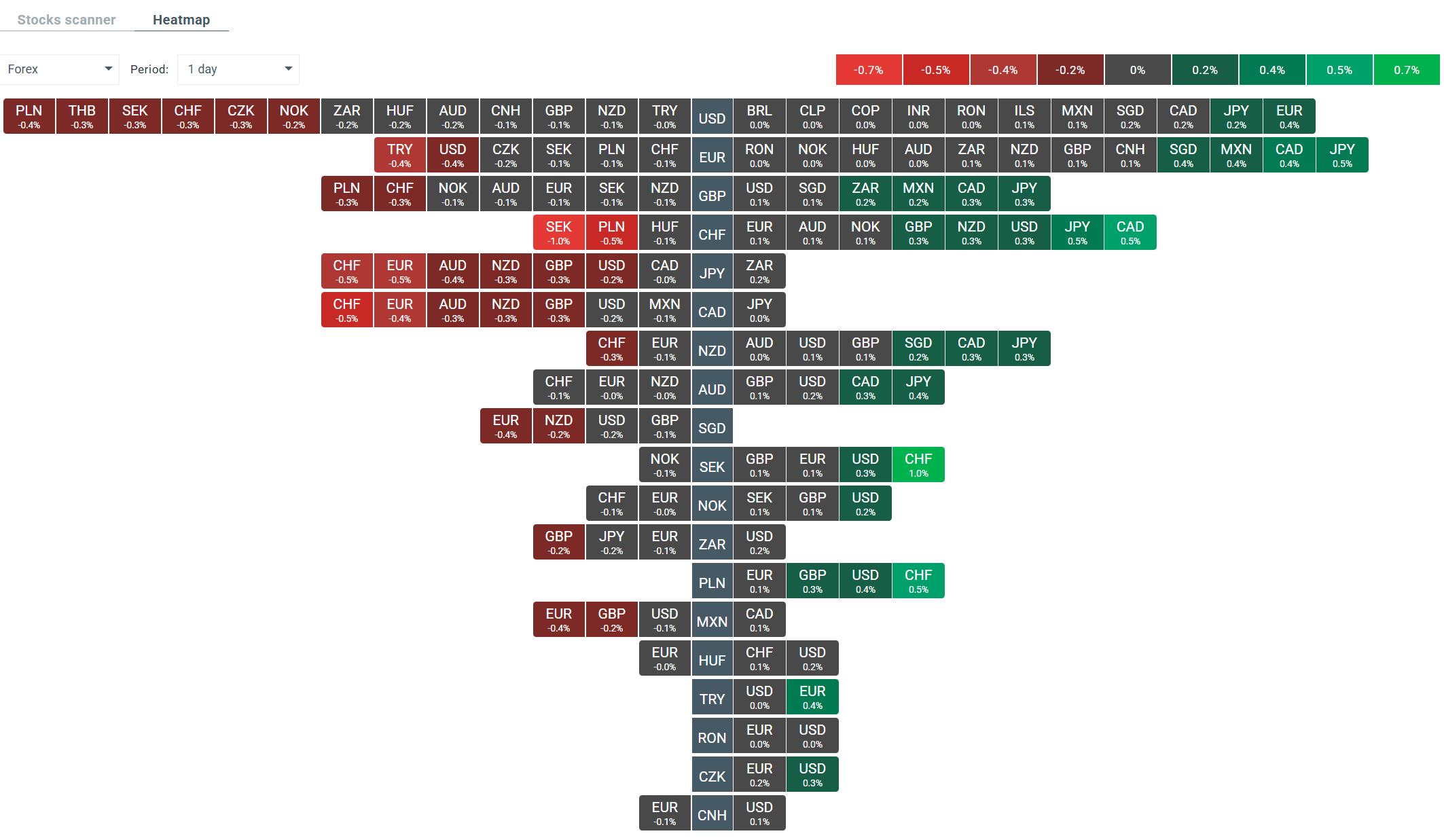

- In the overall Forex market, the yen and the Canadian dollar are currently performing best. Losses dominate the Swiss franc and the Australian dollar.

- The yen's strength stems from statements by Japanese Prime Minister Takaichi, who warned that the government is ready to take action against speculative movements in the face of currency weakness and a sharp rise in bond yields.

- The precious metals market is dominated by increases. The significant upward trends/dynamics of recent weeks are clearly continuing today. GOLD is trading above $5,000 per ounce for the first time, adding nearly 1.9% intraday. At the same time, SILVER prices are up as much as 4.85%, rising above $107.5.

- The extreme increases in metal prices are a combination of the trend toward de-dollarization, geopolitical turmoil, and speculation on the derivatives market itself.

- Trends for NATGAS and OIL.WTI also remain unchanged. Natural gas contracts are already up 5.44% due to continuing low temperatures and snowfall in the US.

- Mixed sentiments prevail on the stock market. Currently, contracts on US indices are losing between 0.10% and 0.3%. On the cash market, most Chinese indices lost value today, with the Nikkei 225 losing 1.83%. Markets in Australia were closed due to a public holiday.

- Sentiment is weak amid concerns about Japanese intervention and the latest threats from US President Trump regarding tariffs on Canada; Trump has threatened Canada with 100% tariffs if it enters into a trade agreement with China.

- Today's macro calendar is relatively empty. Investors will focus on Ifo data from Germany, retail sales from Poland, and the publication of durable goods orders from the US.

- Sentiment on the crypto market is improving after the cryptocurrency plummeted to $86,000 on Sunday.

Current volatility on the currency market. Source: xStation

Current volatility on the currency market. Source: xStation

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.