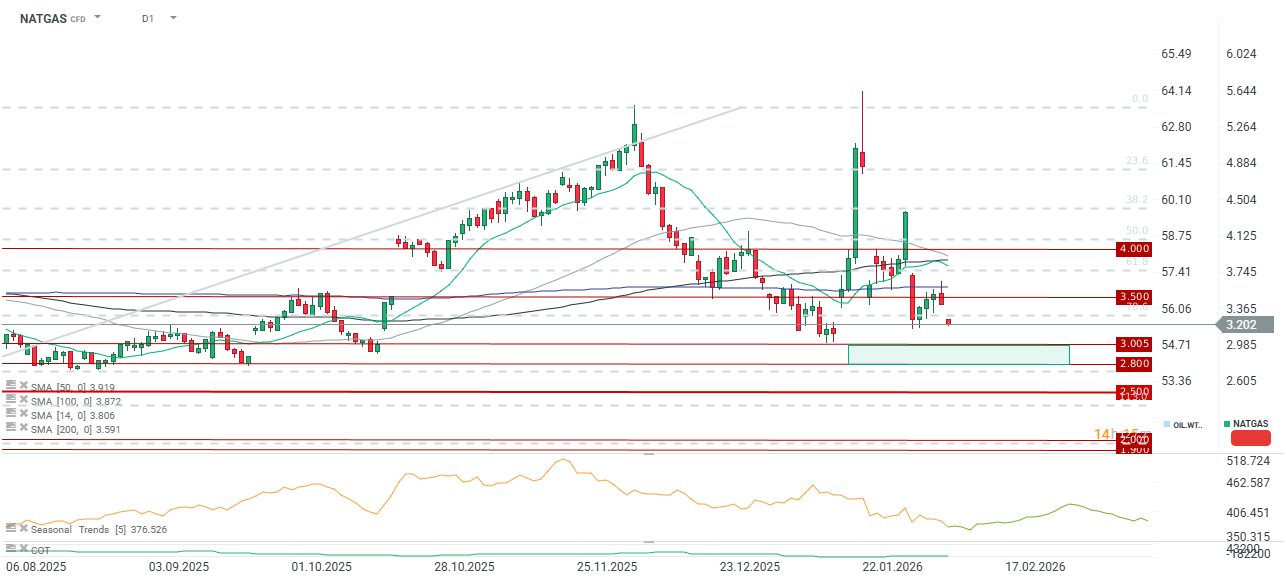

Natural gas prices have retreated by more than 6% at the start of the new week. Looking back to last Friday's peak, the price is now down as much as 12%. Markets are currently testing the $3.2 USD/MMBtu level, representing the local lows from early last week. Should this support be breached, prices would hit their lowest level since mid-January, with the potential to decline toward a significant demand zone around $2.8–$3.0 USD/MMBtu.

Primary drivers of the decline:

-

Shifting weather forecasts: Following January’s Arctic blast, meteorological models now indicate a warming trend across key US regions (such as the Midwest and Northeast), curtailing gas consumption for space heating.

-

Inventory dynamics: The latest storage report revealed a massive draw of 360 bcf (for the week ending January 30). However, upcoming temperature forecasts point to a significant reduction in heating requirements for February.

-

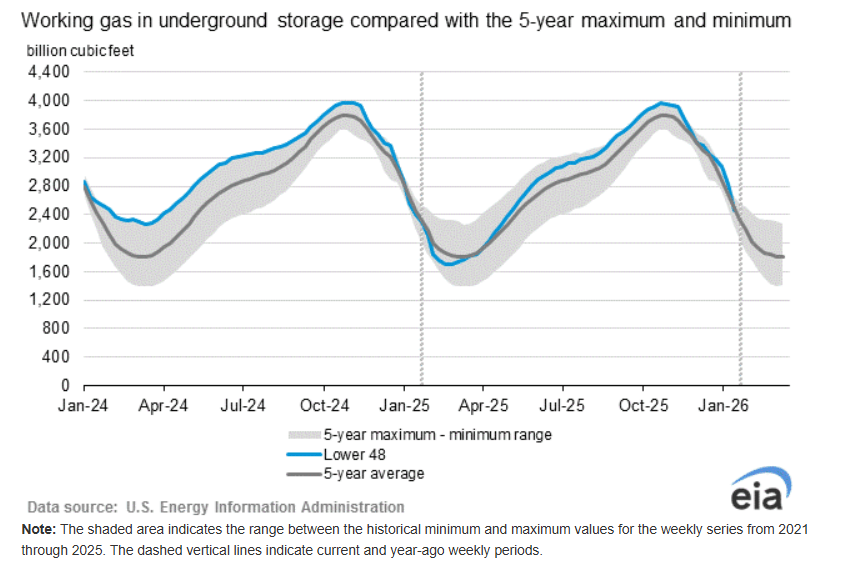

Stockpiles: Inventories remain above year-ago levels, while sitting marginally below the five-year average.

-

Softer industrial demand: Seasonal reductions in activity within the chemical and energy sectors, coupled with high storage efficiency, are weighing on prices.

Inventory and Seasonality Inventories remain relatively close to the five-year average. Forecasts suggest that gas consumption from the start of February will be significantly lower, which should result in smaller weekly drawdowns moving forward. Source: EIA

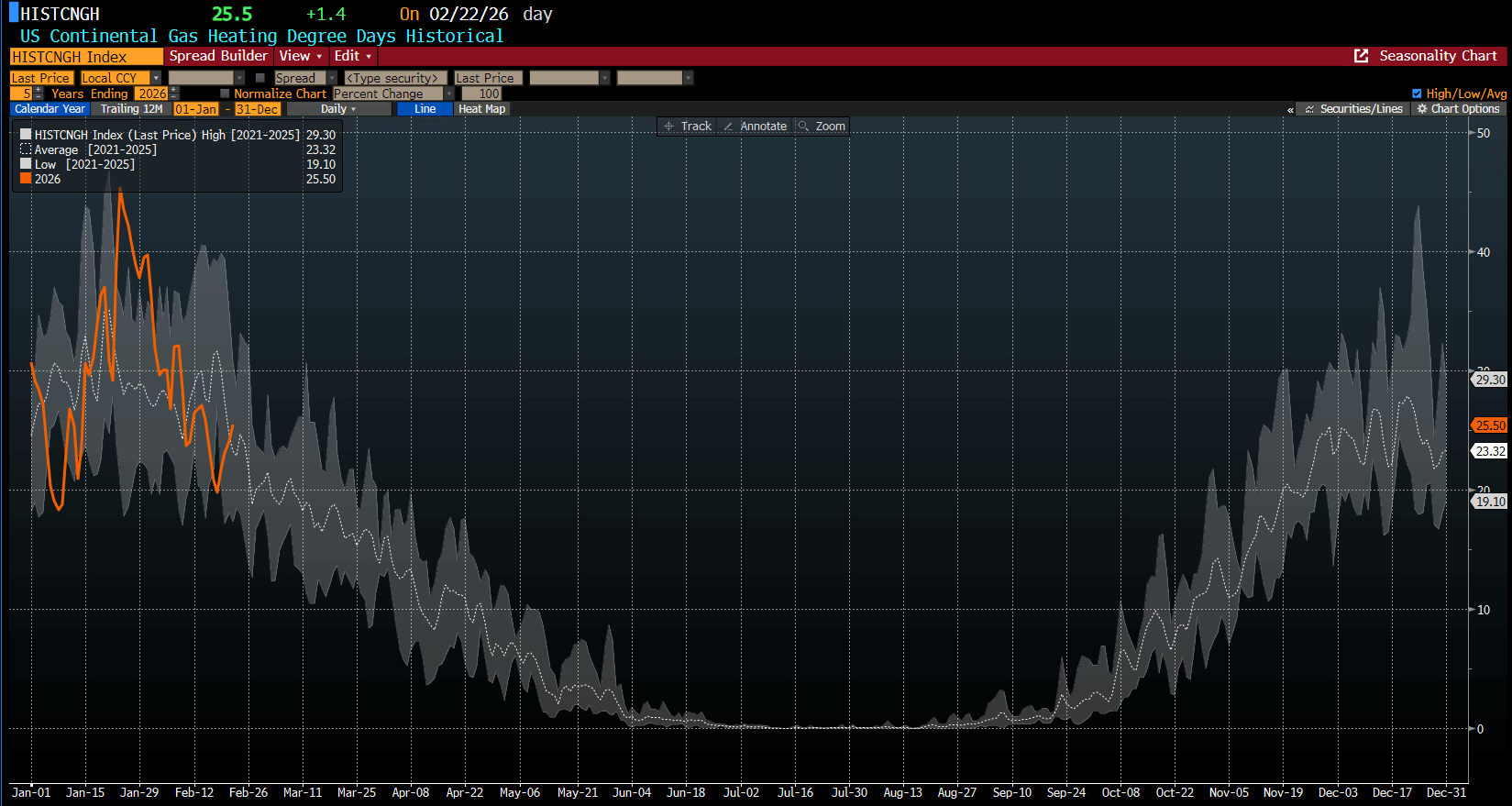

Heating Degree Days (HDD) The forecasted number of heating degree days for February 22 has risen toward the five-year average. Nonetheless, historical seasonality indicates a clear reduction in heating needs during the second half of February. Source: Bloomberg Finance LP

Heating Degree Days (HDD) The forecasted number of heating degree days for February 22 has risen toward the five-year average. Nonetheless, historical seasonality indicates a clear reduction in heating needs during the second half of February. Source: Bloomberg Finance LP

Technical Outlook Prices fell sharply at the start of the week. If the support near $3.2 USD is broken, the price may head toward the next demand zone situated between $2.8 and $3.0 USD/MMBtu. Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.