-

NFP report release on Friday, 1:30 pm GMT

-

Market expects 100k increase in non-farm payrolls

-

ADP showed unexpected drop

-

Markets reaction may be muted

NFP report for December (Friday, 1:30 pm GMT) is a top macro release of the week. Market consensus expects a 100k increase in the US employment following a 245k addition in November. However, ADP report released on Wednesday pointed to an unexpected 123k decline. Are there reasons to be worried about the condition of the world's largest economy?

ADP data showed impact of pandemic restrictions

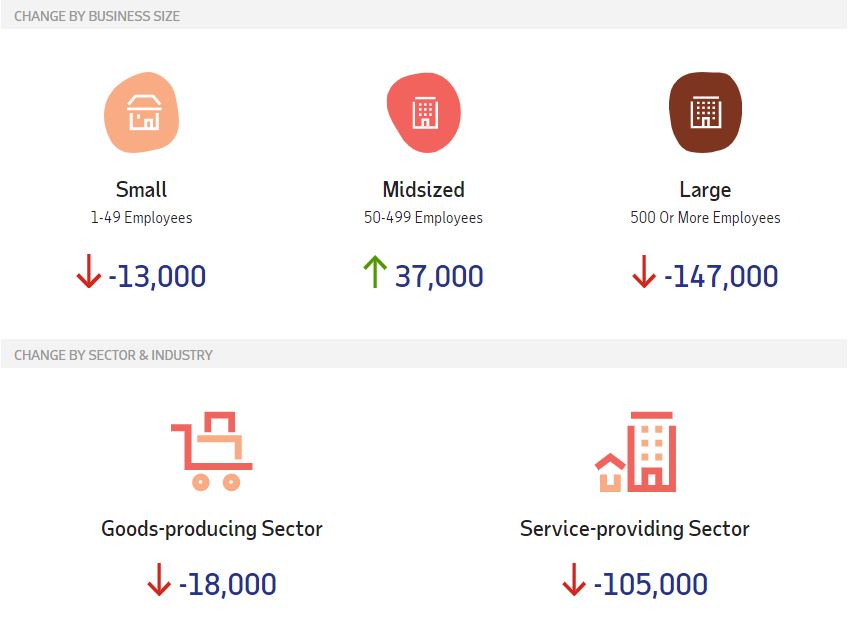

ADP report signalled a 123 thousand decline in the US private employment against an expected increase of 88 thousand. 18 thousand jobs were lost in the manufacturing sector while 105 thousand decline was seen in the services sector. Large companies (over 500 employees) and small companies (less than 50 employees) reduce jobcount by a combined 160 thousand in December. This was partially offset by 37 thousand jobs added by mid-sized companies (50-499 employees). A point to note is that job cuts in the services sector were more or less limited to two categories - "Trade, Transportation & Utilities" and "Leisure & Hospitality". Having said that, an impact of recently reimposed coronavirus restrictions in many parts of the United States on the data is evident. However, these may not be as worrisome as one would think.

Jobs losses in December were limited to small and big companies according to ADP data. Services took the biggest hit. Source: ADP

Jobs losses in December were limited to small and big companies according to ADP data. Services took the biggest hit. Source: ADP

Old news already?

The most important point to make is that the US economic relief package was passed by the end of December therefore ADP and NFP reports won't capture its impact. As business will be provided more support from the government, they may not be forced to cut more jobs. Moreover, a shift on the US political scene may lead to even more stimulus. Democrats have won control over Congress and it will make passing new laws much easier. Traders should keep in mind that it was Republicans who opted for a smaller stimulus deal while Democrats were all in for big and broad spending packages. There is a high chance that Democrats will quickly start working on another badge of government support and this could be the reason why markets largely overlooked dismal ADP reading yesterday.

What is expected from the NFP report and how will markets react?

Median estimate points to a 100k increase in the US employment level in December. Range of estimates compiled by Bloomberg is very wide with -400k being the lowest estimate and +250k being the highest one. Risks are tilted to the downside following a big miss in the ADP data. However, markets may look past disastrous reading because of the reasons mentioned above. Moreover, we have seen a few times in the past months that the market often treats bad news as good news hinting at more fiscal support. Having said that, NFP release is definitely a risk event to watch but investors should not be too surprised if reaction will be muted in case of a weaker-than-expected reading.

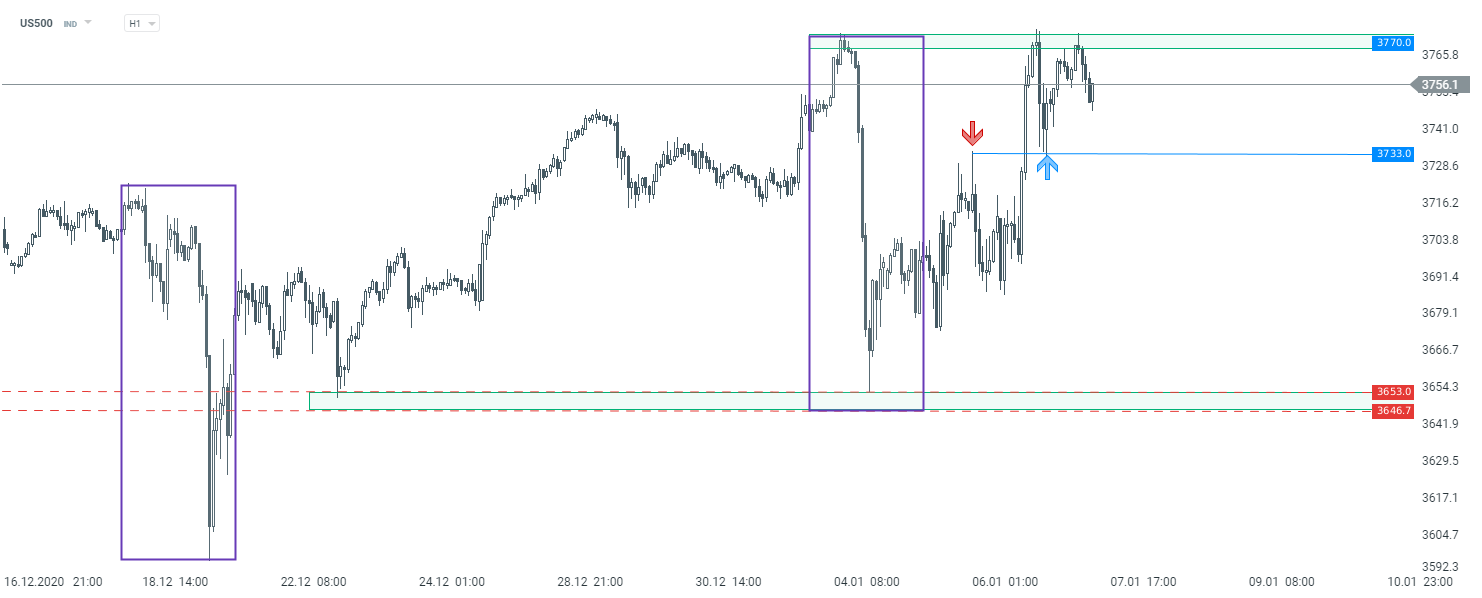

US500 continues to trade near record highs in spite of yesterday's dismal ADP reading. The latest drop was halted at the zone marked by the lower limit of the Overbalance structure and the index rushed to retest a record peak in the 3,770 pts area. A triple top was painted in the area and the index pulled back a bit. Swing area at 3,733 pts remains key support to watch should the decline deepen. Source: xStation5

US500 continues to trade near record highs in spite of yesterday's dismal ADP reading. The latest drop was halted at the zone marked by the lower limit of the Overbalance structure and the index rushed to retest a record peak in the 3,770 pts area. A triple top was painted in the area and the index pulled back a bit. Swing area at 3,733 pts remains key support to watch should the decline deepen. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.