-

NFP report for October to be released on Friday, 1:30 pm GMT

-

Powell made a hawkish turn during congressional testimonies this week

-

Wage growth continues to accelerate amid tight labour market

-

ADP Institute says employment still 5 million jobs short of pre-pandemic levels

-

Gold moved lower on prospect of quicker policy tightening

The upcoming NFP report (Friday, 1:30 pm GMT) will be closely watched by market participants. While US jobs data is always high on the agenda, the report for November may cement expectations ahead of the FOMC meeting scheduled for December 15, 2021. Fed Chair Powell has hinted earlier this week that a quicker pace of taper may be needed against the current economic backdrop.

Hawkish turn from Powell

Fed Chairman Powell made a hawkish turn during his congressional testimonies this week. Head of the US central bank said that it may be appropriate to adjust the pace of tapering during the upcoming meeting in December and finish asset purchase tapering a few months sooner. Moreover, Powell has also said that inflation should no longer be seen as transitory. This is a big shift from Powell and may suggest that the Federal Reserve will turn its focus back to inflation, should the jobs market recovery continue to progress. It may be about time to take a more decisive action as US wage growth continues to accelerate and threatens to result in a wage-price spiral, what would turn out to be a big problem for the Federal Reserve.

Wage growth in the United States continues to accelerate as employers have to boost wage to attract workers to come back to work. Such a situation creates a risk that employers will try to pass at least part of the increased wage costs onto consumers in terms of higher prices of services and goods, and therefore further fuel inflation. Source: Macrobond, XTB

Wage growth in the United States continues to accelerate as employers have to boost wage to attract workers to come back to work. Such a situation creates a risk that employers will try to pass at least part of the increased wage costs onto consumers in terms of higher prices of services and goods, and therefore further fuel inflation. Source: Macrobond, XTB

Promising ADP report, jobless claims

ADP employment report released on Wednesday pointed to a 534k jobs increase during the month of November. While reading was more or less in-line with market expectations, it showed that post-pandemic recovery of the US labour market is still on the roll. ADP Institute said that job gains in the post-pandemic era exceeded 15 million but the employment level remains around 5 million jobs short of pre-pandemic levels. A continued drop in jobless claims also points to jobs market becoming tighter.

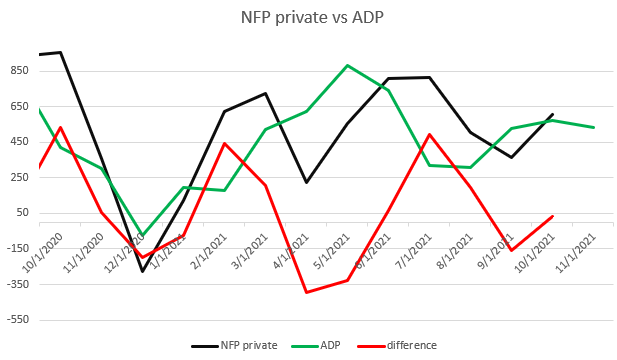

While the ADP report pointed to another month of strong jobs growth, it should be remembered that NFP does not always mirror ADP readings and the difference in some months is large. Having said that, there is still a scope for a surprise tomorrow. Source: Macrobond, XTB

While the ADP report pointed to another month of strong jobs growth, it should be remembered that NFP does not always mirror ADP readings and the difference in some months is large. Having said that, there is still a scope for a surprise tomorrow. Source: Macrobond, XTB

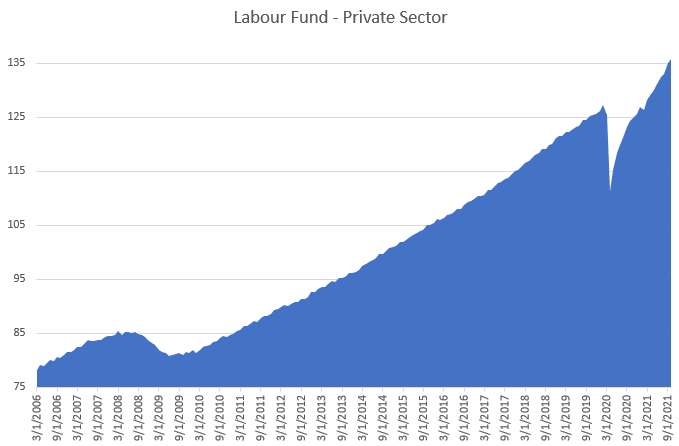

US labour fund - aggregate value of nominal wages - is back in-line with pre-pandemic trend. This is another evidence of very strong wage growth as data returned to the trend even as total employment level is still 5 million jobs short of pre-pandemic levels. Source: Macrobond, XTB

US labour fund - aggregate value of nominal wages - is back in-line with pre-pandemic trend. This is another evidence of very strong wage growth as data returned to the trend even as total employment level is still 5 million jobs short of pre-pandemic levels. Source: Macrobond, XTB

A look at markets: EURUSD, GOLD, US500

Unless the NFP report shows a big negative surprise, the decision on accelerating the pace of tapering during the December meeting looks like a done deal. Markets began to position themselves for such a scenario following Powell's testimonies this week.

Upward correction on EURUSD was halted at the 1.1360-1.1375 price zone, slightly above the upper limit of local market geometry, and the pair started to trade sideways following Powell's testimony. Short-term trading range is limited by 1.1360 handle from the upside and 23.6% retracement of recent downward impulse from the downside. Source: xStation5

Upward correction on EURUSD was halted at the 1.1360-1.1375 price zone, slightly above the upper limit of local market geometry, and the pair started to trade sideways following Powell's testimony. Short-term trading range is limited by 1.1360 handle from the upside and 23.6% retracement of recent downward impulse from the downside. Source: xStation5

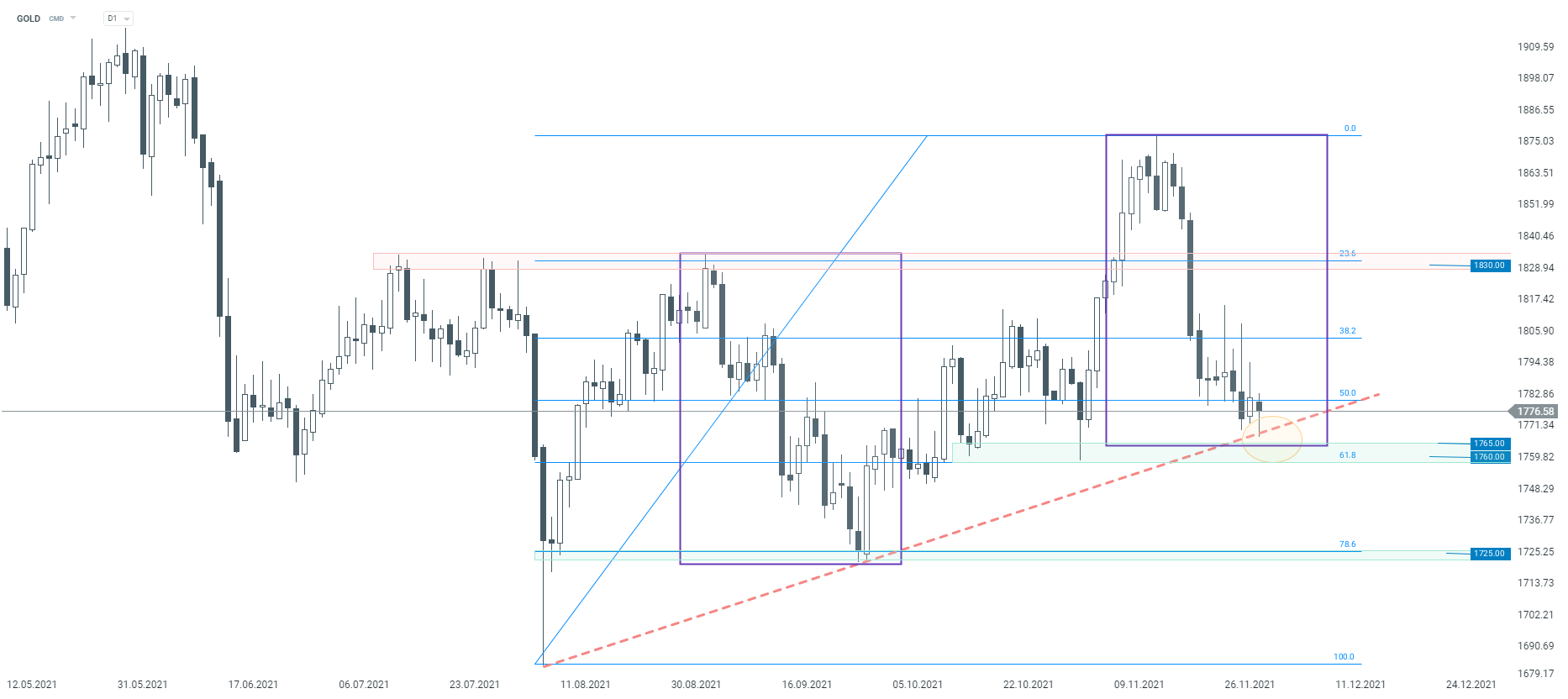

Gold took a hit after Powell hinted at possible quicker pace of QE tapering. Price of the precious metal pulled back and is trading just a touch above the lower limit of the Overbalance structure at $1,765 per ounce. The upward trendline has not been breached yet but price is trading dangerously close to it. Source: xStation5

Gold took a hit after Powell hinted at possible quicker pace of QE tapering. Price of the precious metal pulled back and is trading just a touch above the lower limit of the Overbalance structure at $1,765 per ounce. The upward trendline has not been breached yet but price is trading dangerously close to it. Source: xStation5

S&P 500 (US500) dipped below the 4,550 pts support marked with September's peak. Sell-off was halted slightly above the 100-session EMA (green line) and the index attempts to recover today. Key support - lower limit of the Overbalance structure - can be found around 3.5% below current market price. Source: xStation5

US100 gains 1% before Nvidia earnings📈

Will Powell remain hawkish❓

Market story: Valentine's Day has never been so expensive? The prices of coffee, chocolate and gold are at an all-time high

Will the ECB be forced to follow the Fed?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.