Nvidia's (NVDA.US) highly anticipated report significantly beat Wall Street expectations in both revenue and earnings per share. Revenue from the Data Center (AI) segment rose powerfully and guidance was extremely bullish. As a result, the stock is up nearly 6% after the Wall Street session and is approaching the area of psychological resistance, $500 per share.

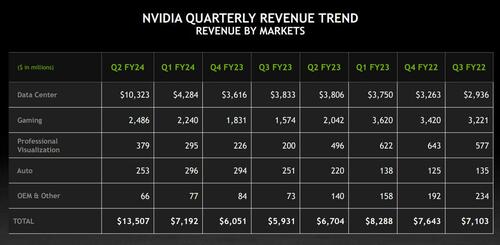

- Revenues: $13.51 billion vs. $11.04 billion forecast and $6.7 billion in Q2 2022 (101% y/y growth)

- Earnings per share (EPS): $2.7 vs. $2.07 forecast and $0.51 in Q2 2022

- Data center revenues: $10.32 billion vs. $7.99 billion forecasts and $4.28 billion in Q1 (171% y/y increase)

- Gaming revenues: $2.49 billion vs. $2.38 billion forecast (24% y/y growth)

- Professional Visualization revenues: $379 million vs. $318 million forecast (24% decrease y/y)

- Automotive revenue: $253 million vs. $309.4 million forecasts (15% increase y/y)

- Adjusted gross margin: 71.2% vs. estimated 70% (45.9% increase y/y)

- Company estimates Q3 revenue at $16 billion with 2% variance with forecasts consensus of $12.5 billion

- The board of directors approved an additional $25 billion for share buybacks, which Nvidia plans to continue in the current fiscal year. In Q2, it repurchased 7.5 million shares for $3.28 billion (easing market concerns somewhat around recent share sales by some company affiliates and the company's 'overvaluation' after 'astronomical' increases)

The results literally blew away analysts' expectations and confirm that demand for AI solutions remains huge. Revenue from the data center market was driven mainly by orders from major Internet companies and cloud providers. Data center computing performance grew 195% y/y and a dizzying 157% q/q largely due to Hopper chip architecture. Nvidia's growing computing power positions the company as a major beneficiary of the AI trend, not only now but also in the coming quarters - there is no competitor on the horizon that can threaten the position.

The company's higher-than-forecast result from the gaming segment is mainly due to its RTX 40-series graphics cards. Results from automotive surprised forecasts mainly through weakness in China, but rose y/y thanks to higher sales of autonomous driving models. However, the market sees Data Center results as key, and these literally shocked Wall Street expectations. The results surprised but even more strongly surprised analysts with euphoric forecasts. Third-quarter revenue is expected to be $16 billion, well above the highest expectations of $15 billion. Gross margins are expected to be 71.5% (non-GAAP).

Revenue from the Data Center segment (GPU chips for the AI sector) is emerging as the absolute base of the company's overall business. Source: ZeroHedge, Nvidia

Tomorrow, Nvidia (NVDA.US) shares are likely to test levels above $500 per share after US market open. Source: xStation5

TSMC Shares Are Soaring. Here’s Why the Markets Have Gone Crazy for the Company!

The coup in Venezuela boosts Europe and local defense stocks⚔️

Daily Summary: Massive Gains in U.S. Indices Completely Wiped Out

TSMC launches 2 nm, shares rise 📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.