Crude oil futures are gaining on Monday following the escalation of the Middle East conflict over the weekend and the announcement that Libya's eastern government will halt all oil exports and production. Libya currently exports more than $30 billion in oil annually. By 2023, the country will export an average of 1.2 million barrels of oil per day.

Weekend escalation

Hezbollah fired hundreds of rockets and drones toward Israel early Sunday morning. The attack came after the Israeli military carried out a preemptive raid on Lebanon using some 100 jets to thwart an allegedly larger attack by Hezbollah. Hezbollah, backed by Iran, announced the end of its military operation for the day, but said it would continue its military operations against Israel until a cease-fire in Gaza is agreed to

Suspension of exports

Libya's eastern government announced a halt to all oil exports and production, declaring a state of force majeure for all oil fields, terminals and oil facilities. The decision was made in response to moves by rival Tripoli to replace the central bank's leadership, exacerbating a domestic dispute over central bank independence and control over oil revenues. The decision to halt exports came amid already existing production problems this month, caused by failures at some oilfields.

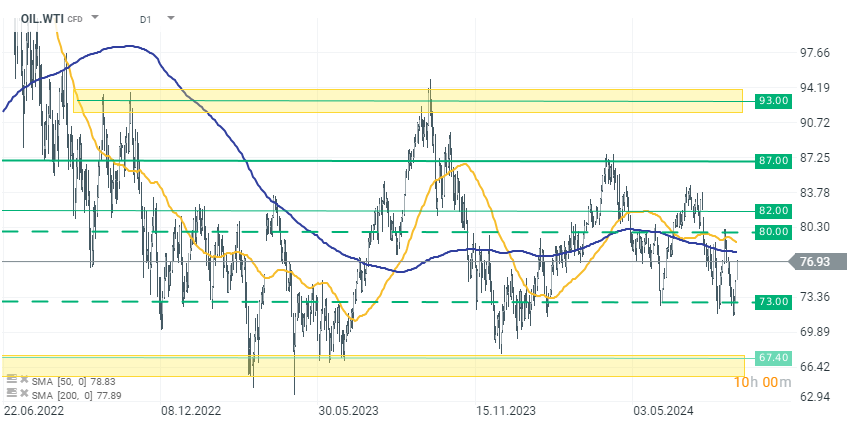

OIL WTI (D1 interval)

The price of WTI crude oil is gaining rapidly, extending the gains in Friday's session. The rebound from around $73 per barrel took the price to levels around $77 per barrel. If the escalation of the conflict in the Middle East continues and the situation in Libya does not calm down, testing the levels of $80 is within the range of the current upward movement.

Source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.