-

Oil producers discuss additional output cut of 500k bpd

-

Saudi Arabia’s energy minister said that “beautiful news” are coming today

-

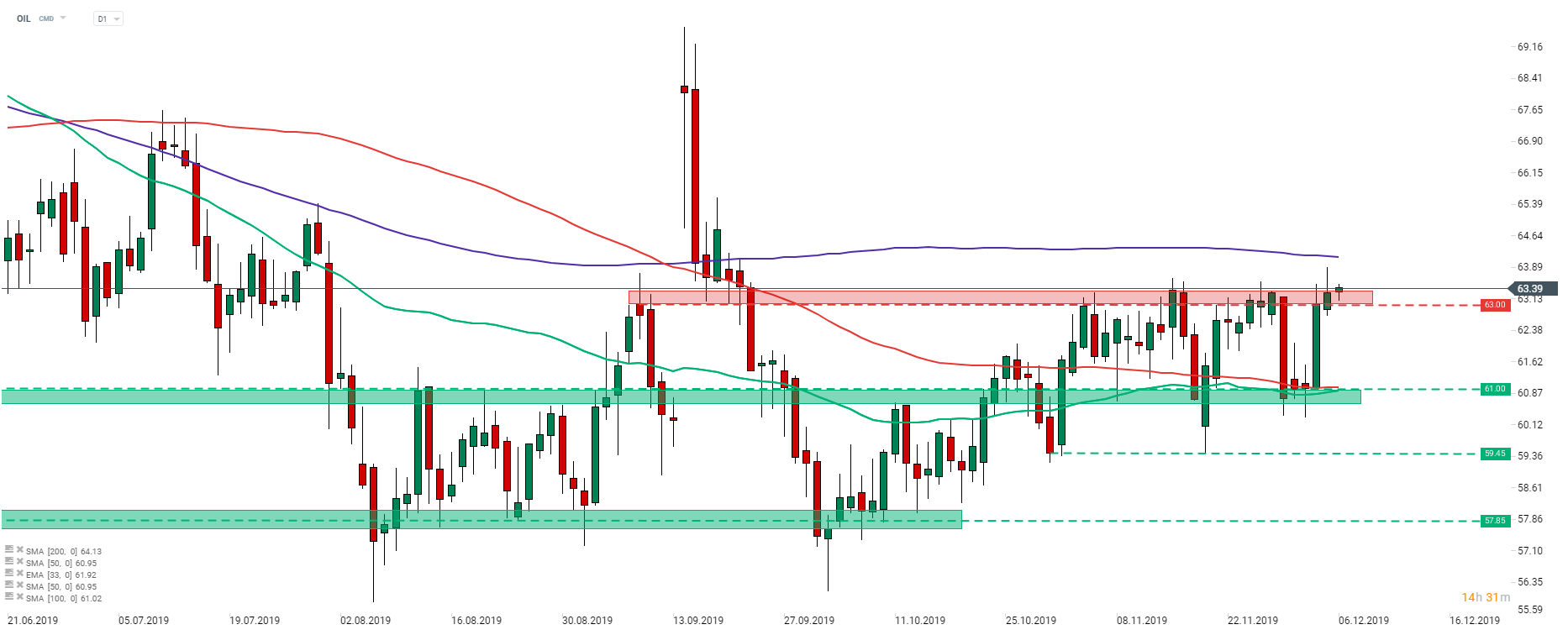

Brent (OIL) tests the upper limit of the trading range

OPEC members met yesterday in Vienna to discuss the future of the output cut agreement. It is said that oil producers are discussing an additional cut of 500 thousand barrels per day in the first quarter of 2020. However, no consensus was reached on the matter yesterday and, in turn, OPEC did not hold a post-meeting press conference for the first time in history. However, talks will continue today with non-OPEC producers, like Russia. Here is what we know at the moment:

-

It was rumoured that OPEC may deepen cuts by 300-800k bpd but 500k looks like the most probable scenario

-

Additional cuts are expected to take place in the first quarter of 2020

-

Whole output cut agreement may be extended until the end of the first half of 2020 (currently end-Q1 2020)

-

Russian cuts are expected to be left unchanged at 228k bpd

-

Russia and Oman want oil condensates to be exempted from the deal

-

Russian Energy Minister said that proposed quota will come into force only if all OPEC members commit to their pledged cuts

OPEC+ closed meetings session will start at 11:00 am GMT today. Press conference with a decision announcement is expected to be held afterwards. Comments from the Saudi Arabia’s energy minister suggest that deal is likely to be made as he promised “beautiful news” today. However, it should be noted that some oil producers were making deeper output cuts throughout the year and boosting agreement by additional 500k bpd cut may not have much of an impact on the fundamental situation. Meanwhile, Brent is testing the upper limit of recent consolidation range.

Brent (OIL) is attempting to break above the upper limit of the trading range. Crude price reached a 2.5-month high yesterday but failed to close above the resistance zone at $63. In case additional output cuts are announced today, prices could jump higher and test the next resistance in line - 200-session moving average (purple line, $64.15 area). Source: xStation5

Brent (OIL) is attempting to break above the upper limit of the trading range. Crude price reached a 2.5-month high yesterday but failed to close above the resistance zone at $63. In case additional output cuts are announced today, prices could jump higher and test the next resistance in line - 200-session moving average (purple line, $64.15 area). Source: xStation5

Cosmic increases in precious metals, yen in turbo mode! 🚀

🔝Gold breaches $5100 as silver tests $110

Gold surges over 2% and is approaching $5,100 on the back of a weaker dollar 📈

Daily summary: Precious metals madness 🚨SILVER breaks through $101 and rises 5%❗

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.