- For Broadcom, this breakthrough deal cements its role as a key player in the AI infrastructure sector.

- Broadcom’s shares are rising thanks to the OpenAI agreement.

- For Broadcom, this breakthrough deal cements its role as a key player in the AI infrastructure sector.

- Broadcom’s shares are rising thanks to the OpenAI agreement.

OpenAI has announced a strategic partnership with Broadcom aimed at developing and deploying its first independently designed artificial intelligence chips. This move responds to the company’s rapidly growing computational needs as it develops advanced generative models like ChatGPT. The new chips are scheduled to be launched in the second half of 2026, with a combined power capacity of 10 gigawatts—more than five times the energy generated by the Hoover Dam and enough to power over 8 million households in the United States. Following the announcement, Broadcom’s stock jumped nearly 8% at the start of trading!

Under the agreement, OpenAI will handle the design of the graphics processing units (GPUs), while Broadcom will be responsible for their technical development, manufacturing, and integration with servers and data center infrastructure. The new systems will be deployed both in OpenAI’s own facilities and in data centers managed by external partners. The entire setup will rely on Broadcom’s networking technology, including Ethernet solutions, which could serve as a viable alternative to Nvidia’s currently dominant standard.

This agreement fits into OpenAI’s broader strategy to reduce dependency on Nvidia’s limited supply and high-cost chips. Previously, OpenAI signed a contract with AMD for 6 gigawatts worth of chips and is collaborating with Nvidia to build infrastructure with an additional 10 gigawatts of capacity. Altogether, this amounts to 26 gigawatts of contracted computing power—more than the total summer electricity consumption of New York City.

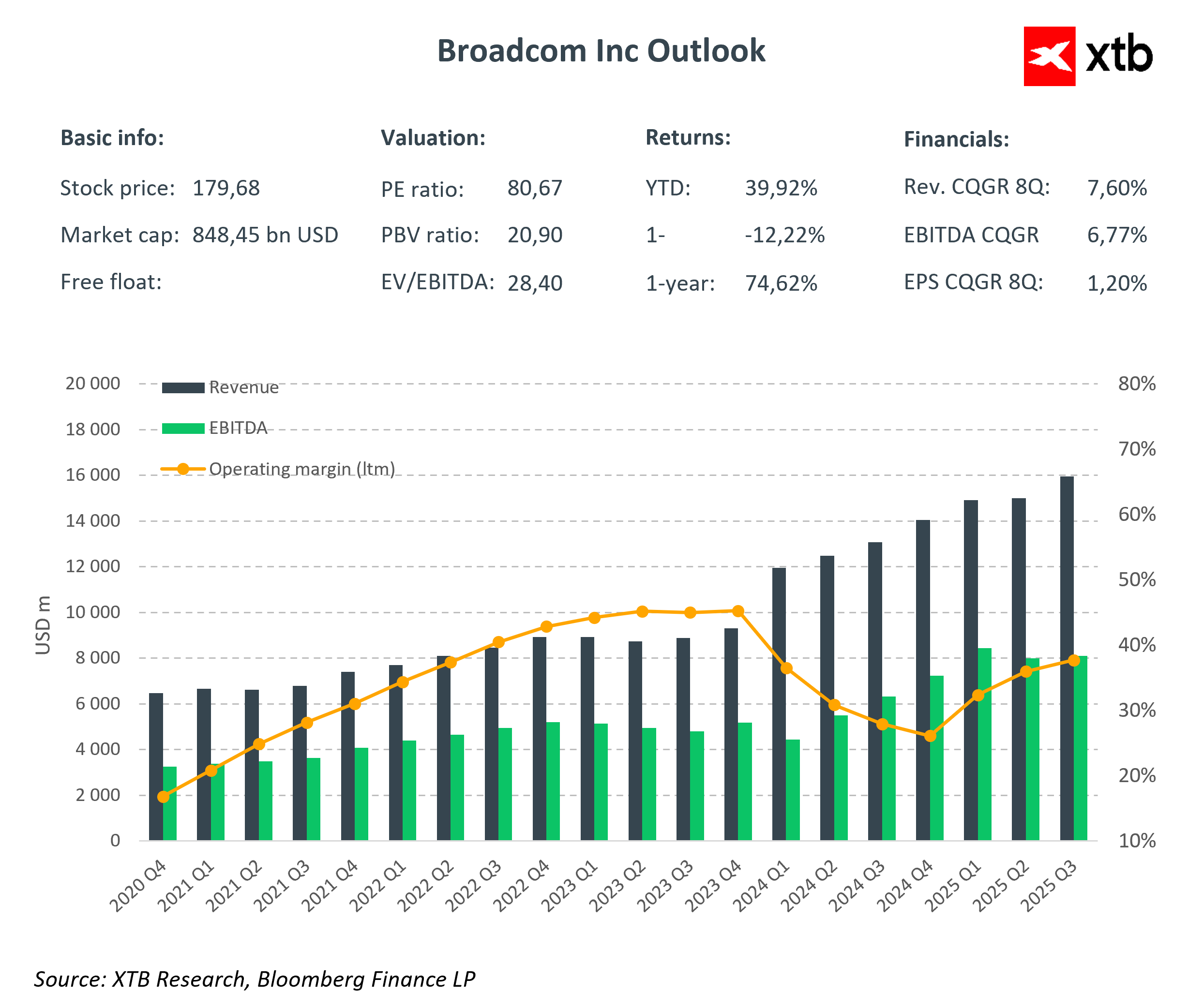

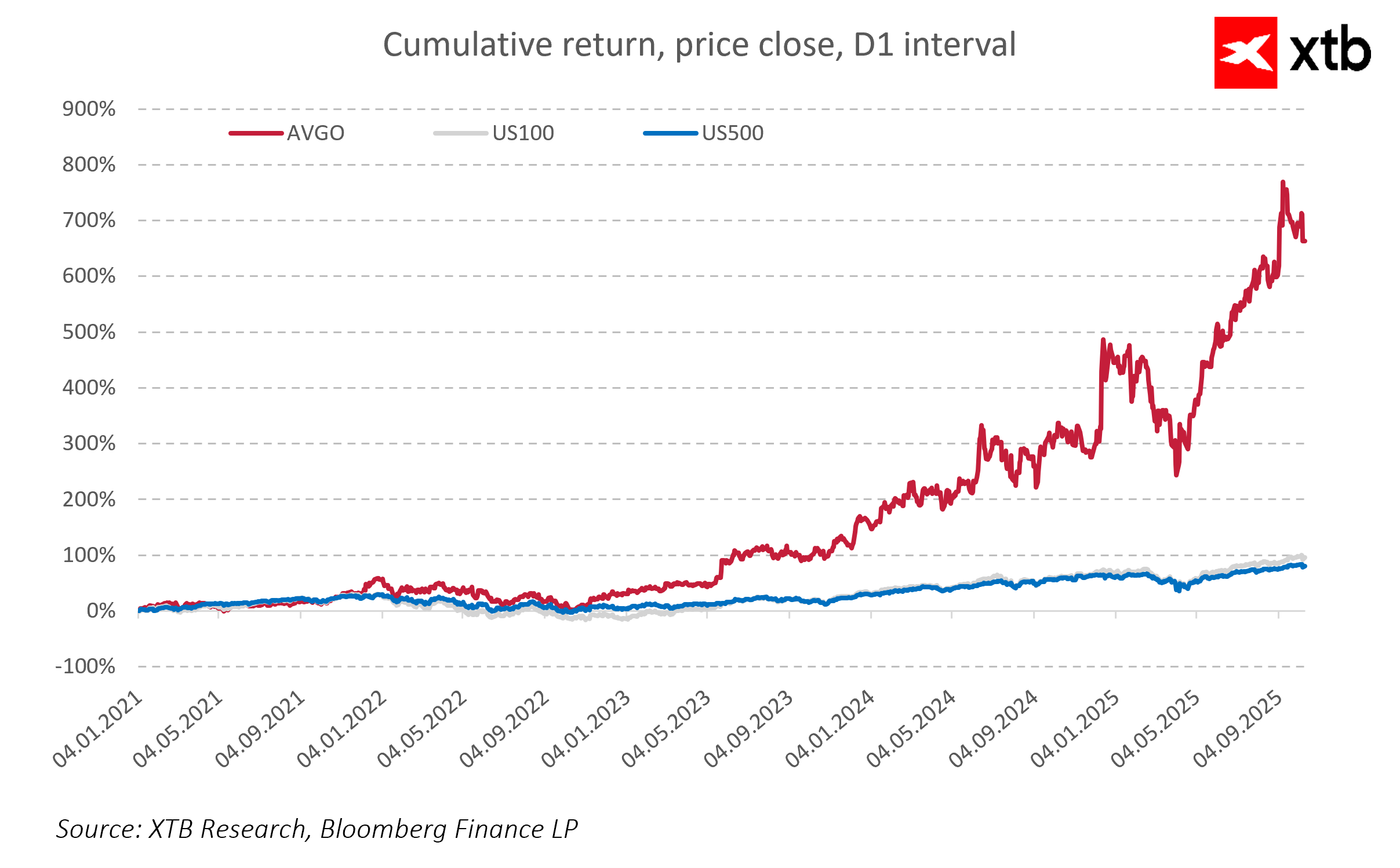

For Broadcom, this is one of the largest and most prestigious contracts in the company’s history. Traditionally known for networking chips and telecommunications solutions, Broadcom is now becoming a key player in the emerging AI infrastructure segment. Since the end of 2022, Broadcom’s stock price has been in a strong upward trend, rising nearly sixfold. Moreover, Broadcom’s revenue grows quarter after quarter, with each financial report confirming the increasing importance of the AI chip segment in the company’s overall revenue structure. The partnership with OpenAI further strengthens Broadcom’s position as a major beneficiary of the global artificial intelligence boom.

Daily Summary: Middle East Sparks Oil Market

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

Oil Under Pressure as G7 Decision Remains Pending

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.