Peloton (PTON.US) shares plunged more than 4 % after Wedbush Securities downgraded the fitness equipment maker’s stock to “neutral” from “outperform” saying there may be too much competition now for Peloton to keep up the pace as consumers now have a wider spectrum of workout alternatives, as well as the post-pandemic option of out-of-home workouts. Wedbush analysts believe that Peloton is going to need to introduce innovative new products and initiate some savvy marketing if it expects consumers to choose it over the competition.

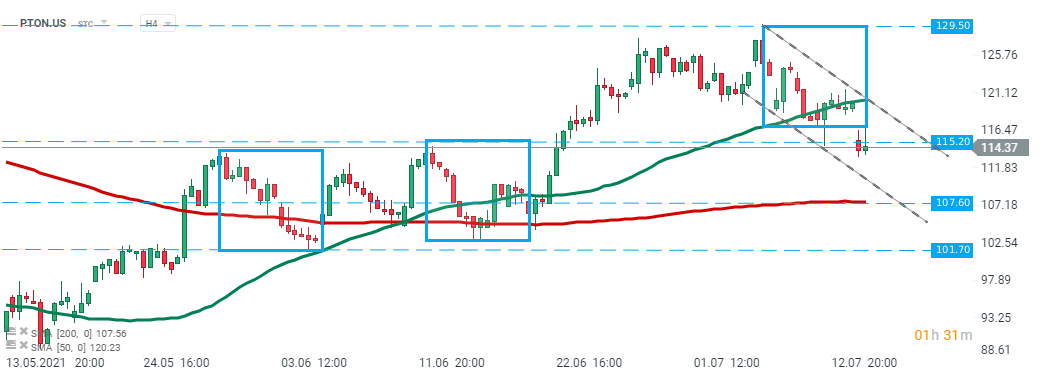

Peloton (PTON.US) stock has been moving in an upward trend since the beginning of May, however, some weakness can be spotted in recent days. Stock failed to break above the upper limit of the descending channel which is strengthened by 50 SMA (green line) and price pulled back below the lower limit off the 1:1 structure and major support at $115.20. In case downward move deepens, 200 SMA (red line) should act as the first support. Should the stock price break below it, the way towards next major support at $101.70 will be left open. Source: xStation5

Peloton (PTON.US) stock has been moving in an upward trend since the beginning of May, however, some weakness can be spotted in recent days. Stock failed to break above the upper limit of the descending channel which is strengthened by 50 SMA (green line) and price pulled back below the lower limit off the 1:1 structure and major support at $115.20. In case downward move deepens, 200 SMA (red line) should act as the first support. Should the stock price break below it, the way towards next major support at $101.70 will be left open. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.