Pinterest (PINS.US) stock trades over 8.0% higher on Friday after the image-sharing platform beat quarterly revenue estimates and its monthly user numbers also topped expectations.

-

Company earned $ 0.11 per share, topping market expectations of 6 cents per share. However, the figure came in lower than the prior-year quarter's adjusted earnings of $ 0.28 per share.

-

Revenue jumped 8% YoY to $ 684.55 million and analysts’ projections of 666.7 million. However today's figure was considerably lower than the 43% growth rate it reported the prior year in the same quarter.

-

Global MAUs increased slightly to 445 million from 433 million recorded in the second quarter. However, global average revenue per user (ARPU) soared 11% to $ 1.56. Pinterest's latest earnings report has defied the trend of online advertising companies posting results that haven't met analyst expectations.

-

"Despite the challenging macro environment, we are delivering performance and a distinct value proposition to advertisers, reaching users across the full funnel," Pinterest's new Chief Executive Bill Ready said in a statement.

-

Pinterest expects that Q4 revenue will "grow mid-single digits on a year-over-year percentage basis." Analysts on average expected adjusted earnings of 6 cents a share on sales of $667 million, according to FactSet.

-

Operating expenses are expected to grow around 35% YoY for 2022.

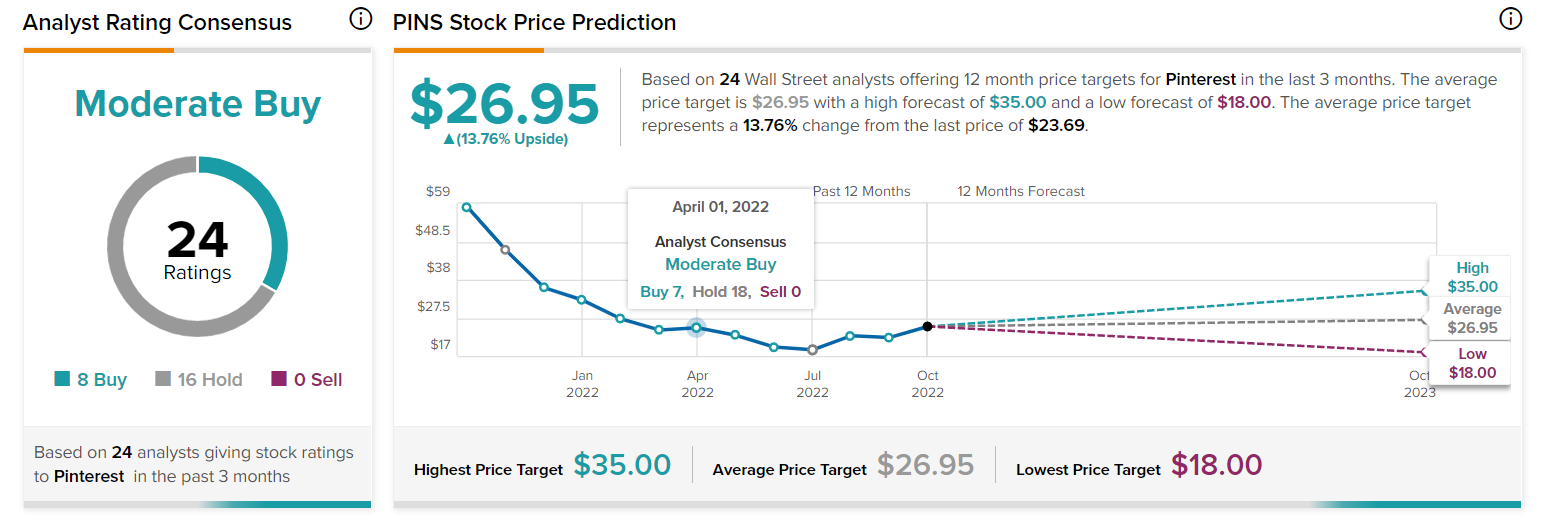

Pinterest has a Moderate Buy consensus rating based on eight Buys and 11 Holds. The average price target of $26.94 implies 16.0% upside potential to current levels. Source: tipranks.com

Pinterest has a Moderate Buy consensus rating based on eight Buys and 11 Holds. The average price target of $26.94 implies 16.0% upside potential to current levels. Source: tipranks.com

Pinterest (PINS.US) stock fell nearly 40.0% so far this year. In recent weeks the price has been moving sideways. Perhaps fresh earnings will be a catalyst for a bigger move. Nearest resistance to watch is located around $27.10 and coincides with 78.6% Fibonacci retracement of the upward wave started at the beginning of the pandemic. Nearest support can be found at $16.00 where lows from July are located. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.