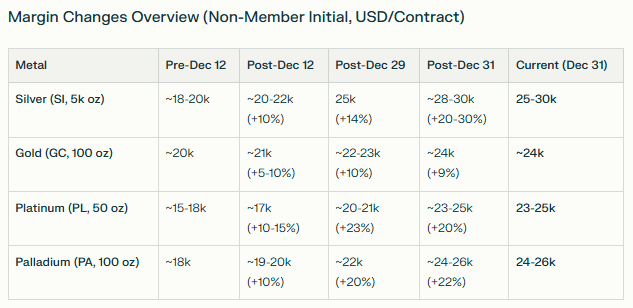

Following Friday’s close, the exchange announced a hike in both initial and maintenance margins for precious metals on its COMEX division. This has prompted a significant retreat across the sector, despite an earlier dramatic surge in silver prices beyond $80, driven by the announcement of Chinese export restrictions. Citing persistent volatility, the CME has signaled a further increase effective after today’s closing bell.

The following initial margin requirements have been compiled using AI tools, aggregating data from sources including the CME, Bloomberg, Yahoo Finance, and AIInvest. The table reflects initial margins; maintenance requirements typically stand at approximately 80-90% of these levels. The numbers may differ from the actual ones.

While speculative positioning on futures exchanges has not yet reached extreme levels, the current hikes may compel commercial investors to reduce their market exposure. However, a more sustained price correction would likely require action from long-term investors, such as profit-taking within exchange-traded funds (ETFs).

On Tuesday, silver and palladium ETFs reduced their bullion holdings, while gold and platinum funds increased their exposure. Since the start of the year, gold volumes in ETFs have risen by 19%, silver by 20%, platinum by 2%, and palladium by 50%. The current value of gold held in these funds stands at nearly $430bn, with silver at $65bn, platinum at $7bn, and palladium at almost $2bn.

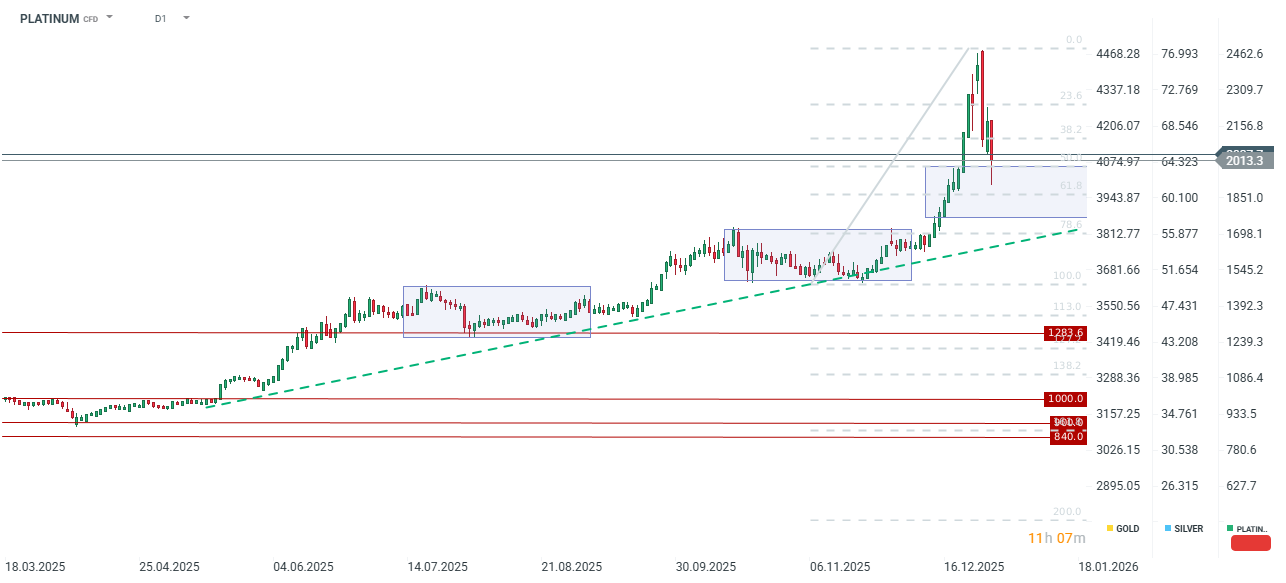

Platinum has retreated by more than 7% today, testing the $2,000 level after a rebound yesterday saw prices touch $2,200 per ounce. The metal is currently testing the 50.0% Fibonacci retracement level. Should this support be breached, the next significant technical floor lies near $1,700, coinciding with the 78.6% retracement of the most recent upward wave and the prevailing bullish trendline.

BREAKING: Stronger than expected ADP fails to support the dollar 🇺🇸

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%

BREAKING: Oil falls after NYT report on talks between Iran and the CIA regarding a suspension of military action💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.