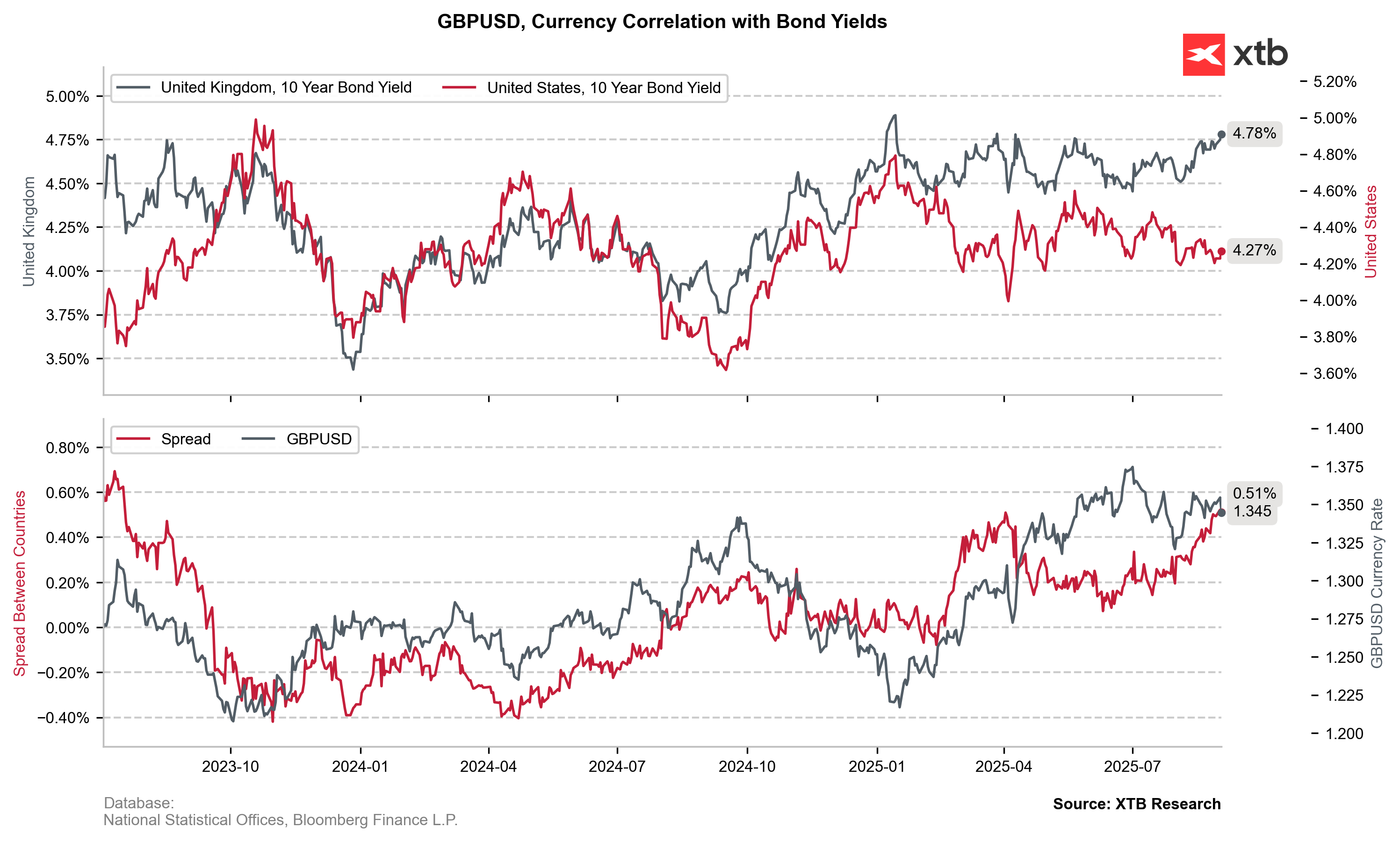

The GBPUSD collapsed sharply following a sell-off in the UK government bond market, which pushed 30-year yields to their highest level since 1998 (5.66%).

At the start of the session, GBPUSD was the least volatile G10 pair, with the pound showing strong resilience to the broad rebound in the dollar. The bond sell-off dragged the rate down to its lowest level since August 7 (just below 1.339). Buyers managed to recoup part of the losses, pulling GBPUSD back to 1.34, slightly above the lower boundary of the current consolidation. Source: xStation5

Yields on 30-year UK government bonds (“Gilts”). Source: Bloomberg Finance LP

Long-term borrowing costs in the UK have risen to their highest level since 1998, reflecting investor concerns about the country’s economic outlook, including persistent inflation, rising public debt, and doubts about the government’s ability to reconcile fiscal rules with economic growth.

Moreover, markets increasingly see the risk that Chancellor Rachel Reeves will be forced into tax hikes or deeper spending cuts in the Autumn Budget, with bond yields signaling tighter financing conditions.

Reeves’ recent comments included, among other things, a windfall tax on banks, but financing still-weak public services and infrastructure projects will likely require deeper reforms and new revenue sources – topics the Labour Party avoided during the last campaign. Incumbent Prime Minister Keir Starmer has pledged to lead Labour into the next election.

The pound resumed gains in mid-July alongside growing expectations for a September rate cut in the U.S. and further inflationary pressures in the UK, which boosted British medium-term government bonds. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.