Bitcoin is trading down a modest 1.3% and retreating to $44,400 today. In the altcoin market, Stepn is losing the most heavily, with a nearly 12% sell-off. At the same time, the U.S. dollar continues its rise, which yesterday recorded its best session since March 2023, putting pressure on risky assets. The crypto market is awaiting the SEC's decision on ETF applications, after Reuters sources cited the current week as the likely time for the regulators' decision. So far, however, the agency has not provided any information, on the matter.

- The SEC has until January 10 to accept or reject ETF applications from Ark Invest and 21 Shares. The agency lost a case in a Washington court against Grayscale, a fund that has been waiting for years to convert a GBTC fund to a spot ETF

- The court stressed that the SEC should not delay in approving the transformation of Grayscale's application to an ETP fund

- The SEC did not appeal the court's decision, which implies that the agency may reject Grayscale's application, but for a different reason than those indicated so far in the regulator's responses

- In the Grayscale case, the SEC indicated that the previously elected CME exchange could not share oversight of the Bitcoin fund because trading does not take place on it

- As a result, both Grayscale and the other 8 of all 14 institutions that submitted applications chose as 'custodian' the cryptocurrency exchange Coinbase, where Bitcoin trading takes place

- Shares of Coinbase (COIN.US) lost more than 10% yesterday despite Bitcoin's rally, fueling concerns around possible SEC comments regarding Coinbase's shared oversight with ETF issuers and failure to approve proposals. The SEC is still in a dispute with Coinbase over regulatory issues and the trading of digital assets on the cryptocurrency platform, which the agency views as securities.

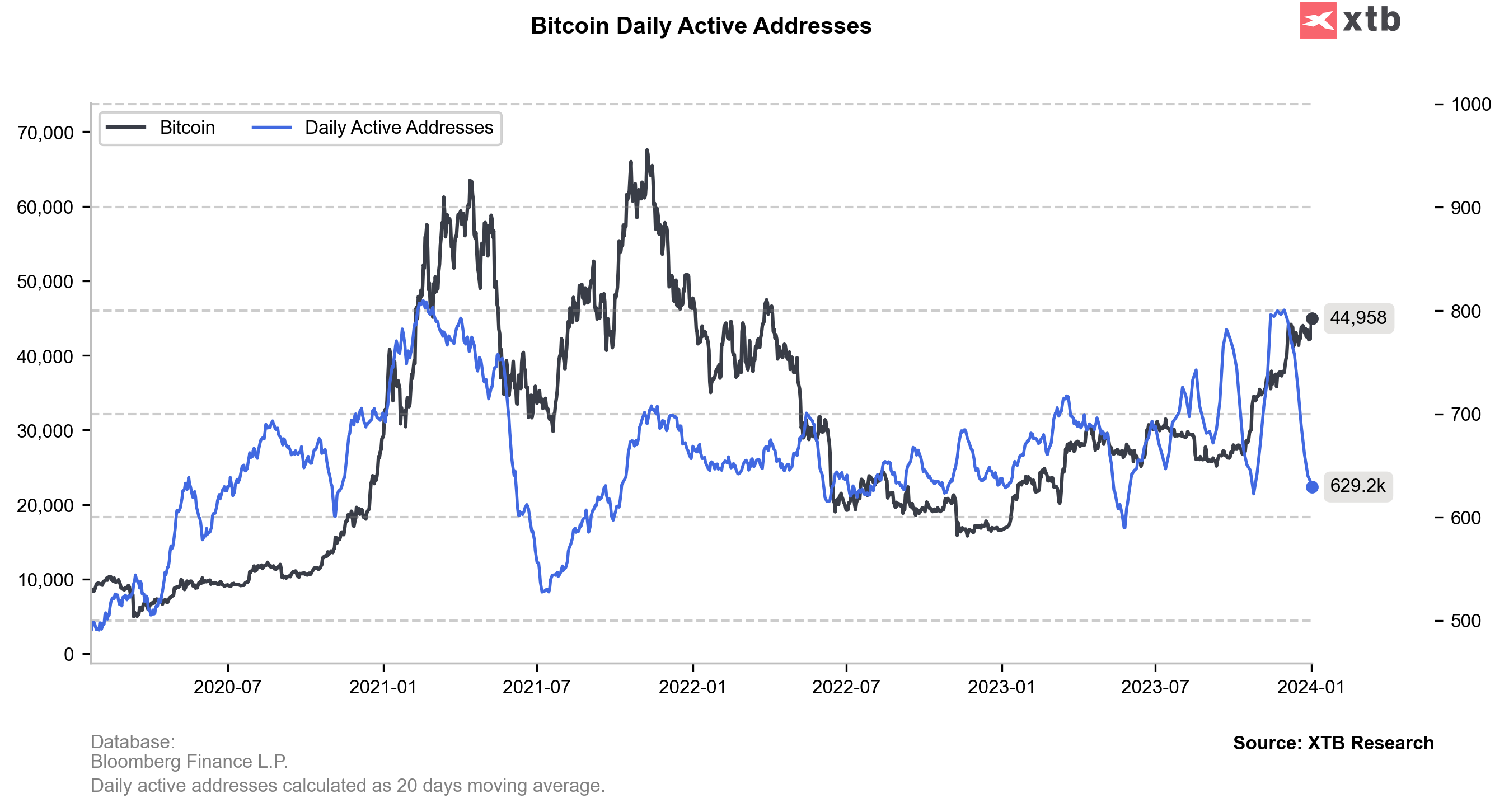

Onchain activity of bitcoin addresses has declined dynamically since the first half of December, historically indicating a decline in the momentum of transactions made or periods of declining interest in cryptocurrency market. Source: XTB Research

Onchain activity of bitcoin addresses has declined dynamically since the first half of December, historically indicating a decline in the momentum of transactions made or periods of declining interest in cryptocurrency market. Source: XTB Research

On the W1 interval, bitcoin broke out above the 2023 peak structure. Currently, the move is being tested by the sellers' side, and the cryptocurrency is back below the $44,000 barrier. Source: xStation

On the W1 interval, bitcoin broke out above the 2023 peak structure. Currently, the move is being tested by the sellers' side, and the cryptocurrency is back below the $44,000 barrier. Source: xStation

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.