Following market's expectations, the Reserve Bank of Australia decided at today's meeting to lower the interest rate. From 3.85% to 3.6%, an effective reduction of 25 basis points. The AUD-USD pair is reacting with declines.

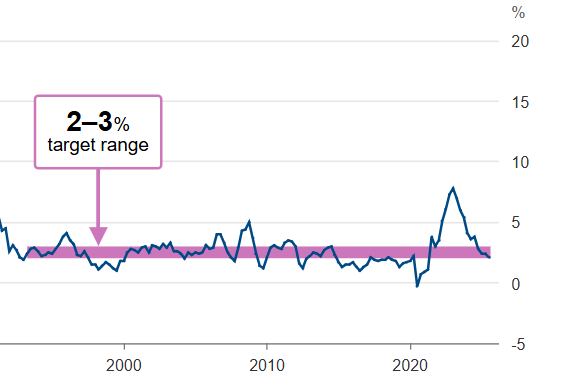

The market consensus indicated an almost certain cut, due to a series of economic variables in Australia. Primarily, the RBA's preferred inflation measure, the "trimmed mean CPI," showed 2.7% and fell within the Bank's target policy range of 2 to 3%. A fact that the bank's management was clearly pleased with. It is also worth mentioning the rising unemployment, currently 4.3%. This supports the central bank's thesis of a cooling economy and justifies the reductions. Additionally, recent tariffs imposed on Australia by Donald Trump may trigger further slowdown.

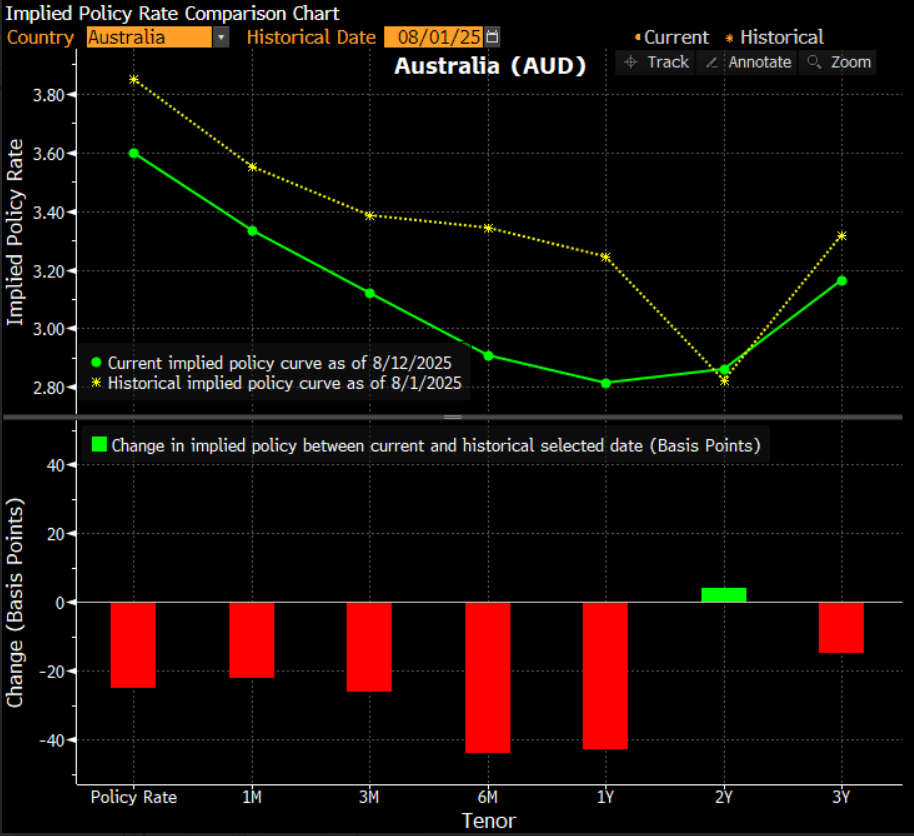

In light of this information, the market not only expects further reductions but, after the last meeting, sees an acceleration in the pace of policy easing. Currently, the central bank's target interest rate, after the current cycle of rate cuts, is expected to be around 3%

The central bank's president, Michele Bullock, emphasizes the important role of data, including employment and inflation, as sources of RBA policy. Ms. Bullock also mentioned the significant dependence of Australia's situation on foreign markets, especially the USA. She added that the current reductions are already preemptive and are a reaction to the bank's expectations for the economy. Despite market expectations, as of today, the president does not declare larger reductions; these are to be dependent on incoming data.

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.