• Rivian Automotive Inc (RIVN.US) shares available at XTB

• One of most highly anticipated public offerings (IPO) this year

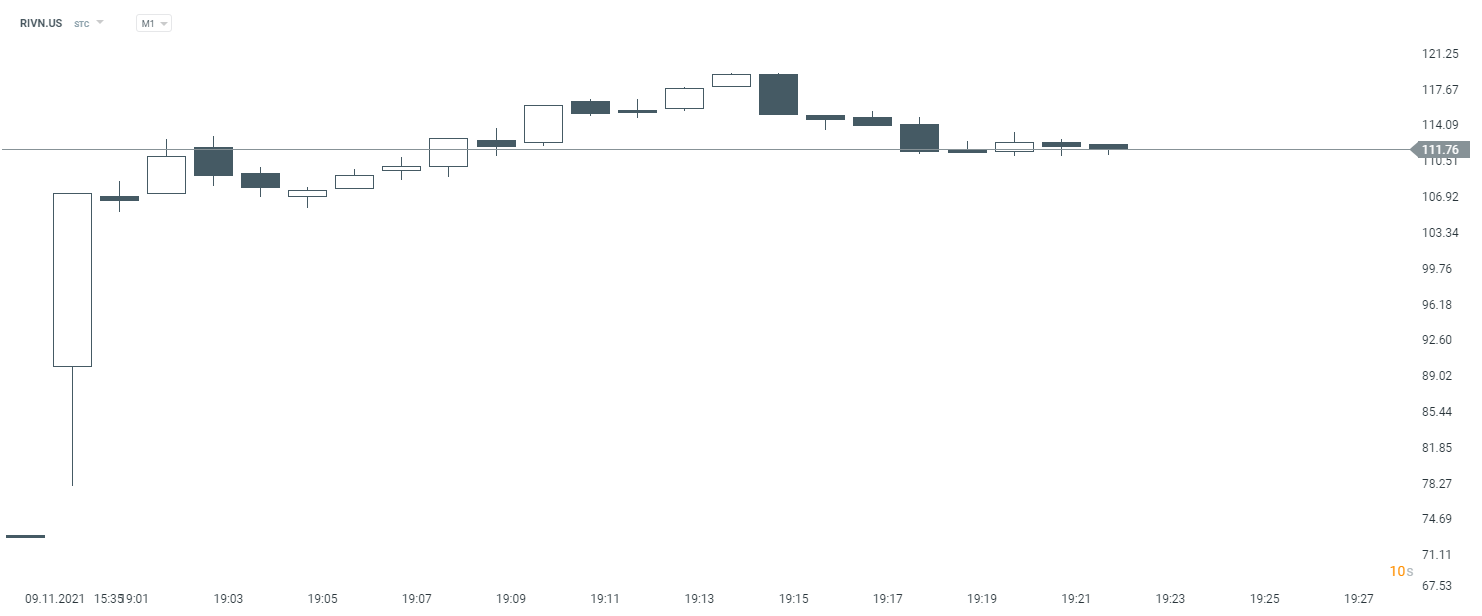

Rivian Automotive Inc. (RIVN.US) went public today in one of the biggest stock market IPO's since Facebook’s 2012 debut after pricing its initial public offering at $78 per share, well above its target range of $72 to $74, and raising about $11.9 billion. Company also sold 18 million more shares than expected. However the company’s stock opened 36% higher, namely at 106.75$ and valuation reached $90 billion

Rivian's biggest stakeholders include Amazon.com Inc., which owned 22.4% of its Class A stock heading into the IPO, and Ford Motor Co., which had a 14.4% stake. Both companies together with other major investors indicated in a filing that they planned to buy up to $5 billion worth of shares in the offering. Company revealed in its amended IPO prospectus that it will lose up to $1.28 billion in the third quarter and that revenue will range from zero to $1 million. Rivian, which currently describes itself as a "developmental stage company", has not generated any material revenue to date.

However this could change in the future as Amazon has ordered 100,000 of Rivian's upcoming electric delivery vans, which will be delivered by 2030. According to internal testing, the 700-cubic-foot EDV has 201 miles of range on a single charge. By the end of 2021, Rivian intends to produce and deliver approximately 10 EDVs. Also, the company accepted about 55,400 pre-orders for its R1T trucks and preorders for its R1S SUVs in the United States and Canada as of Oct. 31, which it expects to fill by the end of 2023. Rivian's manufacturing facility in Normal, Illinois is currently able to produce up to 150,000 vehicles annually.

Rivian (RIVN.US) stock price is clearly gaining in the first session. XTB clients may invest in the company using classic stocks or CFDs. Source: xStation5

Rivian (RIVN.US) stock price is clearly gaining in the first session. XTB clients may invest in the company using classic stocks or CFDs. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.