Rivian (RIVN.US) stock dropped over 10% during today's session after the electric vehicle maker posted a quarterly loss of $1.23 billion for the third quarter stemming from expenses to begin production of its electric pickup truck. The company had previously predicted an operational loss between $745 million and $795 million and a net loss between $1.21 billion and $1.28 billion. It was Rivian’s first quarterly report as a public company, and revenue was $1 million from its first deliveries. Moods worsened after the company said it expects to fall “a few hundred vehicles short” of its 2021 production target of 1,200 vehicles as it struggles with supply chain problems as well as challenges ramping up production of the complex batteries that power the vehicles.

On the other hand, the company confirmed plans for a new $5 billion plant in Georgia that’s expected to be operational in 2024. Also combined preorders for the electric truck and SUV climbed to 71,000 as of December 15 from 55,400 at the end of October, the company said.

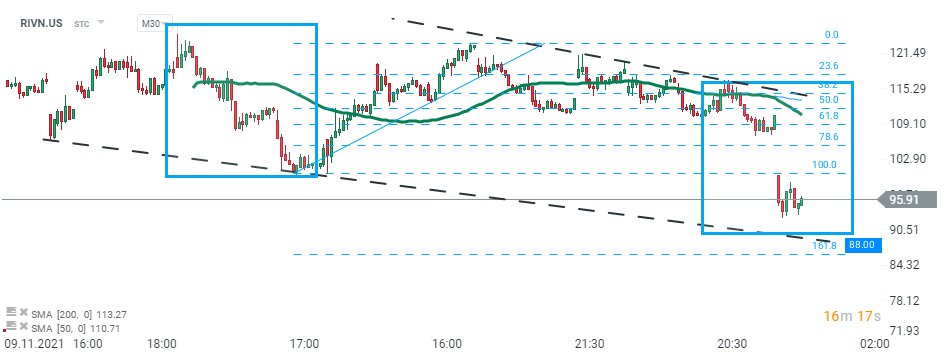

Rivian (RIVN.US) stock price dropped to the lowest level since IPO during today’s session. If current sentiment prevails, a downward move may accelerate towards support at $88.00 which is marked with a lower limit of the 1:1 structure and lower boundary of the wedge formation. Source:xStation5

Rivian (RIVN.US) stock price dropped to the lowest level since IPO during today’s session. If current sentiment prevails, a downward move may accelerate towards support at $88.00 which is marked with a lower limit of the 1:1 structure and lower boundary of the wedge formation. Source:xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.