Shares of Swedish defense contractor Saab AB (SAABB.SE) are moving higher and are trading close to an all-time high of around SEK 700 per share. The biggest concern for bulls at this stage is valuation: after a strong re-rating, Saab is increasingly priced more like a high-growth technology name than a traditional defense company.

Saab generates roughly 40% of its revenue in Sweden, and demand for its products could accelerate across the Nordic region as countries prioritize shorter, more secure supply chains and respond to rising strategic risks - both from Russia and from uncertainty around relying on U.S. equipment amid potential conflicts of interest in the Arctic under the current Donald Trump administration.

At the same time, Saab’s aeronautics segment - around one-quarter of the business continues to face margin pressure: the company’s aircraft compete against strong foreign rivals, a broad lineup of fifth-generation fighters, and a likely gradual shift of major defense spending toward drone capabilities.

SAAB shares (D1 timeframe)

Source: xStation5

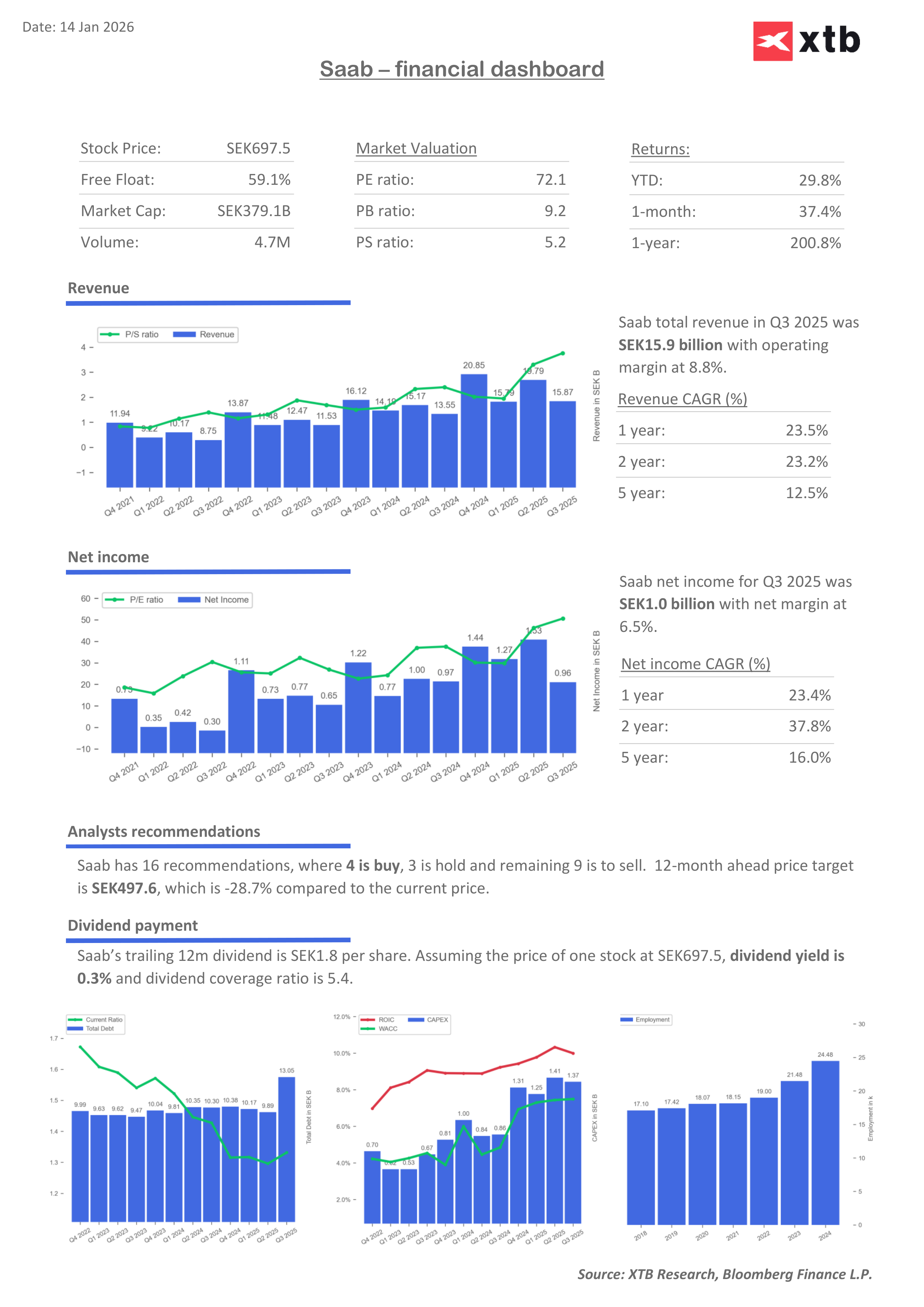

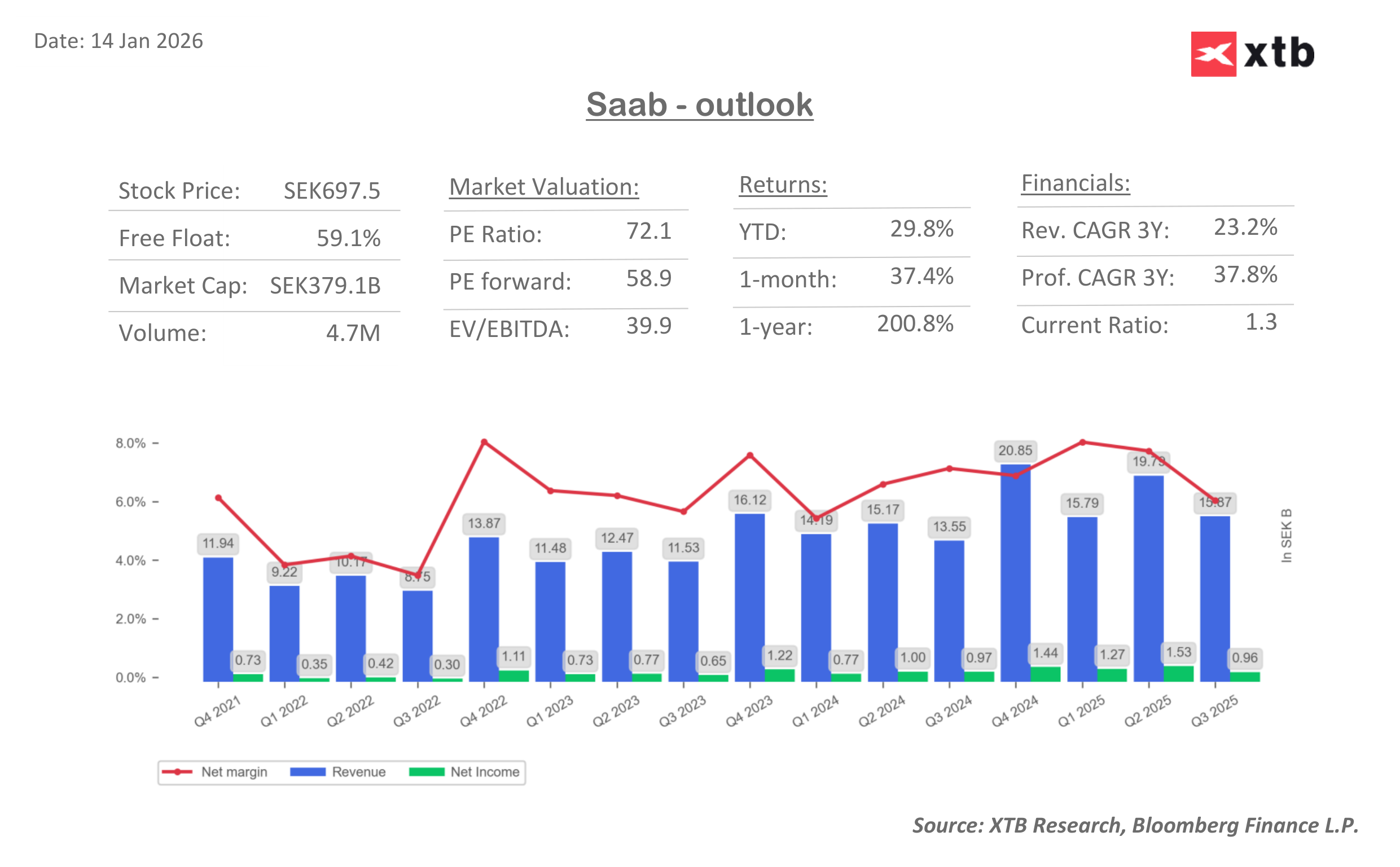

Saab’s valuation has climbed sharply, while net profit—although clearly higher (in Q1 and Q2 2025 it was up roughly 50% y/y, but flattened in Q3)—has not increased in line with the share price. This suggests investors are pricing in future expansion more aggressively, raising the risk that the stock becomes overstretched. The price-to-book ratio is now close to 10, while price-to-sales is above 5. ROIC still exceeds WACC, but costs have also risen alongside a rapid increase in headcount, and leverage has increased as well. The most obvious risk for Saab shares is a potential ceasefire and peace deal in Ukraine, which could reduce long-term growth expectations for the defense sector and cool capital inflows—even if defense investment remains structurally elevated. Importantly, Saab’s net margin has been declining since Q1 2025 and is not meaningfully above its historical average.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Stock of the Week: Broadcom Driven by AI Sets Records

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.