Precious metals are trading higher today. Prices are supported by safe haven flows triggered by escalation in the Middle East as well as the post-PPI US dollar weakening. Silver is the best performing within the asset class with an over 3% gain at press time.

US and UK airstrikes on military targets linked to Iran-back Houthi in Yemen have greatly increased risk of further escalation in the Middle East. US and UK authorities said that strikes were in retaliation for recent attacks on commercial shipping as well as aimed at deterring Houthi from carrying out further attacks. However, Houthi do not seem to be backing down and have vowed retaliation against US and UK interest in the region. Oil gained following the attacks, as did precious metals.

Precious metals are also supported by weakening of the US dollar. US PPI inflation data for December released today at 1:30 pm GMT showed a smaller-than-expected acceleration in headline producers' price growth and a bigger-than-expected slowdown in core PPI. As a result, US dollar is one of the worst performing G10 currencies today, with USD index (USDIDX) dropping 0.1%.

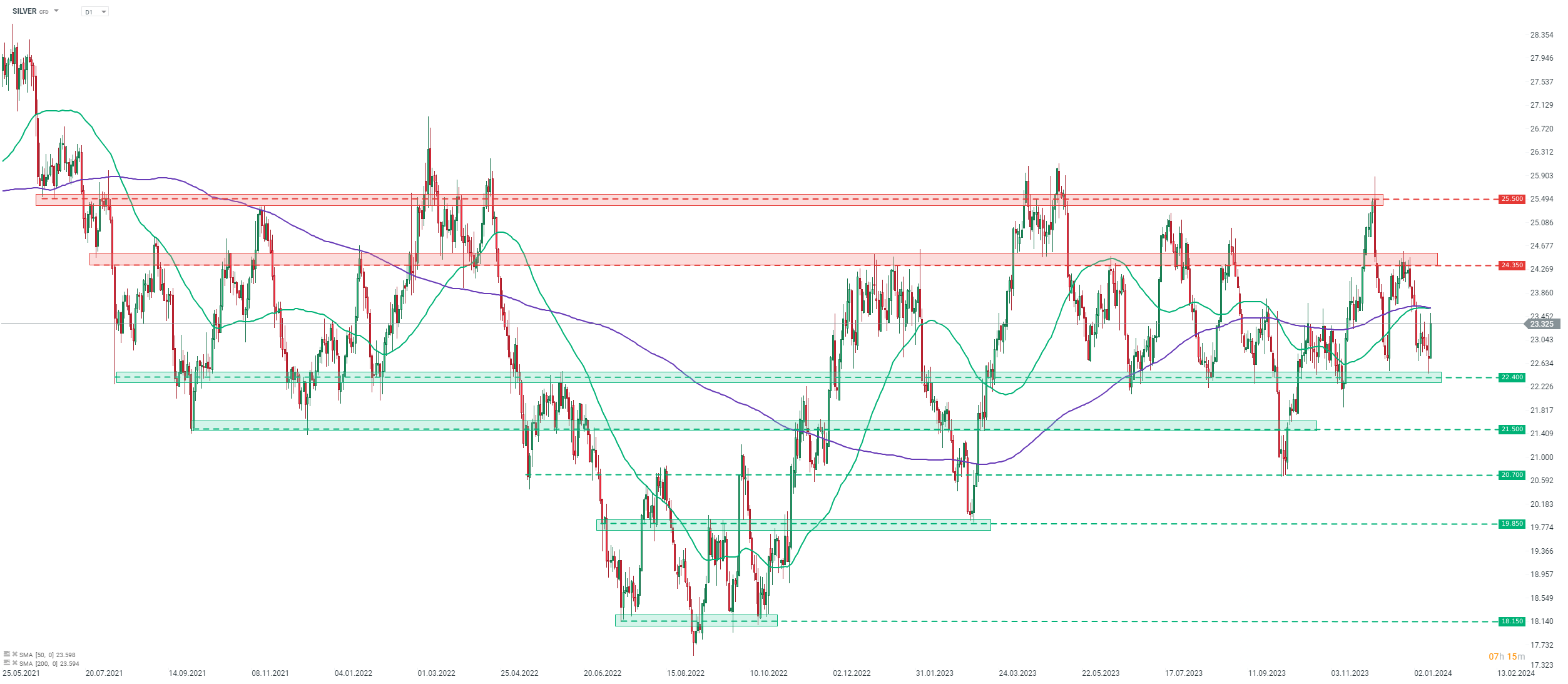

Taking a look at SILVER chart at D1 interval, we can see that the recent pullback was halted at the $22.40 support zone, which acts as the lower limit of a trading range. Bullish price reaction to this support suggests that the sideways move is still in play and a climb towards the upper limit in the $24.35 area may now follow. However, 50- and 200-session moving averages near the mid-point of the range ($23.60 per ounce area) may offer some short-term resistance on the way there.

Source: xStation5

Source: xStation5

Daily summary: Markets capitulate under the influence of the Persian Gulf

US Open: Wall Street in Blood

Chart of the day 🚨OIL surges 5% putting pressure on Wall Street

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.