After last night’s sharp drop, silver quickly erased the losses and is regaining momentum, making another attempt to set a new all-time high. Swiss refiner MKS PAMP noted that retail investor demand is massive and far exceeds available supply. Tight delivery schedules and strong appetite for physical silver mean that more and more ounces are being shipped by air rather than by sea. Buying pressure is being heavily reinforced by investors from China and India, while the persistent double-digit premium of Shanghai silver prices versus COMEX suggests that “Western” market prices may still have room to rise.

Since this morning, the U.S. dollar has weakened noticeably, with the DXY (USDIDX) contract sliding from around 97 to 96.5. Investors are pricing in a scenario of a persistently dovish Fed, following speculation that Nick Rieder of BlackRock could potentially take a leading role at the Federal Reserve. At the same time, markets see growing risk to U.S. Treasury demand stemming from the new White House administration’s more “isolationist” foreign policy stance. Combined with strained relations with allies (Europe and Canada, which is now openly signaling improved ties with China) and a BRICS bloc that is broadly less USD-friendly, this is driving increased allocations to precious metals, especially gold (rising toward nearly $5,090 per ounce). Silver is benefiting indirectly from that move.

Source: xStation5

On the short 5-minute timeframe, the “cooled off” MACD and RSI indicators support a rebound. Price is returning toward the $113 per ounce area, where we previously saw three brief but bearish impulses during the last several hours.

Source: xStation5

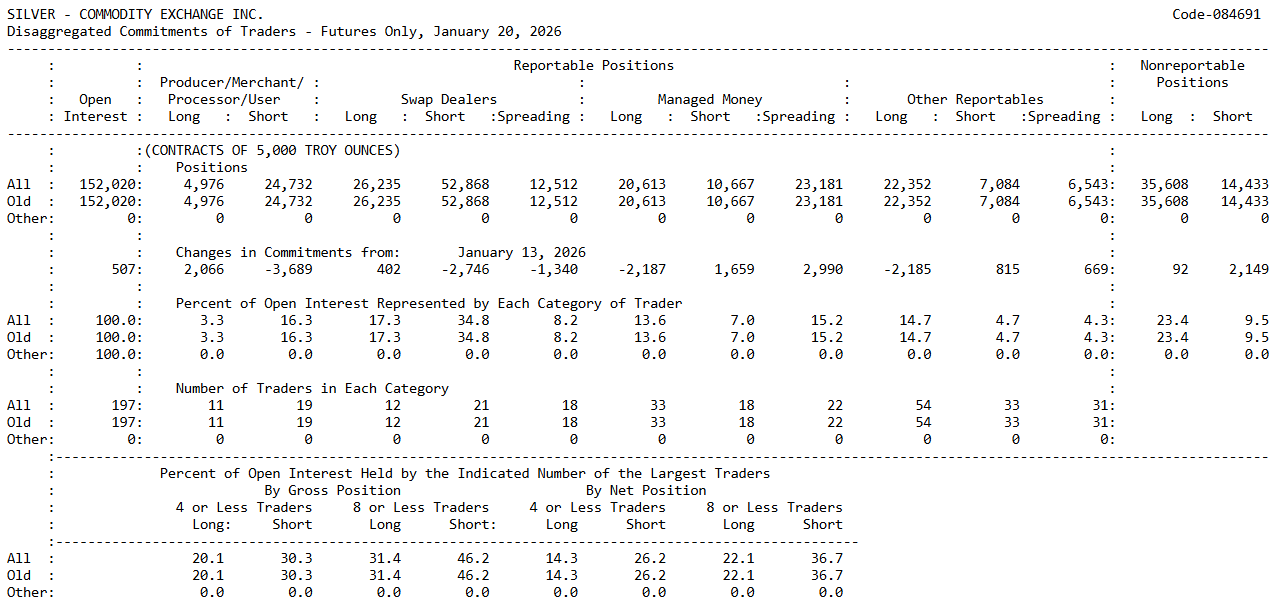

CFTC Commitment of Traders report (January 20)

Looking at positioning on COMEX, we can see that Commercials (producers, processors, and end-users) are heavily on the short side: roughly 24.7k short contracts versus about 5k long. In practice, they are hedging downside risk or locking in future sales. Managed money (funds, CTAs, institutional speculators) is positioned the other way: about 20.6k long and 10.7k short, meaning they remain net long and positioned for higher prices. As prices rose, Commercials eased their downside pressure and added to long positions. Large speculators did the opposite: they trimmed longs and added some downside exposure, as if part of the market started taking profits or stopped believing in a simple, easy, exponential rally. So the biggest speculators are still on the bullish side, but over the past week we saw the first sign of caution. Commercials remain “the other side of the trade,” yet they have softened slightly, which sometimes happens when prices are already high and a portion of risk has been hedged earlier. At the same time, small traders (Nonreportables, not required to report positions to the CFTC) are positioned very bullishly: about 35.6k long and 14.4k short, meaning they stayed strongly net long and supported the rebound. This is often typical during euphoric phases and strong trends.

Source: CFTC

US Open: Wall Street in Blood

DE40 dips 3% and falls to 2026 lows 🚨📉

Chart of the day 🚨OIL surges 5% putting pressure on Wall Street

🚨 EURUSD deepens decline, falls to key support zone

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.