Silver reached its highest daily levels since 2011 last Tuesday, before a minor correction took hold, which was deepened by the Federal Reserve's difficult-to-interpret policy decision. Today, Neel Kashkari, a Fed member, stated that he supported the recent rate cut and foresees two more moves this year. Although Kashkari is not a voting member this year, he will be in 2026. Miran also indicated that voting for a 50 basis point rate cut is appropriate to bring rates to a neutral level.

From a fundamental perspective, silver has been in a significant supply deficit for several years. In 2025, this deficit could exceed 200 million ounces, marking the eighth consecutive year of shortages. While silver recycling is high, growing investment demand could lead to a lack of supply for industrial applications. Currently, silver is primarily used in the photovoltaic sector, electric vehicles, electronics, and 5G technology.

The rise in gold prices is also driven by demand. Gold is being purchased by large investors as well as official bodies like central banks. Silver, being a more affordable option, is favored by smaller investors.

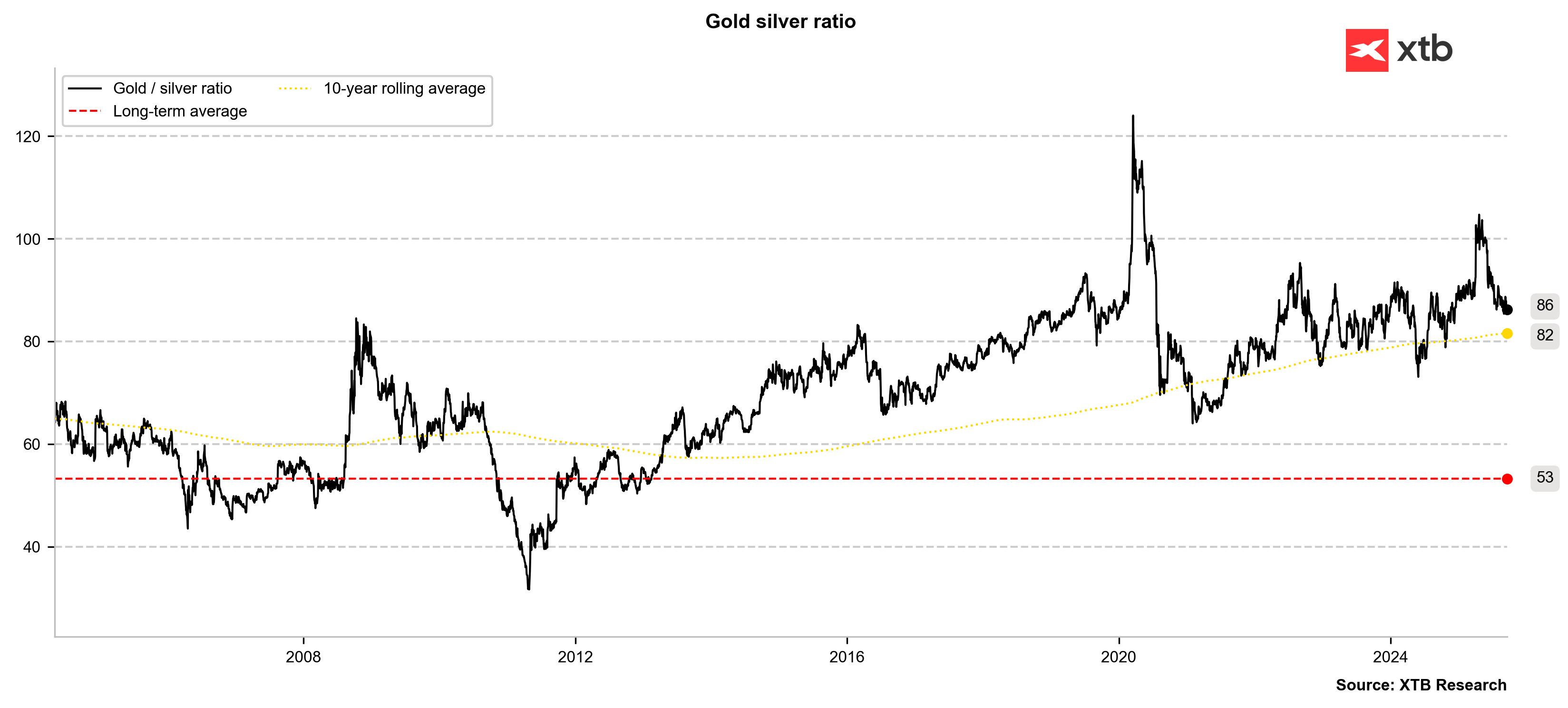

The gold-to-silver ratio is currently dropping to 86, while the 10-year moving average sits at 82. If gold were to return to $3700 or even reach $3800 per ounce, a drop in the price ratio to 82 would value silver at $45-$46 per ounce. While this would not be a record high for silver, it would be very close.

Today, there is a potential for silver to post its highest close since 2011. Today's gains are the largest in nominal terms since September 1. If silver were to reverse and correct, key support levels would be around $41.5 and $40 per ounce. Potential targets for silver are $43 and subsequently $45 per ounce. Source: xStation5

Today, there is a potential for silver to post its highest close since 2011. Today's gains are the largest in nominal terms since September 1. If silver were to reverse and correct, key support levels would be around $41.5 and $40 per ounce. Potential targets for silver are $43 and subsequently $45 per ounce. Source: xStation5

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.