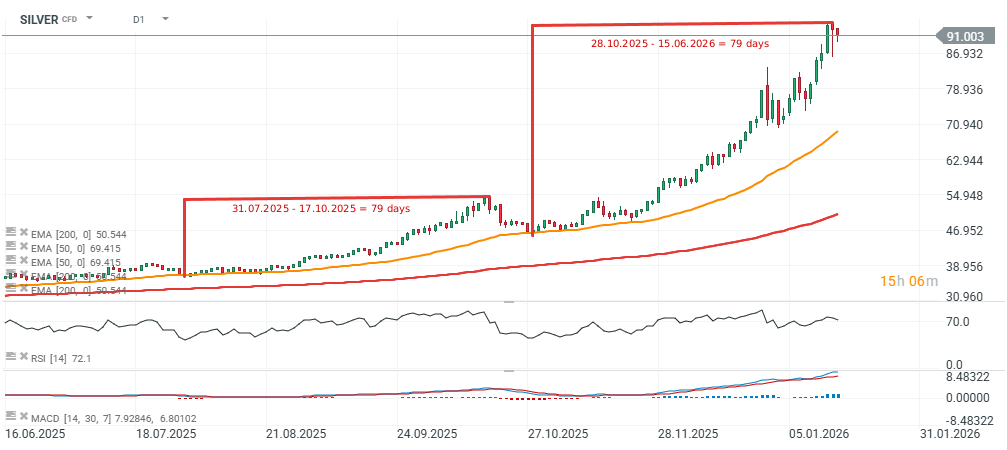

Silver (SILVER) is down more than 1.5% today after a massive rally that has delivered gains of over 100% from the latest local low on October 28, 2025. Looking at the chart, the long-, medium-, and short-term uptrends remain intact. That said, the metal has failed to push decisively above $93 per ounce, and today’s pullback is taking prices back toward the $90 area.

- On the chart, the previous upswing that began on July 31 lasted 79 days before a deeper correction set in, pulling prices down toward $45 per ounce and marking a peak on October 17. Now we can see that another strong leg higher started on October 28 and has lasted 79 days up to today—yet prices are now slipping. This second impulse delivered roughly twice the upside: during the summer–autumn 2025 move, silver rose by about 53%, whereas the autumn–winter leg produced a surge of more than 100%.

- If the technical picture weakens and prices fall below $90 per ounce, profit-taking pressure may weigh on the market and limit any potential acceleration in buying.

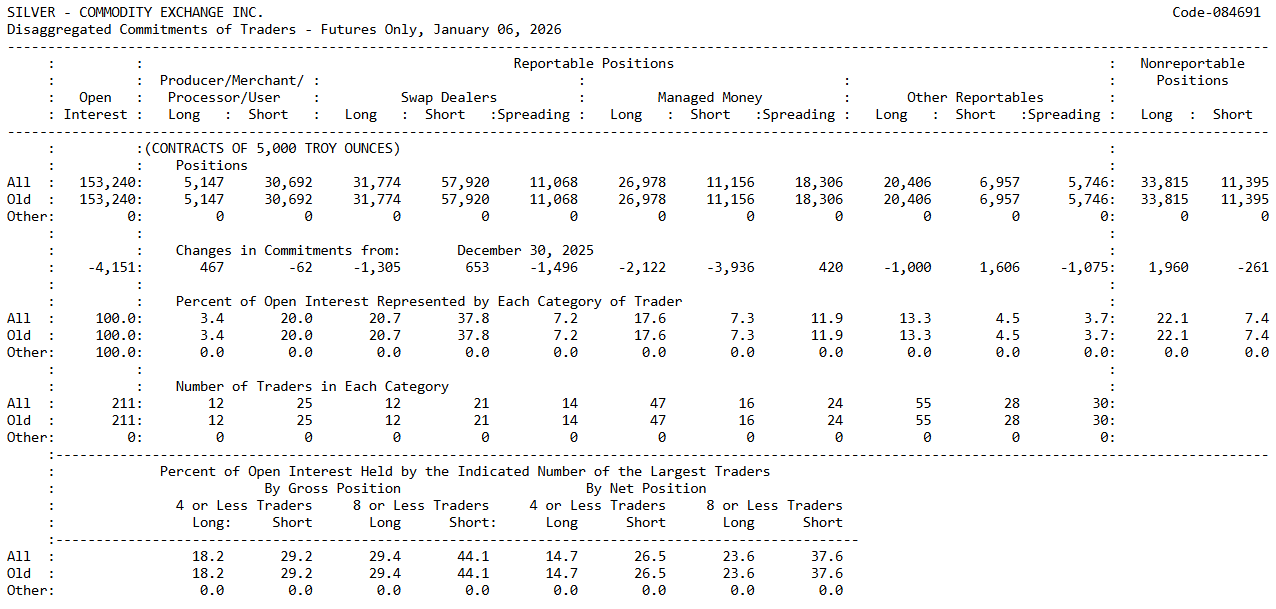

- Looking at the CFTC Commitment of Traders report for silver dated January 6, we can see that producers (Commercials) hold a large hedging short position (net short -25,545 contracts), while speculative funds (Managed Money) are net long +15,822 contracts.

- Bullish exposure increased as of January 6, but not because funds added longs—rather, it was driven mainly by short covering. Commercials also reduced shorts marginally, but the change was negligible: 529 contracts versus a still substantial net short position of more than 25.5k contracts.

- Long exposure is also held by Other Reportables and Nonreportables, pointing to strong bullish positioning among smaller-capital participants. Nonreportables are net long by more than 22.4k contracts.

After silver rebounded above $90 per ounce, the move was very dynamic—largely due to high concentration on the short side. The eight largest net short holders account for 37.6% of total net short positions. Momentum, however, is gradually fading and the rally is showing early signs of fatigue.

SILVER (D1)

A potentially important support area in a pullback scenario could be around $70, where a strong “base” formed around the turn of 2025 and 2026. On the other hand, if silver rebound above $93 again, we could see a pressure toward $100 level.

Source: xStation5

Source: CFTC

Daily summary: Markets capitulate under the influence of the Persian Gulf

US Open: Wall Street in Blood

DE40 dips 3% and falls to 2026 lows 🚨📉

Chart of the day 🚨OIL surges 5% putting pressure on Wall Street

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.