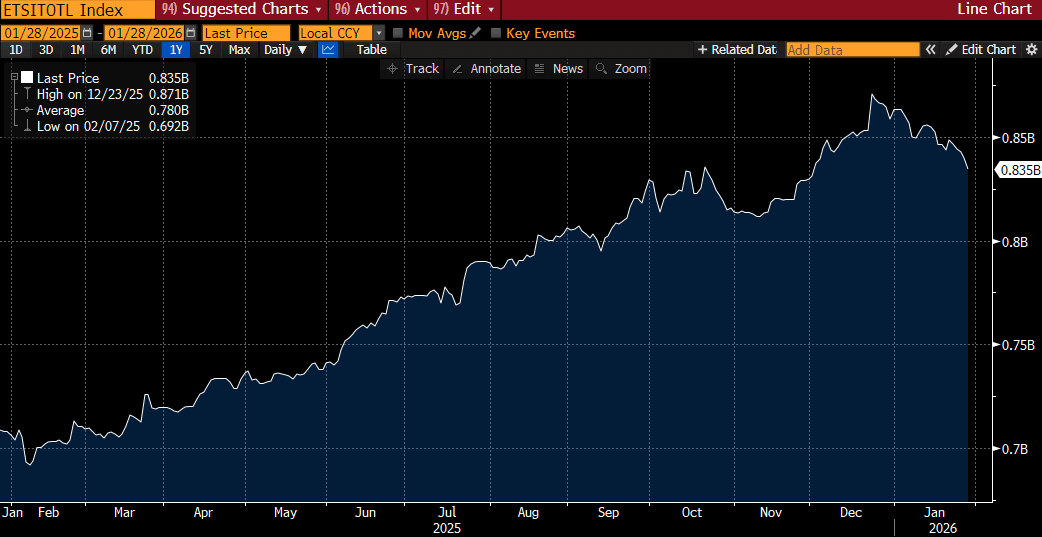

The silver market is showing a clear divergence between institutional flows and retail demand. Silver ETFs reduced their holdings by around 5.1 million troy ounces in the latest session, marking the fifth consecutive day of outflows and pushing total net sales since the start of the year to nearly 29 million ounces. This points to profit-taking or portfolio rebalancing by large investors after an exceptionally strong price rally. Despite this, overall sentiment toward precious metals remains bullish, supported by a weaker US dollar, expectations around US monetary policy, and rising geopolitical uncertainty — factors that are lifting the entire metals complex alongside gold.

Silver ETF holdings have been falling since mid-December 2025. Despite this, silver is up 65% YTD, driven by strong retail and speculative demand. Source: Bloomberg Finance L.P.

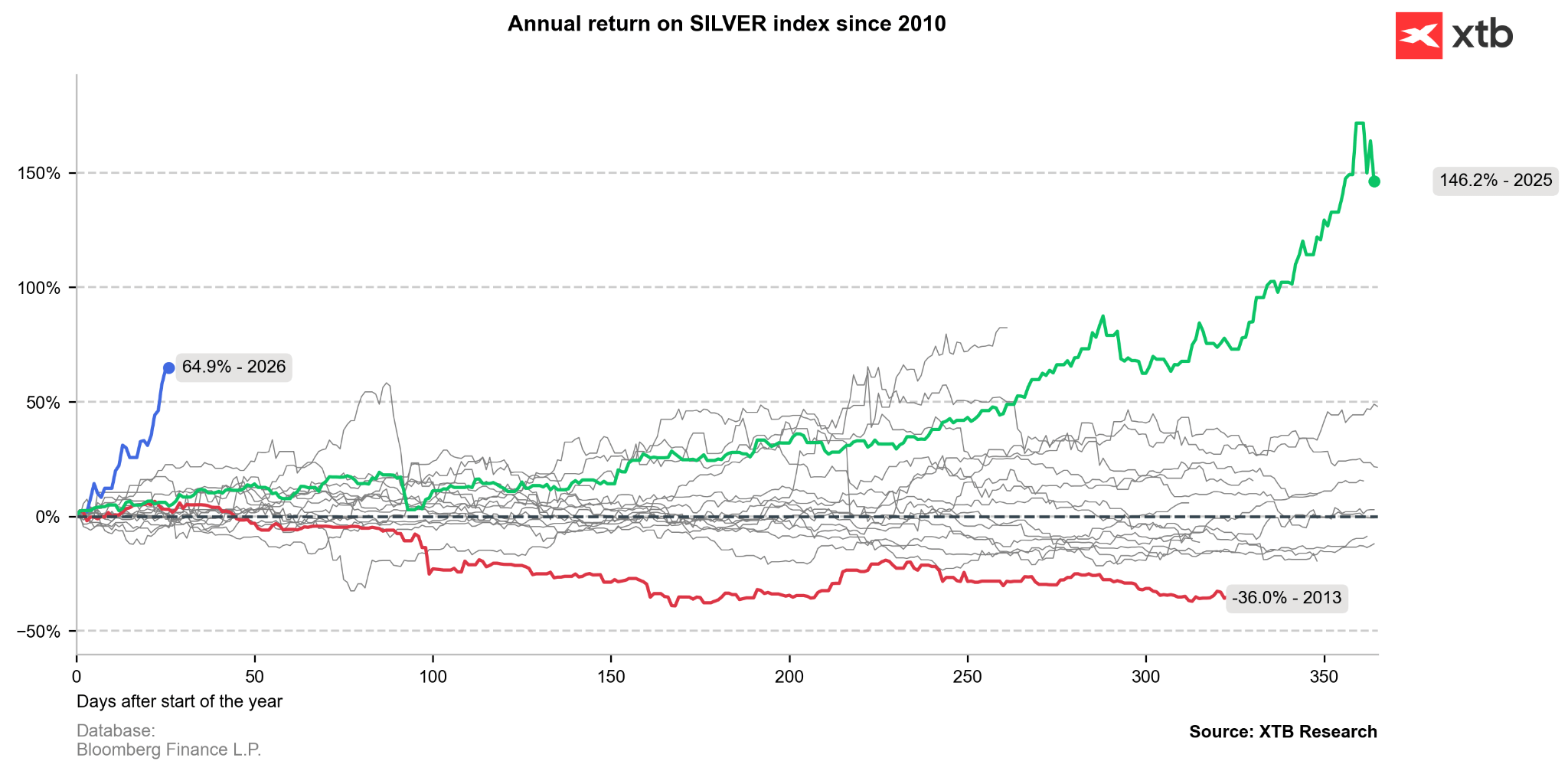

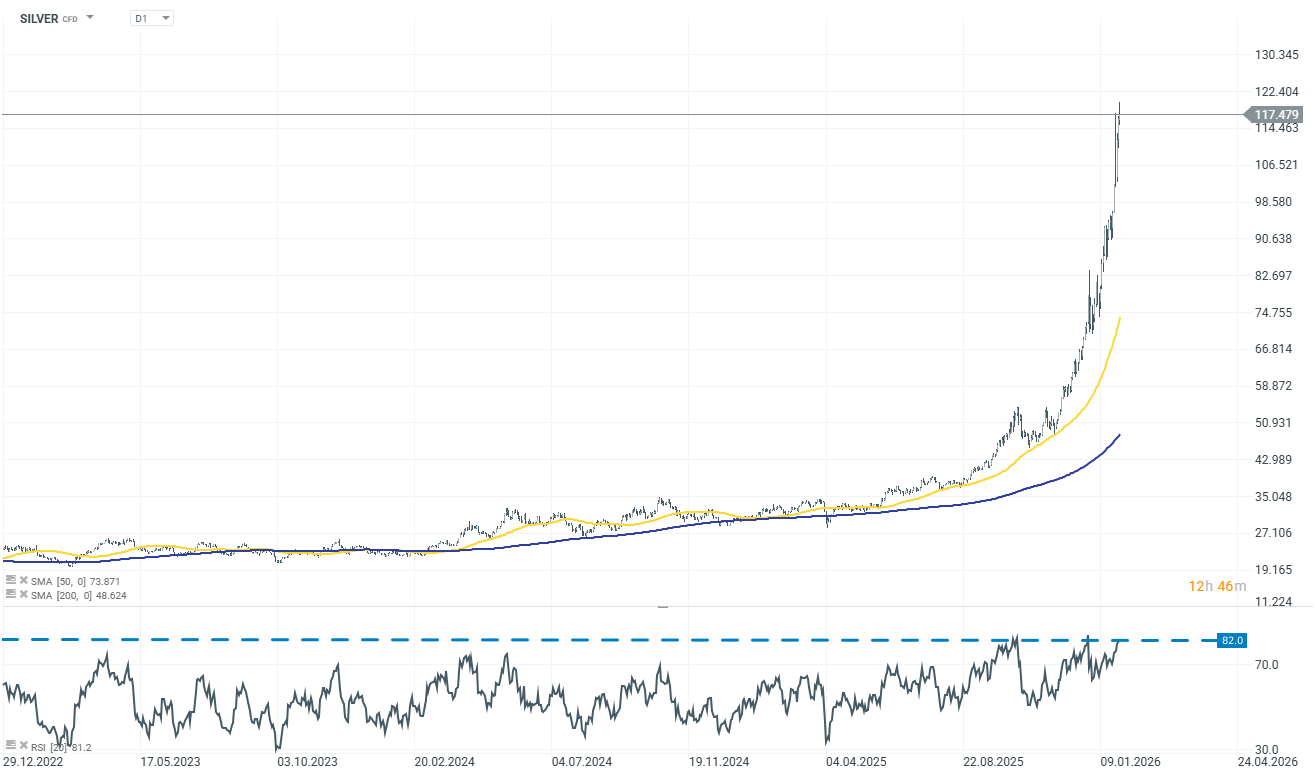

From a price perspective, silver remains extremely strong. Prices have surged to new all-time highs above USD 119 per ounce and are already nearly 65% higher since the start of the year, following a massive 146% rally in 2025.

Annual silver price chart. Source: XTB Research

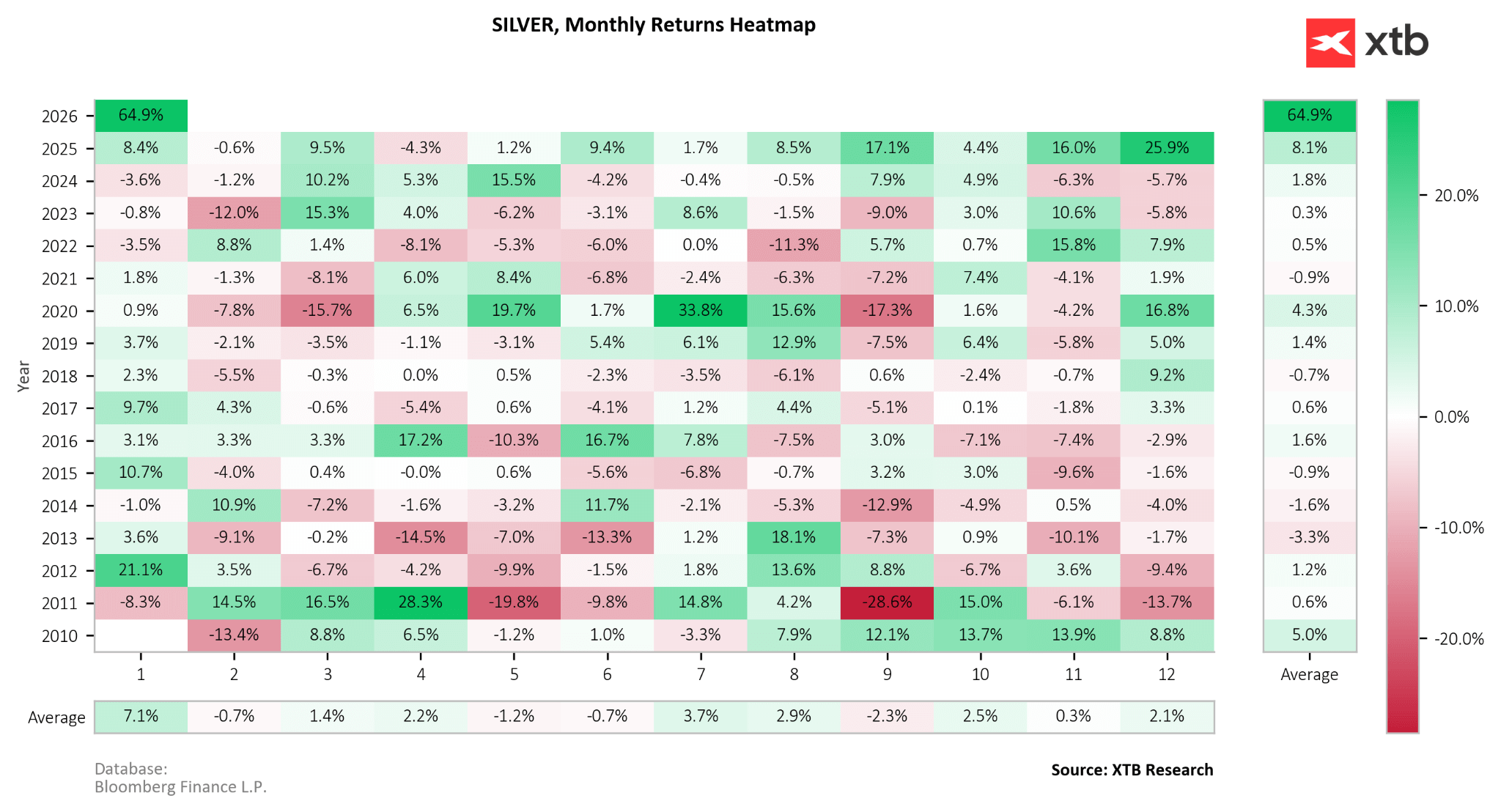

On a monthly basis, silver has delivered two extraordinary gains — +25.9% in December 2025 and +64.9% in January 2026. January is also historically the strongest month for silver, even excluding this record year. By contrast, February and March have more often seen corrections. Source: XTB Research

Physical demand is exploding in Asia — particularly in Hong Kong and southern China — where investors increasingly view silver as a cheaper alternative to record-expensive gold. Shops are selling out of silver bars within hours, and jewelry manufacturers are shifting production from gold to silver.

Source: xStation 5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.