Adobe Inc. has long been a leader in the world of creative software and digital media. Anyone who has ever created graphics, edited videos, or designed marketing materials knows the company’s products. Photoshop, Illustrator, Premiere Pro, and the entire Creative Cloud suite have become industry standards, essential for work in the creative field. In recent years, Adobe has not only maintained its leadership position but has also been rapidly expanding its cloud services and digital experience segment, catering to companies seeking better customer insights and online sales. From a fundamentals perspective, the company’s valuation does not seem to fully reflect its potential. Stable revenue growth, an increasing subscriber base, and innovations in artificial intelligence suggest that Adobe could soon be worth significantly more than its current stock price indicates.

Financial Overview

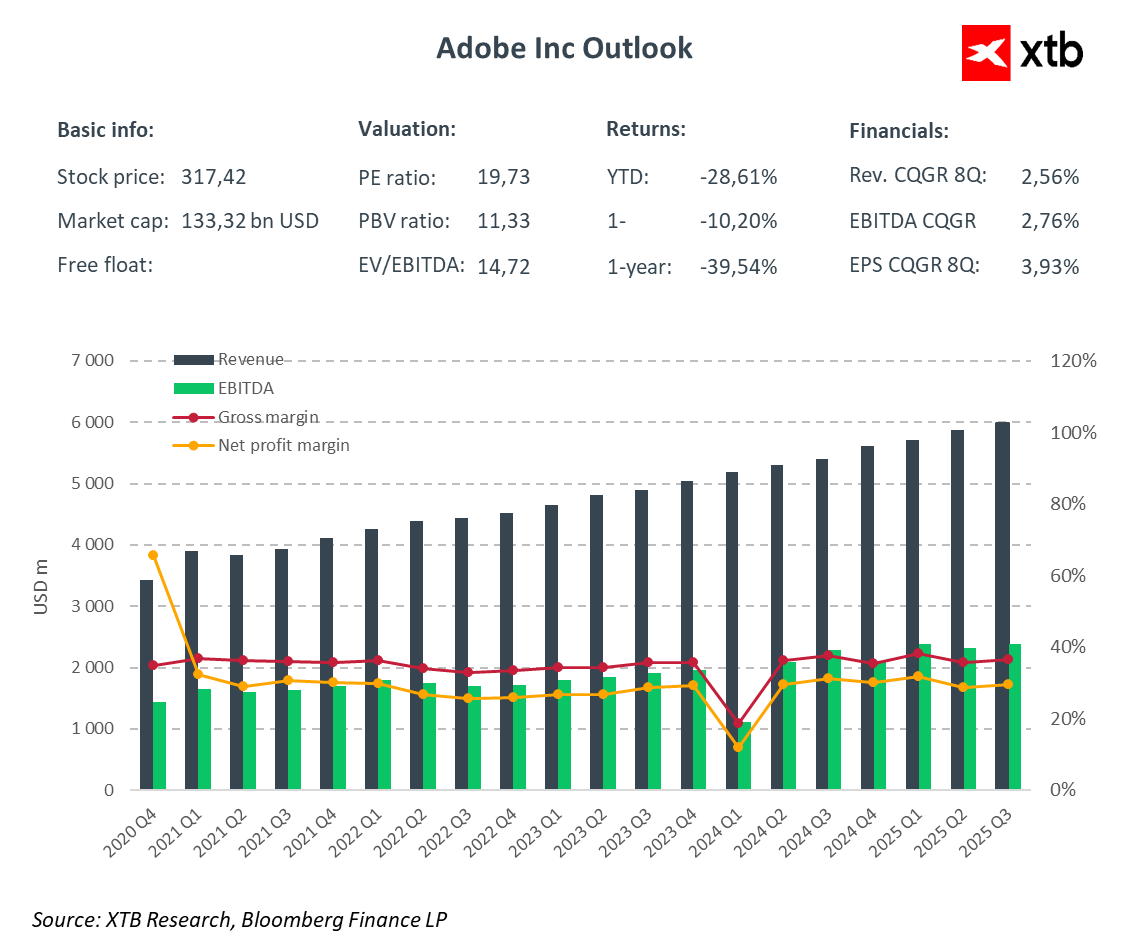

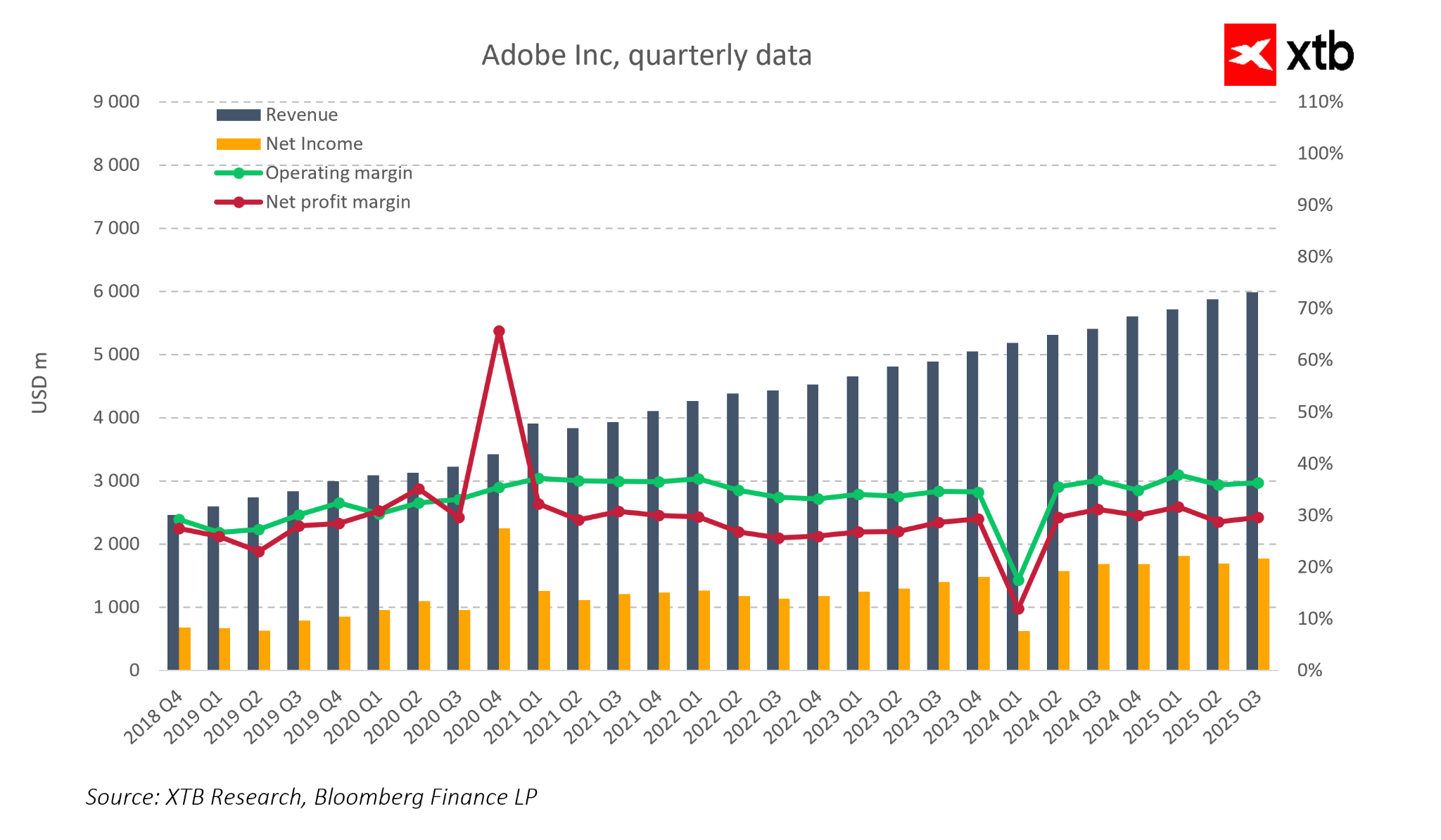

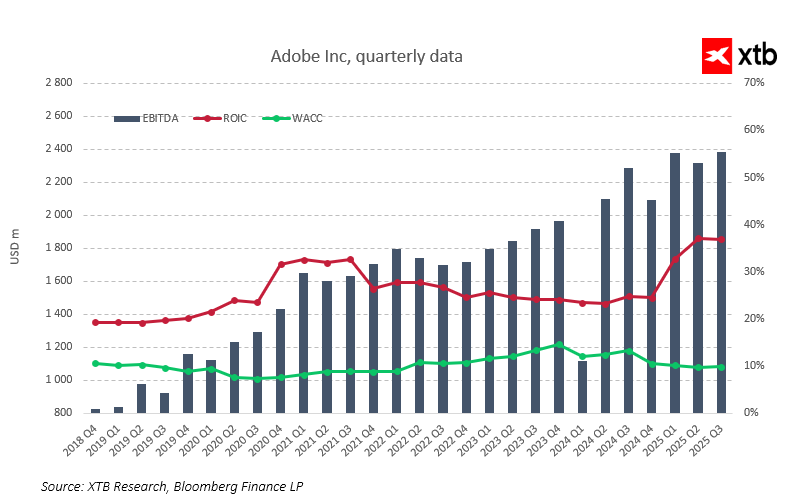

Adobe has consistently increased its revenues, which reached nearly six billion dollars in the third quarter of 2025. This growth is driven by a systematic expansion of its user base and increasing sales of subscription services, which form the foundation of the company’s business model. Stable revenue trends are also visible in historical data. Since 2018, Adobe’s quarterly revenues have grown almost uninterruptedly, even during periods of economic slowdown. At the same time, the company maintains high operational efficiency. Gross margins have hovered around the mid-thirties for years, while net margins have approached thirty percent in most periods. Such stable margins demonstrate that Adobe can generate solid profits even while increasing investments in technology and infrastructure. Strong financial fundamentals translate into healthy cash flows, enabling further investments in innovation and product expansion.

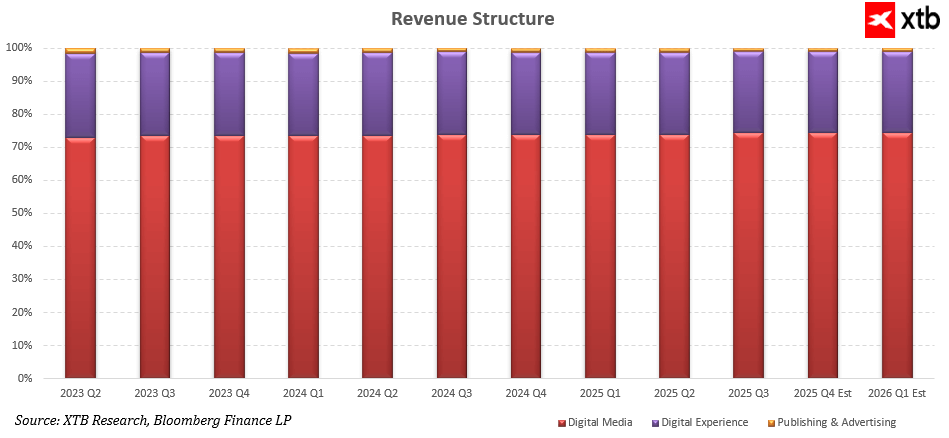

Adobe’s revenue structure highlights the predictability and repeatability of its operations. The Digital Media segment, including Creative Cloud and Document Cloud, accounts for approximately three quarters of total sales, and its share remains stable with a slight upward trend. This confirms the effective monetization of both traditional creative tools and new AI-based solutions. Digital Experience, which encompasses marketing, analytics, and customer experience services, consistently contributes about one quarter of the revenue mix and grows at a pace similar to the company overall. The smallest contribution comes from the Publishing and Advertising segment, which remains marginal and practically unchanged over time, indicating that Adobe derives most of its value from its two main business pillars.

In 2025, a key element of Adobe’s strategy is further development of AI-based solutions. The company is investing heavily in generative tools, from Firefly to features automating content creation and editing in Acrobat, as well as the Experience Cloud platform. These technologies streamline creative processes, increase user productivity, and strengthen the company’s competitive advantage. Growing AI adoption also translates into higher revenues across the Creative Cloud and Experience Cloud ecosystems, demonstrating Adobe’s ability to successfully monetize innovation.

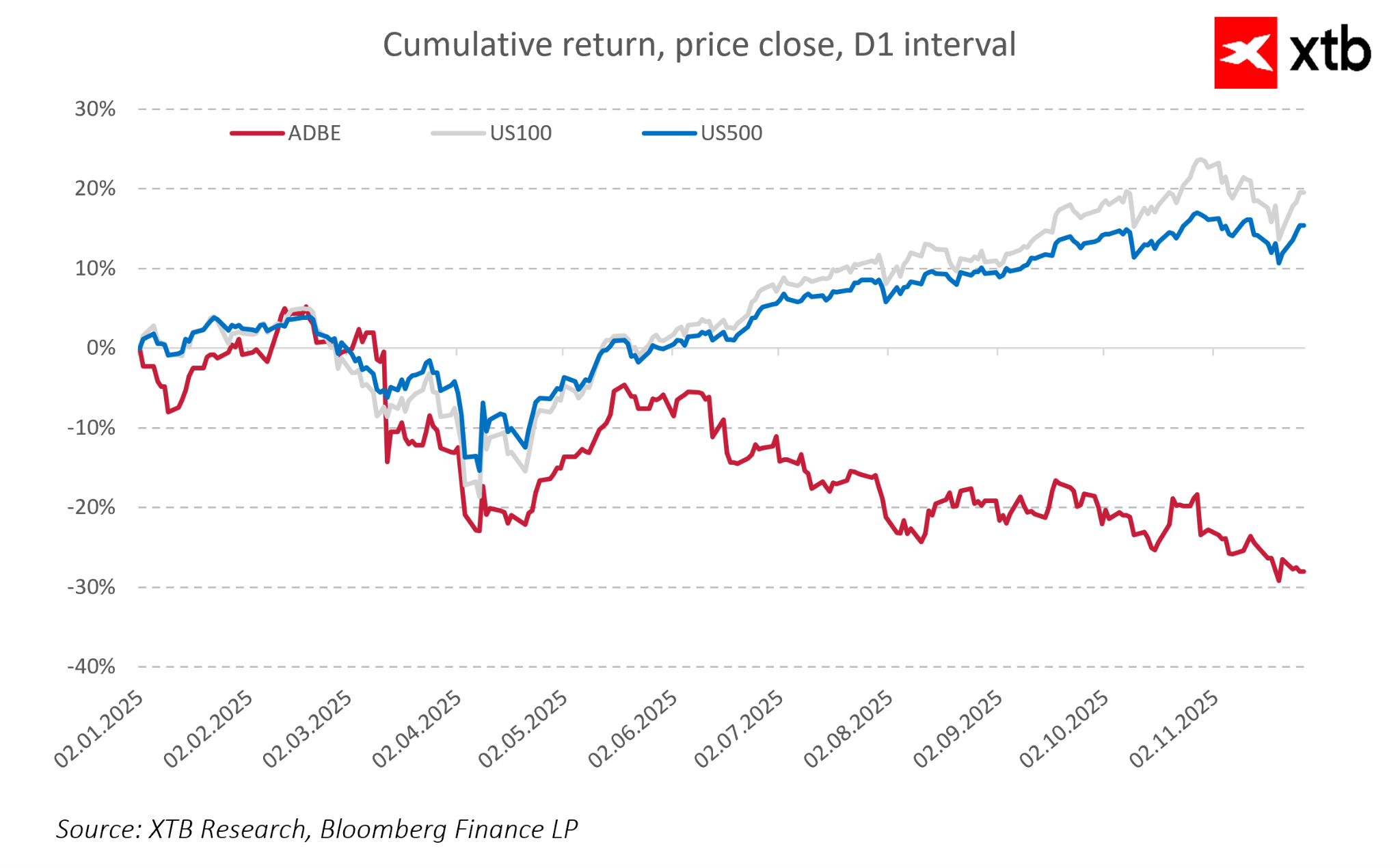

The gap between Adobe’s solid performance and its stock price behavior shows that recent declines are not caused by the broader market or the tech sector but by company-specific factors, such as concerns over growth rates, AI monetization, and competitive pressure. The market has penalized Adobe much more than broad indices, and the roughly thirty percent negative return in 2025 creates a divergence between rising fundamentals and falling stock prices.

The combination of a stable subscription model, increasing AI influence, and a broad, diversified customer base ensures that Adobe maintains a strong financial and strategic position. Financial results indicate that the company’s fundamentals remain solid, and its current market valuation may not fully reflect its long-term potential.

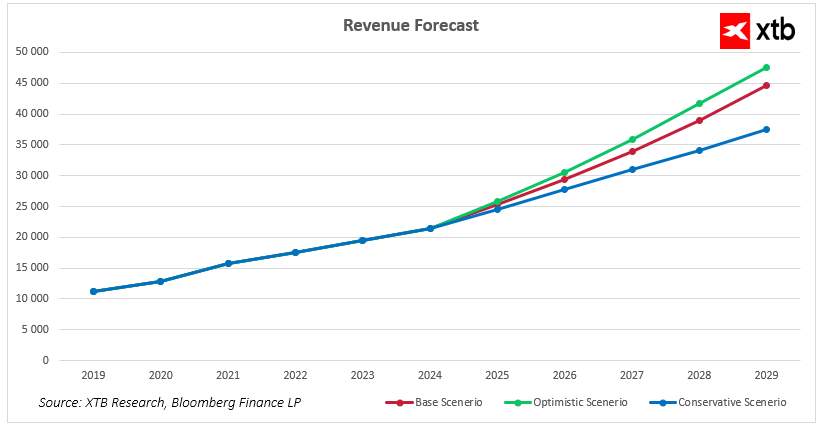

Adobe Revenue Forecast 2025–2029

Adobe enters the coming years with a solid market position and a stable subscription-based business model combined with rapidly growing AI solutions. Recent growth trends indicate that the company can effectively scale revenues in both creative segments and analytics-marketing services. Financial projections for 2025–2029 show that regardless of macroeconomic conditions, Adobe has the potential to continue increasing sales by expanding its product ecosystem, growing its customer base, and intensifying the monetization of generative AI.

In the base scenario, Adobe continues its existing growth trajectory. Revenues rise from around 21.5 billion dollars in 2024 to nearly 25.4 billion in 2025, and then increase steadily to over 44.5 billion dollars by 2029. This growth reflects the strength of the subscription model and the increasing use of AI features that improve user productivity and enhance the company’s competitive advantage.

In the optimistic scenario, faster adoption of generative tools, more intensive monetization of Firefly and Document Cloud solutions, and favorable conditions in the Digital Experience segment are assumed. Under this scenario, Adobe’s revenues could exceed 47 billion dollars by 2029. This scenario illustrates the company’s potential to accelerate growth if technological innovation continues at a high pace and corporate clients increase spending on automation and content creation.

In the conservative scenario, Adobe still grows, but at a slightly slower pace. Revenues reach approximately 37.5 billion dollars in 2029. This scenario assumes more challenging market conditions, slower IT investment, and greater competitive pressure. Even under these assumptions, the company maintains a consistent expansion path, highlighting the resilience of its ecosystem and high customer loyalty.

All three scenarios indicate that Adobe is positioned for years of solid growth supported by AI development, continued dominance in Digital Media, and increasing value delivered to both individual creators and large organizations.

Valuation Perspective

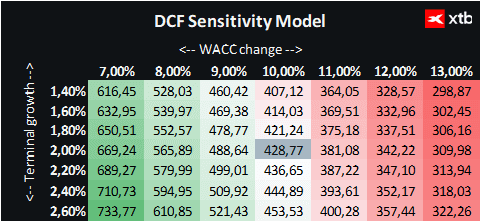

Let us analyze Adobe Inc’s valuation using the discounted cash flow (DCF) method. It is important to emphasize that this analysis is for informational purposes only and should not be treated as investment advice or a precise stock price forecast.

The valuation is based on the revenue base model, which assumes systematic and stable revenue growth for Adobe in the coming years. The base scenario reflects a realistic expansion pace, considering increasing monetization of Digital Media and Digital Experience services as well as the impact of AI-based tools. This approach provides a view of the company’s value within the most probable growth scenario, while maintaining a realistic perspective on risk and opportunities.

For the valuation, a weighted average cost of capital (WACC) of 10 percent was used, reflecting the cost of equity, the company’s low debt level, and the nature of the technology sector. The terminal value assumes long-term revenue growth of 2 percent after 2029, reflecting Adobe’s stable and mature position in the digital creativity and marketing sector.

Based on these assumptions, Adobe’s DCF valuation is approximately 428 USD per share. With the current market price at 317 USD, this implies a potential upside of around 35 percent. This difference suggests that the current market valuation may not fully capture the company’s fundamentals, its predictable subscription model, AI development, and strong position in Digital Media and Digital Experience segments.

The analysis indicates that Adobe has solid potential to continue creating value over the medium and long term. Revenue stability, healthy margins, and operational efficiency combined with investment opportunities in technology and product development create a perspective for valuation reappraisal in the coming years.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.